The battle for next generation TV displays

2020 is a transition year for the TV panel industry, says Yole

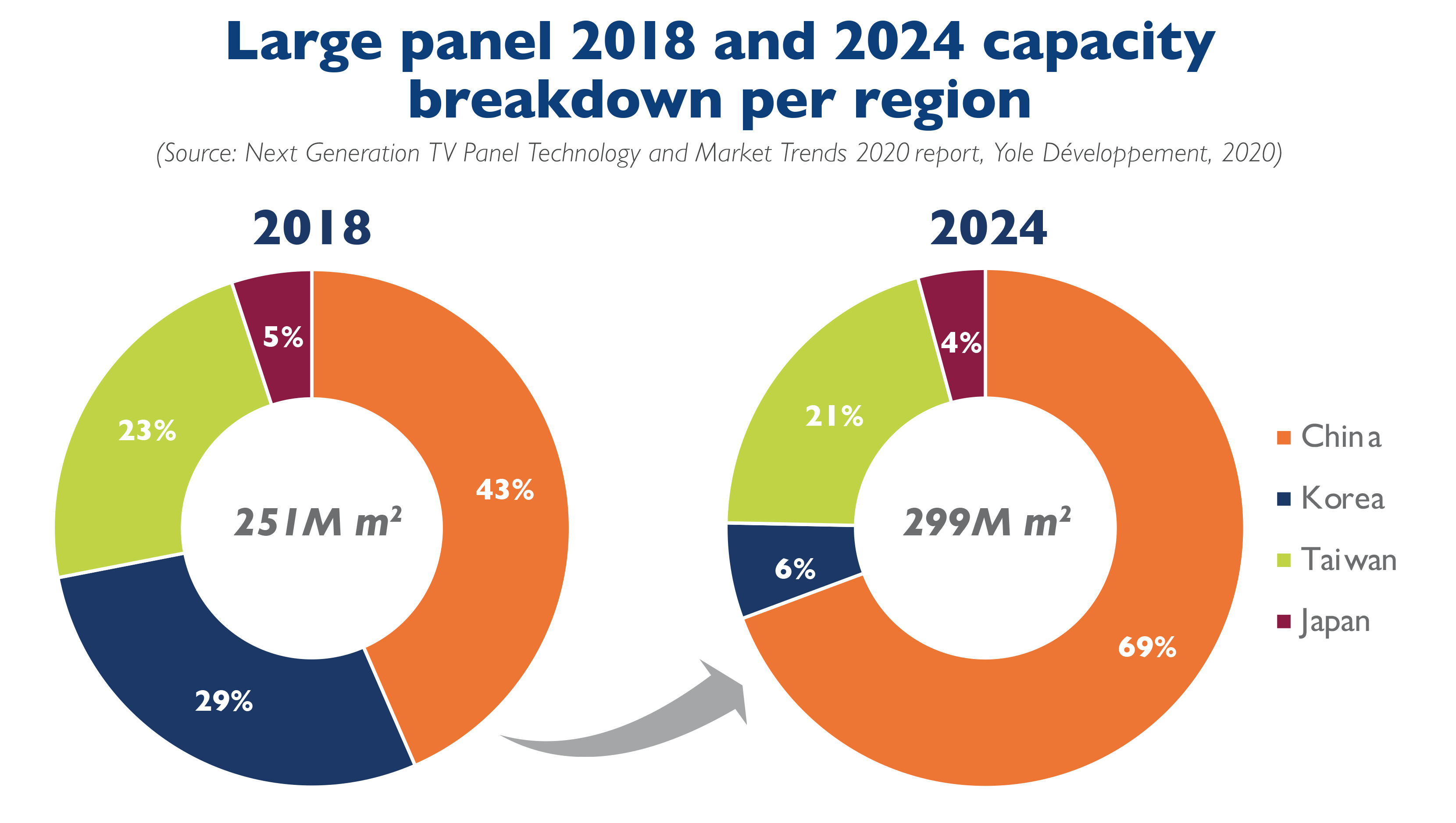

“The TV panel market was disrupted by the rise of large players in China that increased capacity regardless of demand,” says Eric Virey, principal display technology and market analyst, photonics and sensing at Yole Développement.“In 2019, oversupply sent prices to their lowest levels ever, below cash cost for most players. Thanks to subsidies, lower depreciation, more recent and efficient fabs, BOE and CSOT can control price to eliminate competition. Korean and Taiwanese LCD panel makers turned unprofitable and it became clear that China would soon close the technology gap, leaving no opportunity for differentiation, controlling prices and owning the market. In Q1-2020, Samsung and LG therefore decided to retreat from the LCD TV panel business”.

In the meantime, the COVID-19 pandemic impacted the supply chain and demand in the first half of the year.

Until late 2019, the industry had severe and lasting excess capacity. The tables have now turned, says Yole. Samsung and LG will remove the capacity to produce more than 52 million m2 of panels by 2021, accounting for 18 percent of 2019 global capacity. Meanwhile, Chinese players are adding 42 million m2 worth of capacity. There are now risks of shortages from 2021 and beyond. “This could be exacerbated if Taiwanese makers shut down their least efficient fabs and if China converts some of their LCD lines to OLED rather than proceed with greenfield investments”, comments Virey from Yole. “Conversion typically cuts fab capacity by 50 to 66 percent.

As analysed by Yole’s team in the new 'Next Generation TV panel Technology and Market Trends' report, options for the next generation of TV panel technologies keep proliferating. To win the next battle, risky, multi-billion-dollar bets need to be made now. Those choices will decide the fate of Korean panel makers. LG Display got a head start with WOLED. Its new Guangzhou G8.5 fab scheduled for late 2019 was delayed by COVID-19 and yield issues. With WOLED sales below expectation in 2019 and 2020, LG further delayed ramp up until the end of July for fear that depreciation would further harm its financials if it cannot quickly fill its capacity. A G10.5 WOLED fab investment was also pushed back further. In the short term, LG must improve manufacturing efficiency through yields and multi-model glass in order to lower costs and stimulate demand.

