Clas-SiC: A thriving three-pronged attack

The Scottish SiC specialist is excelling on the three fronts – alongside rising demand for prototyping, the manufacture of SiC devices at low-to-medium volumes is on the up, and the licensing side of the business is booming.

RICHARD STEVENSON, EDITOR OF CS MAGAZINE, INTERVIEWS JEN WALLS, CEO OF CLAS-SIC WAFER FAB

RS: What’s your view on the current state of play in the SiC industry?

JW: It’s changed a lot in the last 12 to 18 months. The number of players coming into the market has driven costs down, because capacity has been there. This has opened up new markets.

The cost of the substrate has reduced, bolstered by Chinese government subsidies. There has also been dramatic increases in quality for substrates, epitaxy, device performance and reliability.

Devices are more readily available than they were even a couple of years ago. Voltages are being pushed up in more applications, because device performance has increased. This wouldn’t have happened before, because silicon carbide was so expensive.

Price reductions have opened up markets for silicon carbide where it would not have played before, especially at lower voltages. Silicon carbide can now compete in consumer products, where GaN may have been the device of choice. Some of our customers are supplying makers of consumer products, like LG. That’s been a huge change.

RS: A great deal of excitement in SiC has come from the EV market, which is suffering from some softness. Do you think that’s a big issue?

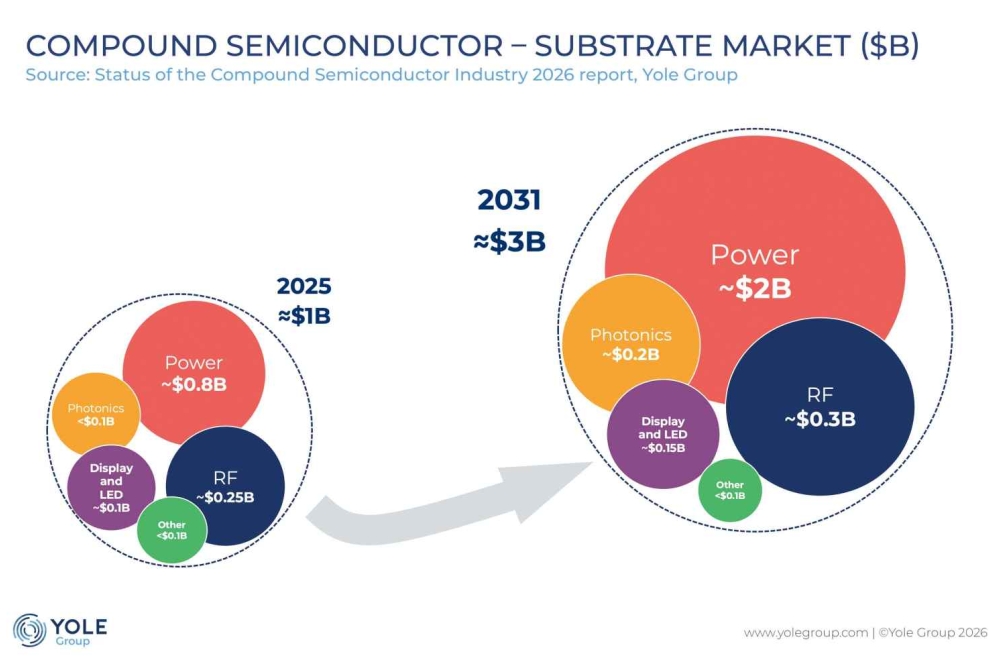

JW: The compound annual growth rate of the EV market hasn’t been at the levels suggested by Yole Group and all the other market predictors. However, it’s growing. You can see that yourself – you can see more EVs on the road.

Here at Clas-SiC, our customers aren’t solely based on the EV market. I think the EV market is an absolute enabler to drive quality and device performance, but it’s not all about the EV market.

Silicon carbide is now seen as a major enabler for data centres. The power systems for large data centres needed for the future of AI are going to need silicon carbide.

RS: When Clas-SiC founded in 2017, I’d argue that the world was a different place. While co-operation still exists, there’s a move away from global supply chains towards sovereign capability. And there’s also the rise in vertical integration. How do these trends impact the progress of Clas-SiC?

JW: Sovereign capability and silicon carbide supply chains are great opportunities for Clas-SiC.

We are licencing our technology to SiCSem, to build a fab in India for India. India’s sovereign capability is driving that. It’s an extremely high-profile project for the Indian government. This will be the first time that they have backed a compound semiconductor fab to this level.

Clas-SiC benefits, not just through the licence fee and the royalty payments, but through the capacity we will get in that fab. Part of the agreement is that we get 15 percent capacity in that high-volume fab. We access high-volume, lower-cost production, but without the associated CapEx.

It’s very similar to the model we’ve already carried out in China. The Chinese fab is now up and running. It’s qualified for diodes and it’s going through MOSFET qualification.

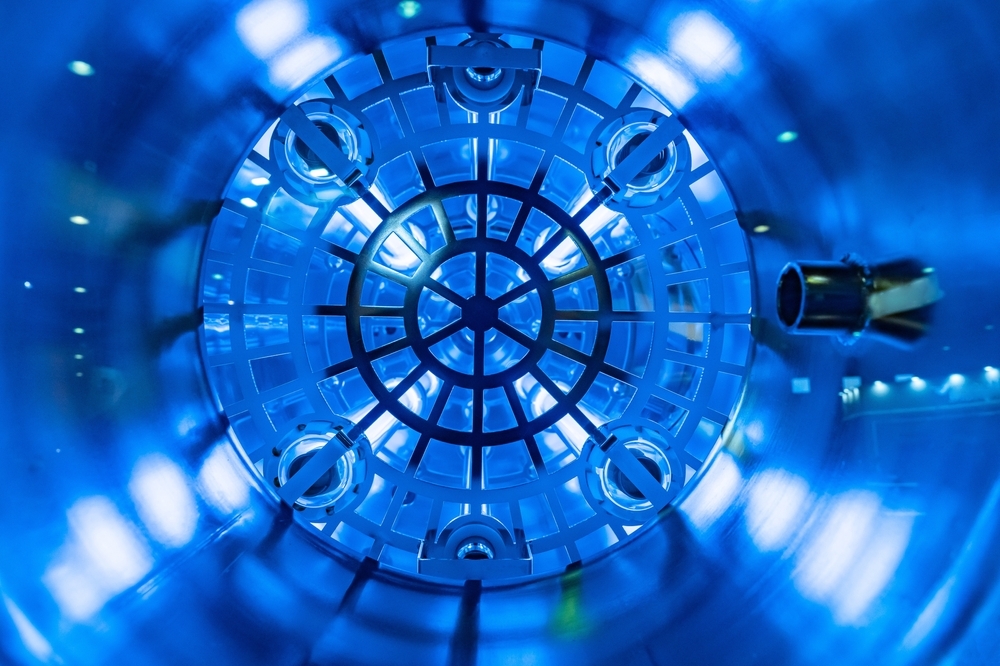

Routine facilities pressure checks are vital to ensuring no unplanned downtime to the wafer fab.

For Clas-SiC, that’s come at the right time. Here in the UK, manufacturing is expensive, electricity is expensive, and labour rates are high. To allow Clas-SiC to compete, that’s very key for us.

For supply chains needing a route outside Asia, right now there are not many options available. That’s good for us.

We’ve also signed an early engagement with a fab to be built in Bulgaria. It’ll be good to have a high-volume route in Europe.

Our customers and others are nervous about US tariffs and where that’s going to go. Again, that has put Clas-SiC in a good position.

RS: Go back a few years and SiC substrate supply struggled to meet demand. Today, what’s your view on SiC substrate and epiwafer supply, in terms of quality, quantity and pricing?

JW: Chinese quality is still the best out there. That’s what we are seeing, anyway. On our baseline MOSFET process, yields increased by 7 percent over the last year or so. That’s huge.

