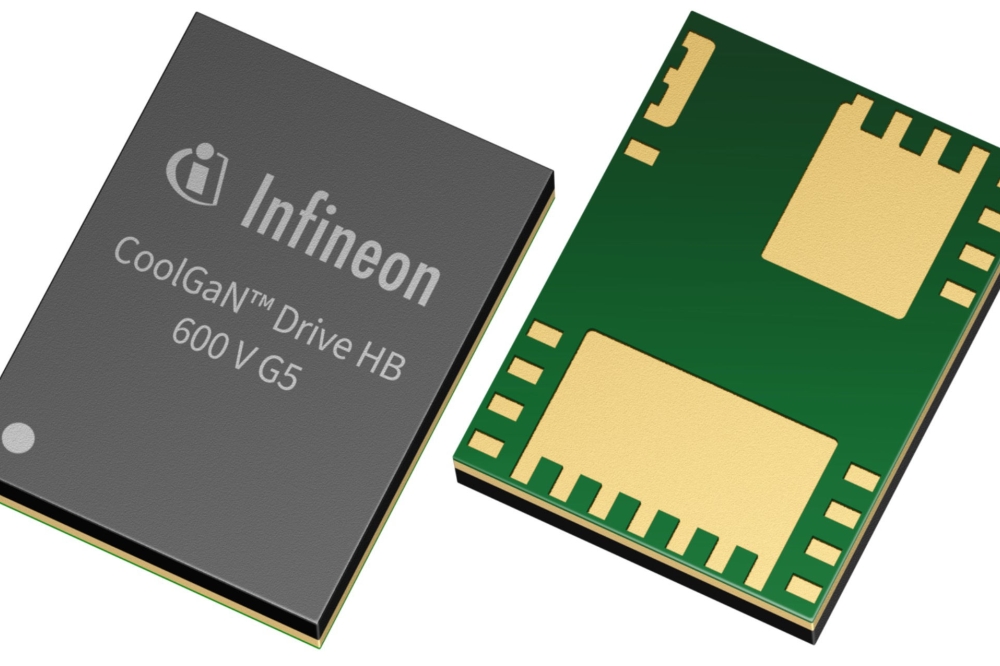

ams OSRAM sells non-optical analog/mixed-signal sensor business to Infineon

Sale of non-optical analog/mixed-signal automotive, industrial & medical sensor business is expected to close in Q2/2026

The sale of ams OSRAM’s non-optical analog and mixed-signal automotive, industrial, and medical sensor business to Infineon Technologies for EUR 570 million in cash is expected to close in Q2 2026 and represents a significant step in the Group’s deleveraging plan.

The divested business generated approximately EUR 220 million in annual revenue and around EUR 60 million in adjusted EBITDA in 2025. It includes entities holding roughly EUR 130 million of assets that secure the Group’s convertible bonds and senior notes, and the proceeds will be used for a pro-rata buyback or redemption of those instruments. In total, asset disposals under ams OSRAM’s deleveraging programme will generate around EUR 670 million, reducing the pro-forma leverage ratio from 3.3 to 2.5 including the effect of the OSRAM Put Options.

Balance sheet deleveraging:

- Sale of non-optical analog/mixed-signal automotive, industrial & medical sensor business to Infineon for EUR 570 million in cash; the transaction is expected to close in Q2/2026

- The divested business delivered approx. EUR 220 million annual revenues and approx. EUR 60 million adj. EBITDA in 2025

- The sale concerns entities holding about EUR 130 million of assets that guarantee the Group’s convertible bonds and senior notes; the related proceeds will be applied to pro-rata buyback or redemption of those instruments

- In total, asset sales under ams OSRAM’s deleveraging plan will generate proceeds of approx. EUR 670 million, pushing the pro-forma leverage ratio from 3.3 down to 2.5 (incl. OSRAM Put Options)

Strategic repositioning:

