Potential killer applications for EELs?

Yole forecasts growth in 3D sensing in LiDAR, face/gesture recognition, medical and lighting applications

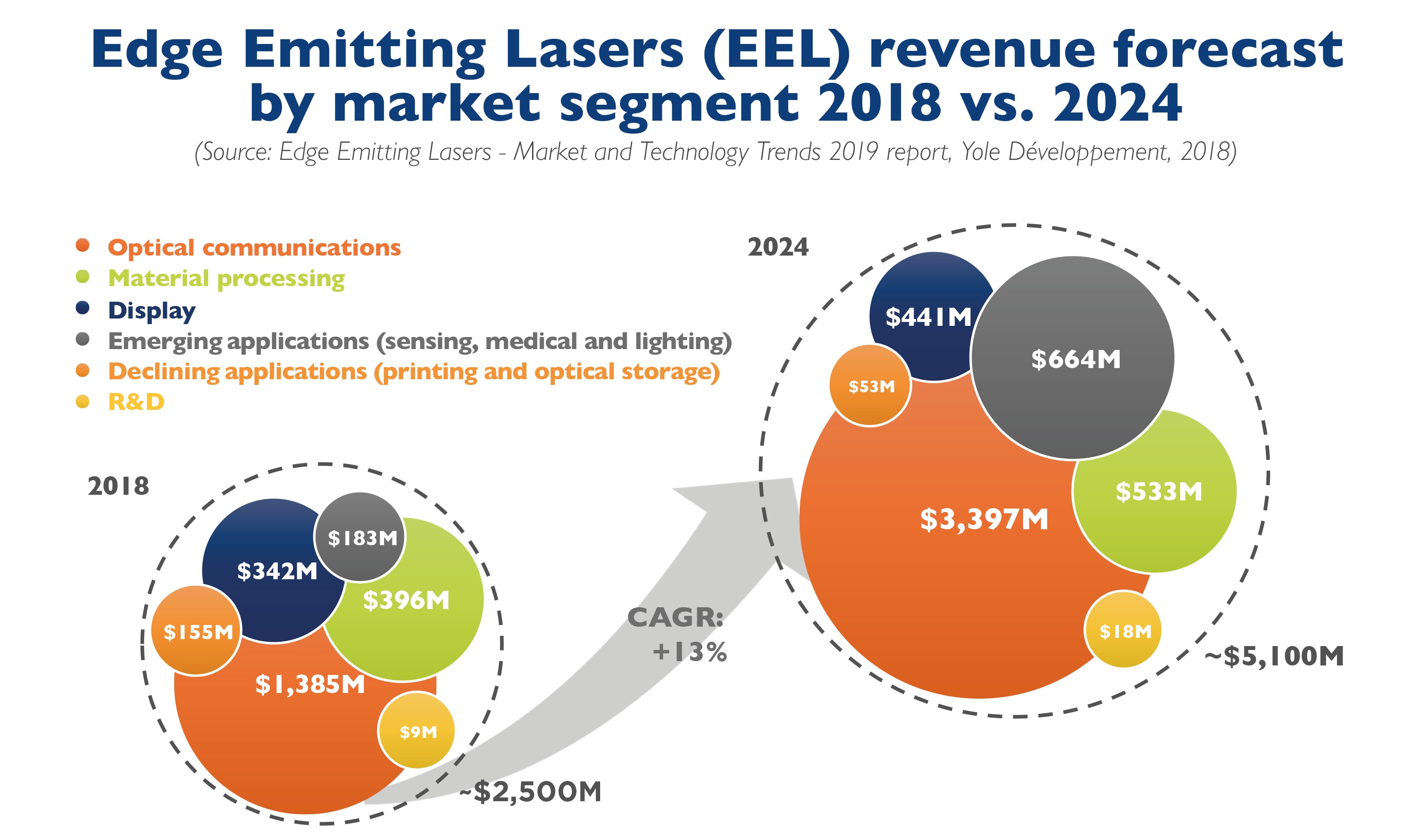

Last year, edge emitting lasers (EELs) represented a $2.5B market, according to Yole Développement (Yole) in its latest technology & market analysis.

“This figure should reach more than $5B by 2024 with a 13 percent CAGR between 2018 and 2024”, comments Martin Vallo, technology and market analyst at Yole. “Indeed the growth is still driven by the optical communication market segment with optical systems for datacom and telecom. It is today the largest EELs segment with 56 percent of the total revenue in 2018.”

“EELs are showing different functionalities: they can be used as fibre 'direct' lasers or coupled with optical fibres or crystals to make fibre-lasers or DPSSLs”, adds Vallo. “As a consequence, the number of applications is impressive. Optical communication, material processing, medical, sensing, printing, display, optical storage and lighting”.

Material processing and display applications make up 16 percent and 14 percent of the market respectively in 2018. However,Yole forecasts their market shares will decline in the future as 3D sensing in LiDAR, and face/gesture recognition, medical and lighting applications emerge in the next five years. Those might represent potential killer applications for EELs in the middle/long term.

But the EEL business also presents challenges. “There is a large variety of applications and system and device specifications, as well as a strong competitive landscape at the technology level, between direct diodes, fibre lasers, CO2 laser, DPSSLs and excimer lasers”, comments Pars Mukish, business unit manager at Yole.

Consequently, the EEL industry is highly fragmented and diversified. Each application addresses a specific supply/value chain, and different positions have to be developed by industrials to access different markets: