ADAS: a rebirth for the car industry?

Advanced driver-assistance systems will drive a sensor market worth $22.4 billion in 2025

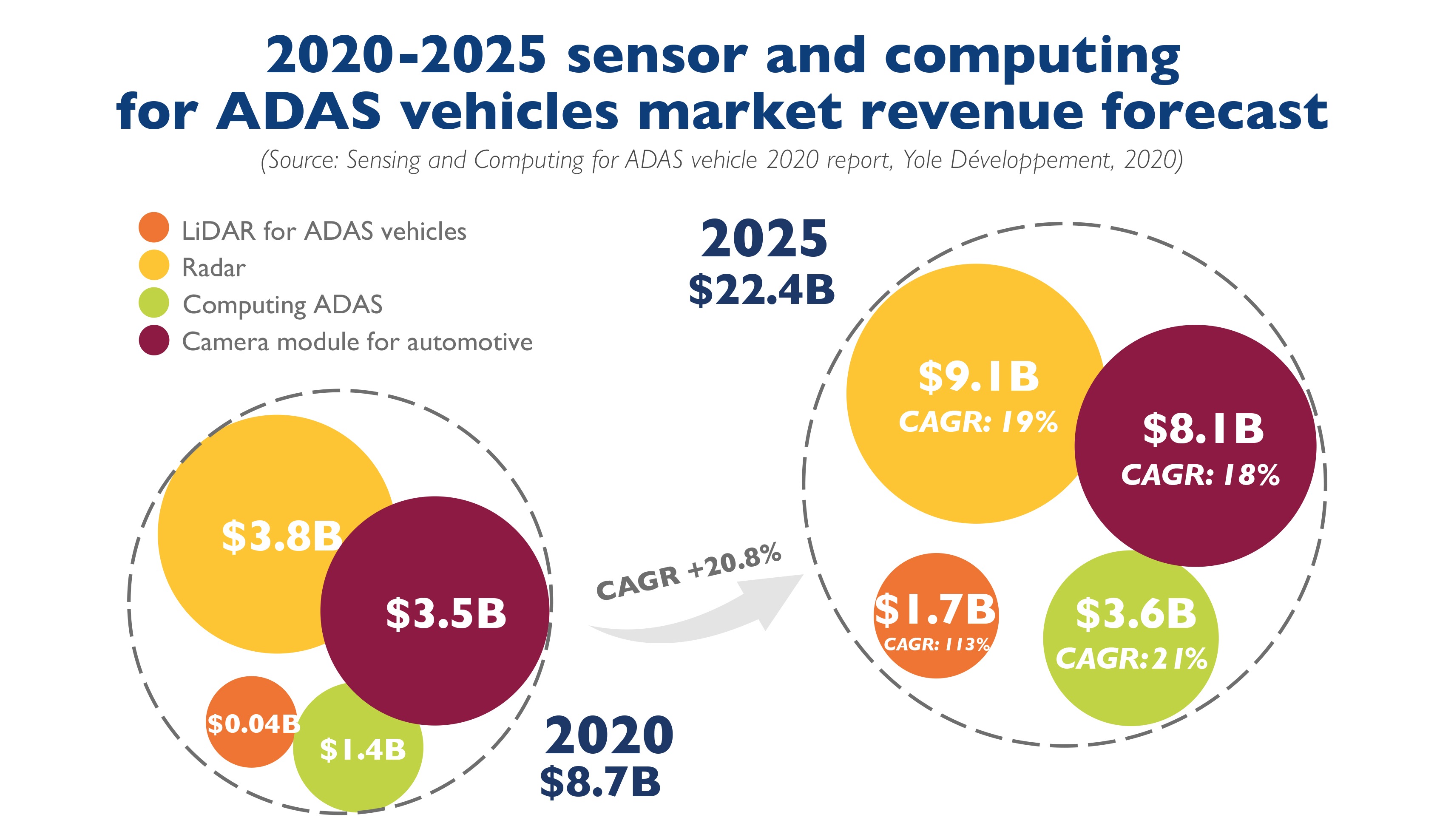

Yole Développement analysts estimates that the global market for radars, cameras, LiDARs and computing advanced driver-assistance systems (ADAS) should reach $8.7 billion in 2020.

Almost half of this market revenue will be generated by radars with $3.8 billion, followed by cameras with $3.5 billion. LiDARs will account for $0.04 billion and computing ADAS will generate $1.4 billion, according to the latest 'Sensing and Computing for ADAS vehicle 2020' report.

The production of new cars is expected to decline by 30 percent compared to the 2019 production level, heavily impacted by the coronavirus crisis. Yole expects it will take three years for vehicle production to recover and get back to the same level of output after the Covid-19 crisis.

Yole says the direction of the automotive industry towards the four major megatrends of connected, autonomous, shared and electric driving is expected to remain unchanged going forward, but the speed of adoption might change due to the Covid-19 crisis. Electrification will be the main focus for OEM s as restrictions and associated penalties on CO2 emissions should remain valid.

The second target for OEMs will be related to the development of ADAS for safety and automated driving features. The development of AEB is a great step to avoid forward collisions but is still perfectible, as demonstrated by the AAA in October 2019. Automated driving features in traffic jams or on the highway will also be developed by OEMs as consumers are looking for these to ease driving.

The development of such features will be a way for OEMs to differentiate themselves. To do so, the addition of more sensors, more computing power and a new E/E architecture will be required.

Cédric Malaquin, technology and market analyst, RF Devices & Technology from Yole comments: “Audi and Tesla, have both initiated this trend using a combination of radars, cameras and a LiDAR in Audi’s case. To fuse the data generated, Audi and Aptiv developed a domain controller, the zFAS, for front sensors. Tesla goes one step further in the development of domain controllers with its Autopilot hardware. Autopilot is much more complex and has more functionality, with the ability to perform frequent OTA software updates”.

For example, technology advances dedicated to Audi A8 has been deeply detailed during an interview powered by Junko Yoshida, EETIMES with Romain Fraux, CEO of System Plus Consulting: “…The challenge for automotive manufacturers will no longer be offering the most speed, or the best acceleration from zero to 100 km/h, but to ensure increasingly advanced autonomous driving and assistance systems. This is the goal of the Audi A8, to continue improving level 2 driver assistance systems, using LiDAR technology…”.

With high penetration rates of radars and cameras in cars, the associated market revenues will recover rapidly from the coronavirus crisis.

According to Pierrick Boulay from Yole: “Radar market revenue is expected to surpass 2019’s revenue in 2021 and will reach $9.1 billion in 2025 at a CAGR of 19 percent. Camera market revenue will also surpass 2019’s revenue in 2021 and will reach $8.1 billion in 2025 at a CAGR of 18 percent. Market revenue from computing ADAS is expected to reach $3.6 billion in 2025 at a CAGR of 21 percent”.

LiDAR market revenue is quite limited today as only one OEM is implementing this sensor as an option in some of its cars. Other OEMs like BMW and Volvo are expected to follow in coming years, but the implementation will remain limited to high-end vehicles, and therefore limited volumes are expected. In this context, LiDAR market revenue is expected to reach $1.7 billion in 2025 at a CAGR of 113 percent. LiDAR is a complex sensor for OEMs and Tier-1s to integrate while radars and cameras are, at the same time, continuously improving their performance.

ADAS and the automotive industry will see lot of changes in the coming months and years. Pushed by innovations and the integration of new functions, the market will open the door to attractive opportunities and new players. The market research & strategy consulting company will follow this evolution and proposes its vision and analysis through its reports, articles and events.