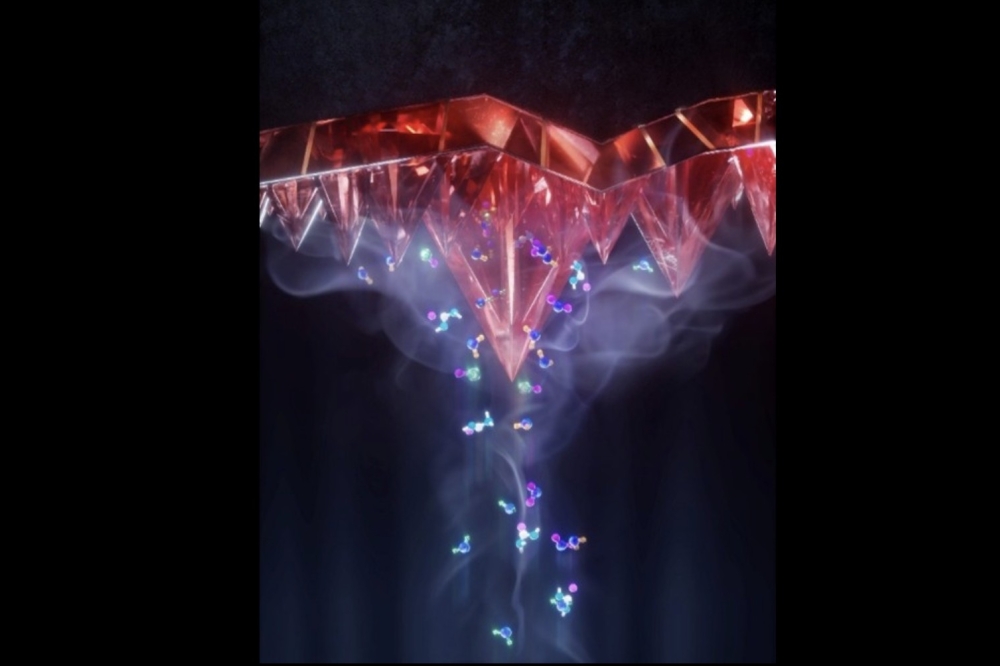

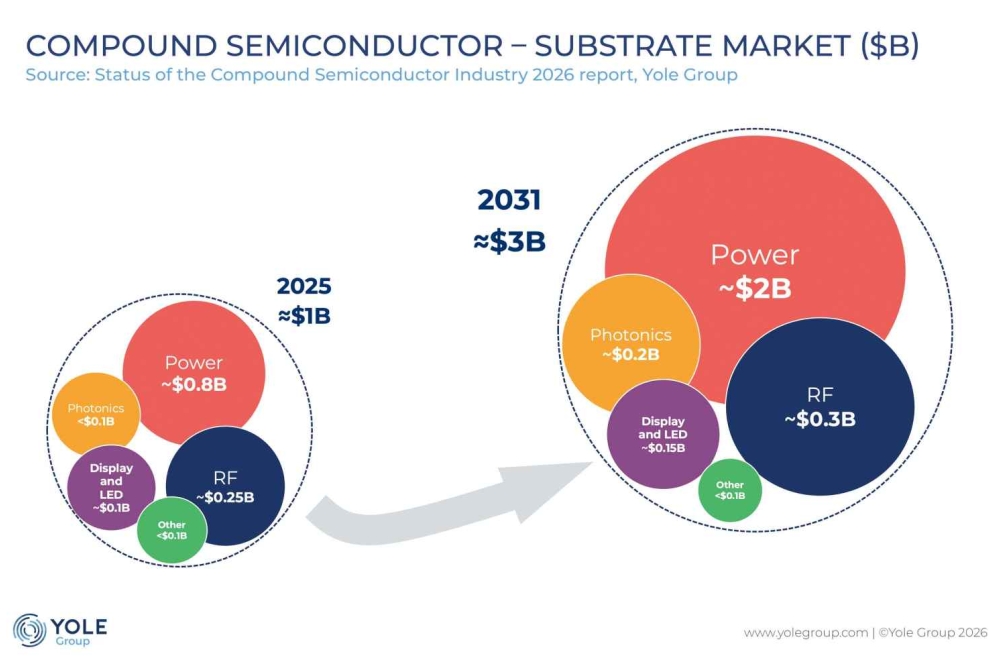

- Transaction increases financial and strategic flexibility and creates the leader in Digital Photonics focusing on intelligent optical semiconductor emitting & sensing technologies

- Digital Photonics means the digitalization of light emission through pixelated emitters and sensors including processing power for added intelligence and drives a set of mid-term growth opportunities supporting the new 2030 financial targets

- ams OSRAM boasts the broadest set of cutting-edge optical semiconductor technology platforms in emitters including specialized driver and power management ICs, and a full range of optical sensors and sensor modules

- The stable traditional automotive lamps (incl. the after-market business) remain part of the Group as reliable cash flow generator for funding growth in its semiconductor business

- New 2030 Over-the-Cycle Financial Targets: Semiconductors: mid-to-high single digit revenue CAGR, ≥ 25% adjusted EBITDA; Group: FCF EUR > 200 m, leverage ratio < 2