Now there’s overcapacity, so pricing’s low. I don’t think it’s going to drop much more

In the future, AR goggles will use silicon carbide for lenses. Our suppliers are already telling us that they’re predicting 80 percent of their capacity will go for that type of material, rather than for device material. So, capacity could be an issue again in a few years if some companies can’t survive without subsidies, and if a lot of capacity is taken up by AR goggles. I think the prediction is that in the next 3-5 years, everyone over the age of 18 will own at least one pair. That’s going to take up a huge amount of capacity, so there’s no way that the price is going to continue to drop as it has over the last 12 months.

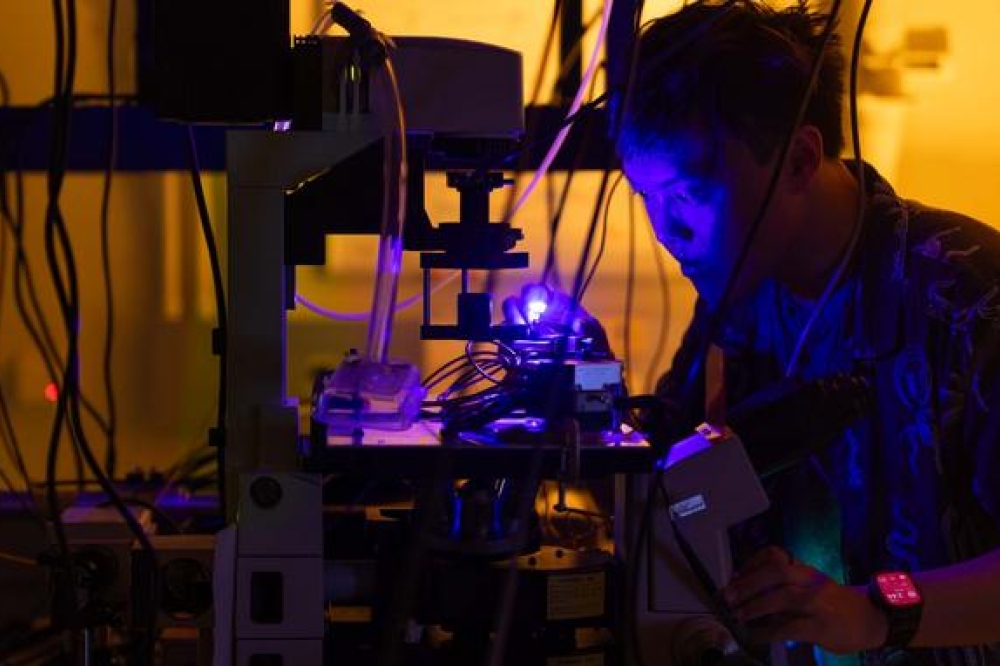

Device scientists reviewing layout prior to mask making- an important step in device manufacture.

RS: Are you happy to process epiwafers from all vendors? And do you offer recommendations to those seeking an epiwafer supplier?

JW: We run a mixed model. Some of our customers supply wafers to us; others, we procure wafers on their behalf.

Normally, in production, we procure wafers on behalf of the customer, but at R&D, prototype-level, customers normally supply wafers to us. We now have PDKs for engineered substrates, plus p-type wafers. Having p-type wafers in the fab is a great leap forward, because if we can get a silicon carbide IGBT that would be amazing.

RS: Around this time last year you secured £10 million of funding from Archean of India. Why did it invest, what’s its return, and what’s that funding been used for?

JW: Actually, we received £10 million, and there was also a shareholder-to-shareholder arrangement, because Carl Johnson gave up equity in the company.

As well as being a sound business decision, it was a strategic decision for them, because they are the financial backers behind SiCSem Private Limited, who are building the fab in India. As part of that investment they get a seat on our board.

Ranjit Pendurthi, who’s the Managing Director of Archean Chemical, sits on the Clas-SiC board now. Archean has brought a different perspective to our board, a really welcome perspective from my behalf.

