UVC LEDs: coming of age?

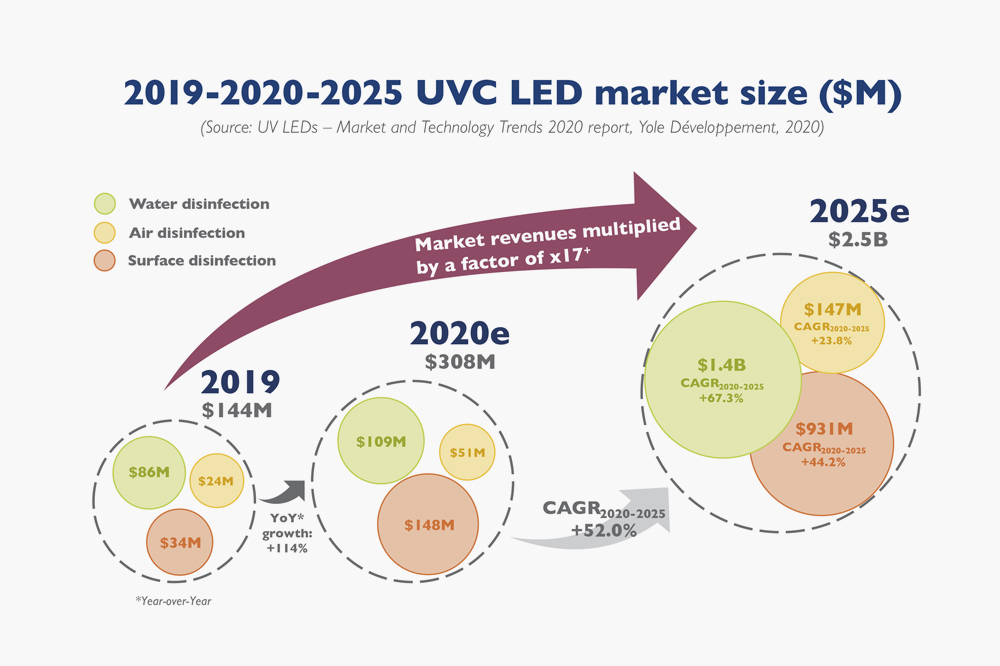

UVC LED market could reach $2.5 billion in 2025 with a 61 percent CAGR 2019-2025, says Yole

“It’s been more than ten years that the industry has waited for this moment to happen, and all the players have worked hard to make it possible,” say Pars Mukish, business unit manager, solid-state lighting & display at Yole Développement. “UVC LEDs are still much more expensive than traditional UV lamps, but manufacturers have got closer to the requirements of the early majority willing to use the technology. Indeed, from ~$100/ mW in 2015, UVC LED prices reached $0.3-2/ mW in 2019, which represents a real threshold for most potential large-volume integrators”.

According to Joël Thomé, CEO of PISEO: “Indeed, the analysis of the portfolio and roadmaps of UV-C LED manufacturers confirms the trends observed for several years: a rapid and regular drop in prices and a significant increase in performance (power and efficiency), which should allow UV-C LED to establish itself in the field of disinfection by UV-C radiation, at mid or long term depending on the applications”.

Both companies, Yole and PISEO, have recently been investigating disruptive LED technologies and related markets .

The 'UV LEDs – Market and Technology Trends' 2020 report from Yole gives detailed analysis of the UVC LED market by disinfection application, of the UVC LED manufacturing cost and of the main UV LED applications. Including market forecast, supply chain, technology manufacturing, performance, price and industry analysis, this study reviews the global UV LED industry. This new report also studies COVID-19 pandemic’s impacts on the UV LED business.

In parallel, the 'UV-C LEDs at the Time of COVID-19' report from PISEO points out the artificial and principles for integrating UV-C LEDs and sizing systems for disinfection, in relation to the required doses. This report studies the dimensioning and implementation of UVC LED systems for disinfection and the characterization of their germicidal efficiency. It also analyzes the regulations and standardization of the UVC LED in Europe and provides the state of the art of UVC LED technology and the outlook for performance changes, compared to traditional UVC sources.

New entrants from the visible LED industry

Yole’s team says the trend has been made possible by the entry of several new entrants from the visible LED industry. Typically, LG Innotek and Seoul Semiconductor have been key companies in getting the UVC LED market ready to emerge. But their destinies will be different. LG Innotek started exiting the business before the COVID-19 pandemic, due to more than 10 years of consecutive losses of its visible LED division. Seoul Viosys has made an IPO in what can be considered as the best timing ever, when the pandemic started and UV lighting was drawing the attention of the entire world. The entry of several pure packager and module players has also helped to accelerate technological development, and further reduce the gap between device manufacturers and integrators.

According to Pars Mukish: “The overall industry was therefore ready for a boom in the UVC LED market – but what has happened has gone way beyond their expectations. The COVID-19 pandemic has created such a peak in demand that an overall shortage appeared across the entire UVC LED supply chain in 2020. And as such trends in demand are likely to last, the overall industry is now looking to increase manufacturing capacity very rapidly. As of Q3-2020, already more than 300 million units of capacity have been announced to be installed in the short term”.

Financial gain will further intensify the competition and it’s likely that an industry experiencing such increase in demand will see big changes. PISEO expects leaders like Seoul Viosys and NFKG to maintain their position in 2020 and 2021. But recent new entrants are close behind and will do their best to collect further market shares and catch orders left behind by LG Innotek.

Regulations and Standards

In the ‘UV-C LEDs at the Time of COVID-19’ report, Joël Thomé from PISEO says: “With the COVID-19 epidemic, many UVC products, mainly for surface and air disinfection, are appearing on the market. The current regulations and standards cover the safety aspects related to the use of these devices, but do not cover the disinfection aspect.”

For now, manufacturers of disinfection systems generally rely on scientific publications and have their products tested by microbiology laboratories as a guarantee of the quality of their product in terms of disinfection. However, even a laboratory test is not a guarantee for the user, as the test conditions may be different from the conditions of use (type of surface, etc.). Eventually, faced with the photo-biological risk, countries have decided to ban the sale and use of UV-C disinfection products outside the medical environment.

For Matthieu Verstraete, innovation leader and electronics & software architect at PISEO: “The UV-C players are putting in effort and confirm a sustained performance increase for the coming years. Among them is Stanley, with its portfolio of UV-C LEDs at 265nm peak wavelength that will gain 25 percent to 45 percent in the coming three years. Knowing that the 265nm peak wavelength is technically more challenging regarding UV-C LED performance while, according to some studies, this wavelength provides a better disinfection effect than higher wavelengths, it is an example of how dynamic the UV-C LED market is.”