MicroLED: a market of exponential growth

5,500 patents filed by more than 350 organisations, according to Yole Développement

In Yole’s latest MicroLED Display report, its analysts estimate that the cumulated effort in microLED to date reaches close to $4.8 billion, with Apple alone close to $1.8 billion, factoring in both the Luxvue acquisition and internal developments.

Excluding this acquisition and the recent deal between Facebook and Plessey, startups have raised a cumulated $800m to date and could add another $100 million in 2020 pending disruption due to the Covd-19 pandemic. In addition, panel makers such as Samsung, LG, AUO or Innolux also significantly increased their efforts.

“The growth is fuelled by the meteoric rise of Chinese companies”, asserts Eric Virey, principal display market and technologies analyst within the Photonics, Sensing & Display division at Yole Développement (Yole).“This mirrors a more general trend in the country as it transitions from a manufacturing to an innovation driven-economy. This also reflects the situation in the display industry where Chinese companies now hold more than 50 percent of the worldwide display capacity in 2020.”

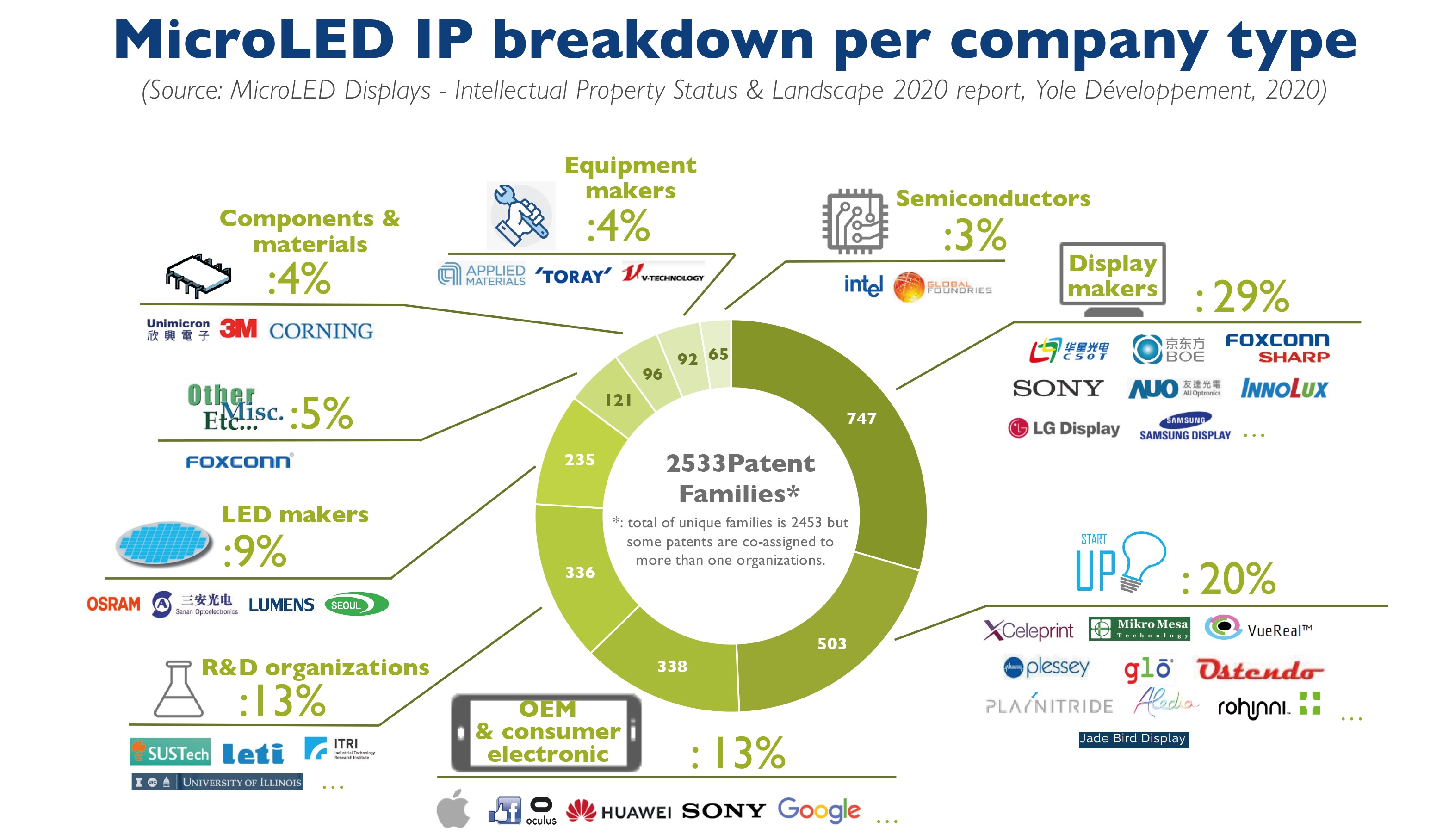

About 5,500 patents filed by more than 350 organisations and representing almost 2,500 families have been identified and selected by Yole. The level of activity is growing exponentially with 40 percent of the patents filed in 2019 alone.

"The increase in patents coming from China is remarkable", comments Virey. "Many of those microLED patents are questionable. Nevertheless, established players shouldn’t underestimate their Chinese competitors and dismiss the threat: some patents show world class innovation and demonstrate a strong resolve to close the gap with established rivals.” In addition, in high volumes, even low quality patents can be used as bargaining tools to fend off infringement lawsuits, negotiate cross licensing agreements etc.

The proliferation of subpar patents may however hinder innovation as it increases barriers to entry: increasing resources are required to conduct freedom-to-operate analysis, monitor patent activities, try to invalidate wrongly granted patents and respond to infringement lawsuits.

Over the last two years, the industry has entered what can be seen either as a virtuous cycle or a bubble: companies are jumping on the µLED bandwagon for fear of being left out.

Virey explains: “Display makers dominated IP activity in 2019. Most were initially dismissive of µLEDs but all are now accelerating their effort. BOE now leads in volume with close to 150 new patent families in 2019 alone.”

LG, AUO, Samsung, CSOT, Tianma, Innolux, CEC Panda, Visionox and companies in the Foxconn group all dramatically increased activity as well.