RS: Earlier this year, you signed a deal to set up a power fab in mainland Europe. What’s Clas-SiC’s role in this project, how much progress has been realised, and what is still to do?

JW: Our role in the Bulgarian project will be the same as the Chinese and Indian licence agreements. We’ve signed an early engagement commitment to help them build a business plan to attract further investment.

We’ve been working in partnership with Wafer Fab Solutions, to help them to work on a toolset, and to help them build an OpEx and CapEx plan to feed into their business plan. The idea is that we will then help them set up the fab in Bulgaria and transfer our technology, whatever the generation of technology is at that point in time.

RS: The founder of II-VI, Carl Johnson, is Clas-SiC’s executive chairman. How much of a role is he playing in the direction of your company?

JW: I personally value his mentorship over the years. He’s a lot of experience. It’s not just the technical side – he’s run a huge company that’s had varied revenue streams, the same as Clas-SiC does. We have our R&D revenue stream, our tech revenue stream, our production revenue stream, and our licencing revenue stream.

I have a weekly one-to-one with Carl that lasts an hour. That’s the only input he has into the day-to-day running of Clas-SiC. The conversations are led by me. They can cover blue-sky thinking, a current issue we’re having, or sometimes just how life’s going for us.

I’ve been in the CEO role here at Clas-SiC for over two years.Clas-SiC has changed a lot over that time because the market has changed. Thankfully, Carl and the rest of the board have been extremely supportive to allow us to do that.

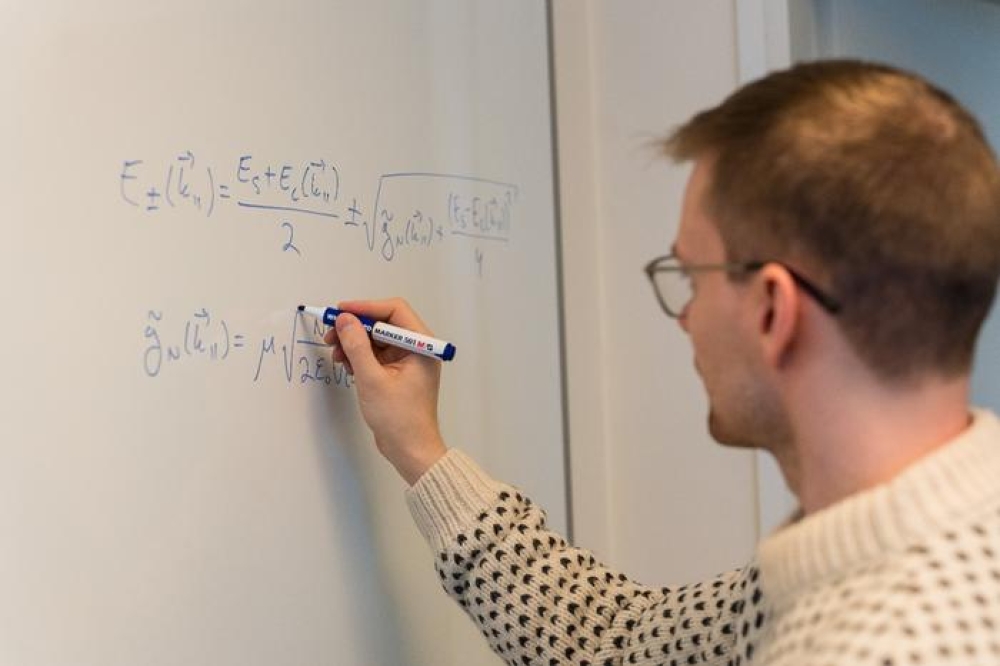

A rapid-thermal-anneal tool loading station. Devices visit these tools at least twice during fabrication.

RS: You have process design kits for 1200

V, 1700 V and 3300 V, and another for 2,300 V in development. How much

interest is there in the higher voltages within this range?

