MicroLEDs, Apple and Samsung

Interest in microLEDs lies beyond just the ability to offer the latest display technology, according to Yole

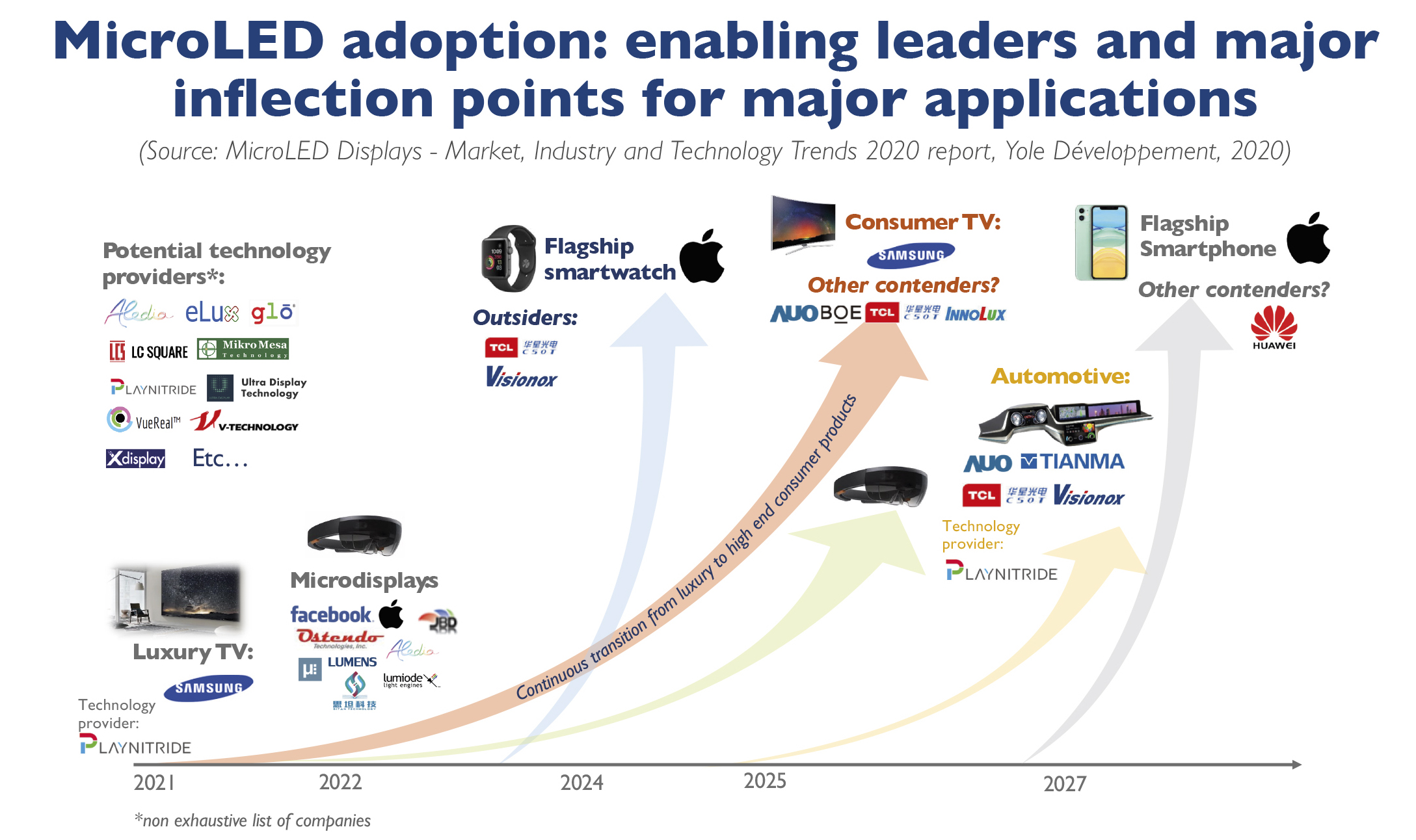

For many companies, interest in microLEDs lies beyond just the ability to offer the latest display technology, according to Yole Développement (Yole).

IP analyses indicate that Apple is planning to forgo TFT backplanes, instead opting for Si-CMOS microdrivers. The implications go far beyond a technological choice. Apple’s microLED supply chain would eliminate reliance on display makers such as Samsung or LG.

Apple can source microdrivers and microLED chips from foundry partners and assemble those components in-house or with other partners to create unique displays. Although it currently has more pressing battles to fight, the same logic applies to Huawei, with the possible added benefits of a 100 percent domestic display supply chain that doesn’t rely on restricted US technology.

Yole’s new 'MicroLED Displays - Market, Industry and Technology Trends 2020' report, says that for Samsung’s TV division SVD microLED would confer the ability for it to compete against OLED in the high end, large, TV segment with a technology that doesn’t rely on panels from China or its friendly enemy SDC.

SVD’s microLED technology still uses LTPS TFTs but, thanks to its modular design, only requires smartphone-sized tiles that could be sourced from existing G6 fabs.

Other display makers such as BOE or CSOT want to use their existing TFT infrastructure. Samsung Display is developing QNEDs, its own flavour of microLEDs that could fast track the technology and leverage most of its Quantum Dot-OLED investments.

For AUO, microLED could be a matter of survival. The company has been successfully managing cash by limiting CapEx and focusing on high added value products. But China won the LCD war and the company never significantly invested in OLED capacity, making it difficult to pursue this strategy in the long term. MicroLED is AUO’s best shot at remaining relevant in high-end automotive and TV panels, without requiring the massive CapEx of an OLED fab. The company has already showed various automotive prototypes and could demo TV prototypes in 2021.

Availability of standard tools and processes enabled the commoditisation of LCD and will soon do so for flexible RGB OLEDs. The lack of microLED process maturity and the proliferation of technology paths hinders the development of high volume manufacturing tools and the development of the supply chain.

This complexity, however, is a welcome barrier to entry for companies such as Apple or Samsung. Both have the financial and technological strength to develop end-to-end solutions internally and acquire missing technology building blocks as needed.

Latecomers or smaller companies are eager to see microLED processes converge and off-the shelf tools become available. Equipment makers such as Toray Engineering, TDK, V-Technology, Besi, SET and others are making the first attempts while technology providers such as Playnitride, XDC and many others can license key processes and components.

For high volume consumer applications, economics drives die sizes to below 5 µm with stringent yields requirement for which traditional LED fabs are not suited. A paradigm shift is required toward a semiconductor-like manufacturing mindset with high efficiency, automation, end-to-end defect prevention and management strategies.

This is creating an additional push toward adoption of larger diameter substrates. Going from 6 inch to 8 inch is especially desirable as it grants access to battle-tested, retrofitted semiconductor equipment. This also increases the appeal for GaN-On-Si platforms that are readily available in 8 inch and already looking toward 12 inch. While more challenging, 8 inch sapphire and GaAs platforms however remain credible options.