According to Zine Bouhamri, technology and market analyst, Displays at Yole: “Samsung is pursuing a dual track strategy: its panel division Samsung Display (SDC) is investing $11 billion in new TV panel technologies, including $8.4 billion of capex to build a QD-OLED Gen 8.5 fab. Its Visual Display TV set division is showing little interest in QD-OLED and prefers milking its profitable “QLED” LCD technology while developing microLED and miniLED which transfer the added value toward the modules and away from the panels. After retreating from LCD, Samsung needs its QD-OLED fab as soon as possible to remain in the TV business. Its QNED technology could fast track microLED if development succeeds”.

WOLED and QD-OLED are stop-gap technologies. BOE and CSOT are both eager to skip WOLED and level the playing field by jumping directly to the next generation: inkjet-printed RGB OLED or EL-QD. CSOT’s $187 million investment in JOLED gives more credence to its plans to build G6 and G8.5 RGB OLED fabs by 2023. If successful, this could quickly render QD-OLED and WOLED fabs mostly obsolete. Samsung and LG must therefore proceed with extreme caution on their QD-OLED and WOLED investments while accelerating their own RGB OLED and EL-QD developments.

AUO, Innolux and Sakai Display will strongly benefit in the short-term from Samsung and LG’s exit from LCD. The need by some TV brands to maintain reliable panel sources outside of China to mitigate supply chain risk (tariffs, etc.) could reduce long term risk. However, they have not significantly invested in OLED. In the longer term, microLED could be AUO’s and possibly Innolux’s best shot at offering high end, large TV panels without the massive capex of an OLED fab.

MicroLED’s unique ability for bezel-less tiling could enable the manufacturing of displays of arbitrarily large size with much lower capex than OLED. All leading panel makers are dramatically accelerating their development. Luxury MicroLED TV priced above $50,000 will enter the market in 2022 but MicroLED cost, yield and manufacturability roadblocks are hard to lift. For the consumer market, microLED remains an outsider for the time being.