JW: There’s a lot of interest. Electric cars require longer ranges and faster charging. Also, as governments are looking to improve grid infrastructure, devices that work at higher powers are required. We have customers prototyping as high as 6.5 kV with us. We even have others talking to us about 10 kV.

Our design kit is pretty flexible. We’re really willing to get our customers to design and own the reliability of the device termination. We can adapt processes as much as we can. What

the customer is doing is leveraging Clas-SiC’s experience and processing of silicon carbide to push voltages higher. We’re small and flexible enough that we’re willing to do that.

These products at extremely high voltages, they’ll never be high volume. They’re probably quite niche. However, that’s where Clas-SiC fits. So, it’s a good part of our business.

RS: In addition, you have a process design kit for diodes. Does this account for a significant proportion of your business?

JW: Two years ago, I think diodes accounted for about 10 percent of the business. Last year it increased. This year it has decreased again.

One of the main drivers is that the licenced fab in China was mainly a diode customer. Now they’ve got their own fab. They’re producing in their own fab. We get the benefit of royalties, but the diodes are not produced here at Clas-SiC.

Recently, we have attracted a few customers at an R&D level that are looking at a more bespoke-type diode technology. But I would say it’s probably back down to 10 percent of our business.

RS: There are two types of MOSFET: planar and trench. You offer the former, but are developing the latter. What’s the motivation behind extending into trench MOSFETs?

JW: Our customers have driven us towards developing a trench process. We have processed trench MOSFETs before, but it’s been a customer-owned process. Now we are developing our own trench PDK, so customers will be able to design on our own process. The aim is to have a trench PDK by mid-year.

We also have super-junction on the horizon. The new kit we’re bringing in is to help serve that technology roadmap. That’s where the £ 10 million investment came in for technology advancement.

RS: You offer both prototyping and low-to-medium volumes of production. Which of these accounts for most of Clas-SiC’s day-to-day activity?

JW: It’s mixed. Having just come from the morning meeting, about 60 percent of the work-in-progress in the fab today is technology and 40 percent is production.

Most of the technology work is extremely engineering-intensive. We work with some major players in the industry that use us at an R&D level, because they’re trying to leverage our expertise. I would hope in future that we will be able to licence parts of the process and black-box solutions.

Just now, for these people, we may use our gate-oxide process or our backside annealing process, but that’s owned by Clas-SiC. They send us wafers just for that process. I hope in future we could licence these parts. We also have long-standing, fab-less design companies.

RS: You also offer licensing of technology. How does that work in practice, and is it a significant part of your business?

JW: It’s quite unique, as there are not many silicon carbide companies that will licence their technology and know-how right now.

While licensing is a key revenue stream for us, it’s not only the revenue that’s key – it’s having capacity in these high-volume fabs. That’s very much part of our business model and strategy. In practise, we assist these fabs to get up and running by transferring our processes.

I think if I was to ask the owner of the Chinese fab, she would say that we’ve saved about three-to-four years in time-to-market because they qualified, prototyped and ran product here on our process while their fab was being built. They were able to sample customers. It became a process transfer, rather than a full qualification for their customers.

It’s an ongoing relationship with our licenced customers. As we develop our technology, they will come back to licence the next generation. That’s actually already happened with the Chinese fab.

At the ICSCRM Conference in 2025, Professor Anant Agawal stood up on stage and said that to make silicon carbide a success, it’s going to take a village. And that is so, so true. I think collaboration is absolutely key.

In November 2025 Clas-SiC CEO Jen Walls addressed an audience of around 600 at the SiCSEM fab groundbreaking ceremony at Odish.

RS: When transferring licenced technology and supporting these companies, do you send engineers to these fabs?

JW: If I think back to China, our engineers were out there for about three months. Not the same engineers, because we would concentrate on one part of the process and set that up, and then another set of engineers would go.

That was an absolutely amazing experience for a lot of the guys and girls here at Clas-SiC. We sent graduate apprentices, we sent modern apprentices, as well as senior engineers, principal engineers.