Korean companies are investing massively in OLED but µLED could be a credible alternative for high end TVs. Chinese makers are at least three years behind Korea in OLED, so µLED could be a more differentiating play. For companies such as AUO or Innolux that haven’t invested in OLED, µLED could be critical for long term survival and allow them to remain relevant in various high end market segments without requiring OLED-like multi-billion dollar capex.

Many companies now have portfolio addressing multiple technology nodes. Licensing and legal battles will likely arise if µLED displays enter volume manufacturing. Except in the field of microdisplays where the most capex-intensive manufacturing steps can easily be outsourced, startups and small companies are not planning to become display makers. Rather, most will focus on their core expertise and attempt to license their technology to established display makers and OEMs.

In order to compete with LG’s white OLED and maintain its leadership in the high TV market segment, Samsung Display Co. (SDC), announced a $13 billion investment to develop and manufacture QD-OLED by 2021-2022. But Samsung is hedging its bets: its Visual Display group is developing µLED using in house mass transfer and chips developed by Playnitride. The company showed impressive 75 inch to 150 inch µLED TV prototypes at CES 2020. Meanwhile, Samsung Displays is following its own development track and its QNED nanorod µLED 'ink', while still at an early stage, could be disruptive and bring the full benefits of µLED to its emerging QD-OLED technology and manufacturing infrastructure. Between the two extreme scenario of broad µLED success or limitation to smaller niche markets and segments, QNED could open a third path by blending µLED into more established display technologies.

The LG effort is more centralised with strong collaboration between the different divisions and a patent portfolio showing increasing maturity in µLED technologies.

Startups eLux, Glo, Vuereal, Mikro Mesa, Aledia Jade Bird Display, Rohinni and others have also significantly increased the size of their portfolio. Activity has accelerated at Facebook after it acquired mLED and InfiniLED. Its recent exclusive licensing and manufacturing deal with µLED microdisplay Plessey confirms its ambitions for augmented reality applications.

IP filing at Sony has stalled despite the fact that the company is commercialising a µLED based Public Information Display. More surprisingly, activity at Apple has also slowed down significantly since 2017. The few patents it has since published however show the high level of maturity and advancement reached by the company in µLED display technologies. Recent patents also show that the company has expanded the scope of its effort into developing microdisplays for augmented reality. Overall, the reduced activity could also be a sign of confidence in an already robust µLED portfolio as the company now focuses on setting up its supply chain.

If successful, Apple would be the first to disrupt the industry by having developed its own display technology and establishing a mostly fabless supply chain model, something that Huawei could be willing to emulate.