GaN power market to surpass $1 billion in 2026

Current market driven by impressive growth of smartphone fast chargers, says Yole

“Following Oppo’s adoption of GaN in its 65W inbox fast chargers for its Reno Ace flagship model in late 2019, several phone OEMs and accessory charger providers released GaN-solution design wins for their fast chargers in 2020,” says Ahmed Ben Slimane, technology & market analyst, compound semiconductors and emerging substrates at Yole Développement (Yole).

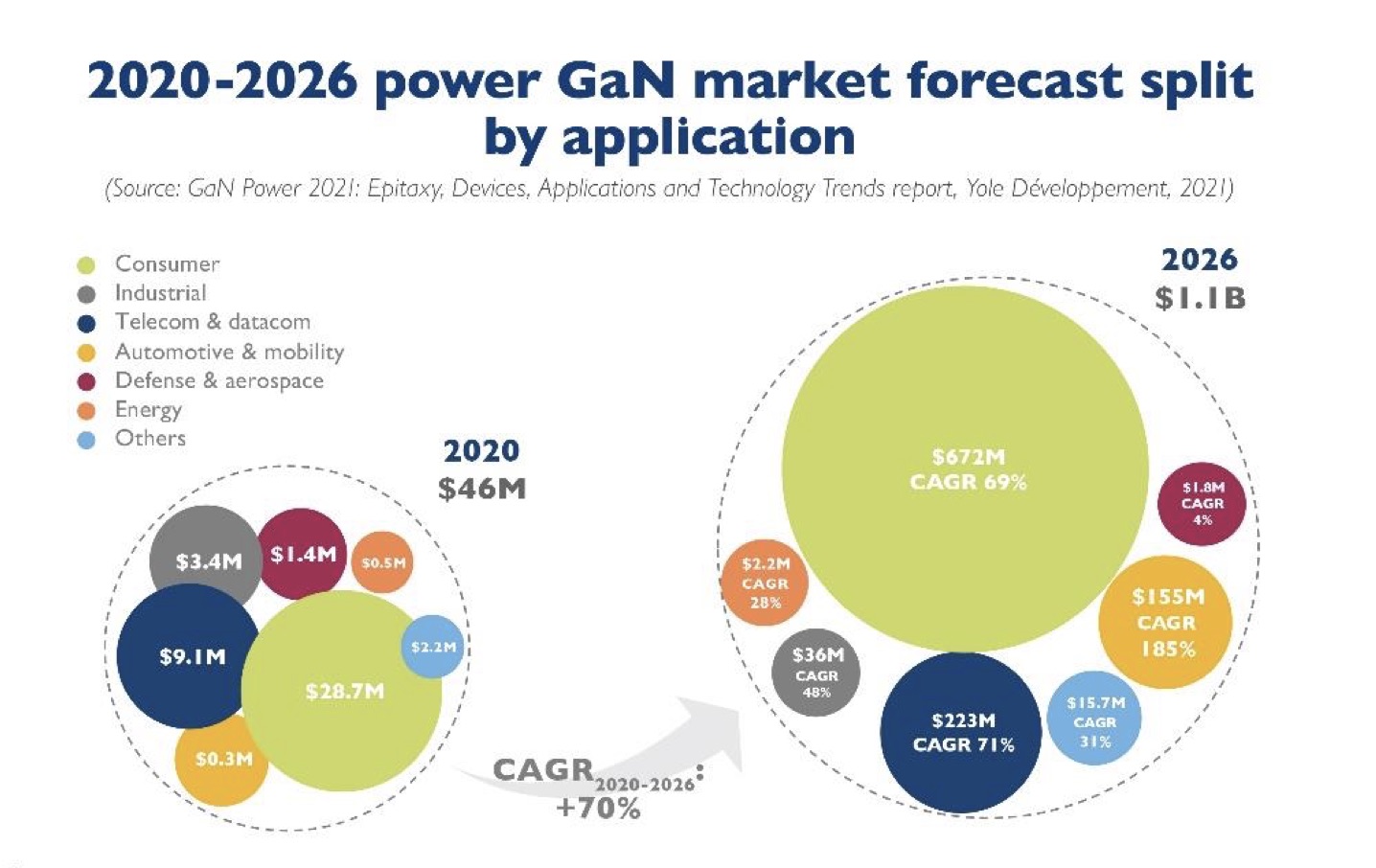

The GaN power market doubled in 2020 compared to 2019 and is poised to surpass the $1 billion mark in 2026. As further confirmation of this impressive GaN market growth, Yole forecasts that the markets for telecom & datacom and automotive & mobility will contribute in the mid- to long-term to overall growth, benefiting from GaN’s ascension in fast chargers.

In its latest report GaN Power 2021, Yole foreacasts the GaN consumer power supply market to be the main driver, as this market is forecast to grow from almost $29 million in 2020 to around $672 million in 2026 with a CAGR of 69 percent.

Following the first small-volume adoption of GaN-based power supplies by Eltek, Delta, and BelPower in recent years, Yole expects a larger penetration of GaN, with a market valued at $9.1 million in 2020 and a CAGR2020-2026 of 71 percent, reaching more than $223 million in 2026. “The automotive & mobility market is also paying lots of attention to GaN, following big incentives for the electrification of cars and the interest in increasing driving range through system efficiency optimization. asserts Yole analyst Poshun Chiu.

Players such as EPC, Transphorm, GaN Systems, Texas Instruments and Nexperia are AEC qualified. The major IDM6 STMicroelectronics, through partnership and acquisition, is also targeting GaN for EV7s. Starting from 2022, GaN is expected to penetrate in small volumes in applications such as OBC8 and DC/DC converters, mainly related to sampling by OEM9s and Tier-1s. Yole expects the automotive & mobility market to reach more than $155 million in 2026.

In 2020, the power GaN market doubled thanks to an impressive penetration of GaN devices in fast charger applications. The adoption of GaN in the smartphone market is fueled by system compactness, high efficiency, and adapter multifunctionalities.

Fast charging is likely to be the killer application for the GaN power device market. So far, at least 10 smartphones OEMs have launched more than 18 phones with an inbox GaN charger. This growth will continue in the aftermarket as well, with companies like Apple, Xiaomi, and Samsung opting for an out-of-the-box charger solution. How will these OEMs’ decisions affect the GaN market? What are the possible market scenarios for GaN adoption? For Ahmed Ben Slimane: “While GaN continues its ascension in the mass consumer market, the markets for telecom & datacom and automotive & mobility will benefit from the “economy of scale effect” and price erosion. Indeed, in these markets where reliability and cost are paramount, Yole expects that GaN penetration will see increasing volumes starting from 2023 – 2024”.

In the long term, in cases where GaN has proven its reliability and high-current capabilities at a lower price, it can penetrate the more challenging EV/HEV10 inverter market and the conservative industrial market, which could create remarkable high-volume opportunities for GaN. In fact, Nexperia and VisIC are working on GaN solutions for xEV inverters to compete with SiC and silicon.