We still support these fabs through a consulting-type basis, and we’ll continue to do that. It’s an ongoing relationship.

We’ve been running this process for so many years, and developing it and improving it. Any problem they see, we have probably seen before. Where it’s maybe taken them three weeks to get the root of a problem, we can fix it overnight.

RS: The SiC industry is shifting to 200 mm wafers. As I understand it, you are still working with the 150 mm platform. Do you have plans to move over?

JW: It would be too much investment right now. There’s no immediate plan. However, when we’re procuring equipment, we make sure that it’s 200-millimetre-compatible.

Our licenced fabs are very much a route to 200 millimetre, because they are setting up as 200 millimetre.

We can compete at a low production level because of our varied revenue streams. In low-rate production, we can offer similar pricing to what these fabs can offer in China. However, that won’t remain forever, so we do need to get our licenced fabs at 200 millimetre up and running.

RS: With SiC, doping may be realised through both ion implantation and epitaxial growth with dopants. What do you see as the pros and cons of both approaches?

JW: For me the jury’s out. It’s very early days. I think only time will tell.

We work with customers looking at and evaluating both methods. Implant is obviously an expensive process, and planters are costly CapEx investment. They’re an expensive tool to manage in production. However, control is extremely good.

RS: One area for improvement of the SiC MOSFET is its channel mobility. Many employ nitridation to address this issue, and there are reports of alternative, promising processes. Does Clas-SiC have a nitridation process, and if so, is it advancing?

JW: We are always advancing, and what we have available right now is the best our customers have seen. Right now, there’s ongoing work with Purdue University.

RS: Within the UK community, is their much effort on SiC? And which research groups and companies are you collaborating with?

JW: Specific silicon carbide activity within the UK is pretty limited. We have one commercial customer in the UK on silicon carbide that we’re working with at a device level. We work extremely closely with academia, with Warwick, the University of Glasgow, Strathclyde, and other universities around the UK.

We also work with some of the Catapults, NMS (the National Microelectronics Manufacturing Centre), and with partners that are looking to develop advanced module packaging or advanced packaging methods.

RS: A company is only as good as its people. Carl Johnson definitely believes in that. What are you doing to recruit the best staff, from technicians to experienced engineers?

JW: I’m glad that you mentioned Carl, because that ethos absolutely carries down into Clas-SiC. People are absolutely our main asset. Because we’ve grown quickly, bringing new people in to Clas-SiC is always on our watch. Carl and I very much share that vision that growing our own talent is always a valuable route. 10 percent of our workforce are graduate and modern apprentices. The modern apprentices have all been promoted from within.

Graduate apprentices have all been linked to the company in some way, whether they’ve been here on work experience, or whether they were a friend or family member of an employee. We’ve promoted one of our operators into a quality role and another into a facilities technician role.

We look where we can to bring people on to be the best they can possibly be. This benefits not only the employee, as it allows us to bring in new blood and see where that goes.

Professional engineering roles are obviously harder to fill because of the skills gap in the UK. We have had to bring in people from overseas. I sit on the technology Scotland Skills Group, and I’m part of TechWorks UK, looking at skills for women in technology. Keeping the talent pipeline filling in the UK is extremely important.

To retain talent here at Clas-SiC we’ve had to be as flexible as we can. We definitely had an ageing workforce, looking to retire. We have some engineers who would normally have retired that we’re managing to retain because they’re working on reduced days to give a better work-life balance. They enjoy it, and want Clas-SiC to be a success, so they’re happy to stay. Some of these engineers I’ve personally worked with for almost 30 years.

RS: What are the goals for Clas-SiC for 2026?

Our absolute main goal for 2026 is to achieve IATF 16949 accreditation – that’s automotive accreditation. It’s imperative for us, for working with customers that work in the automotive supply chain. We’ve got our stage-one audit in January, followed by our stage-two audit. So hopefully by the middle of 2026 we’ll be IETF 16949 qualified.