Revenue up marginally at Rubicon

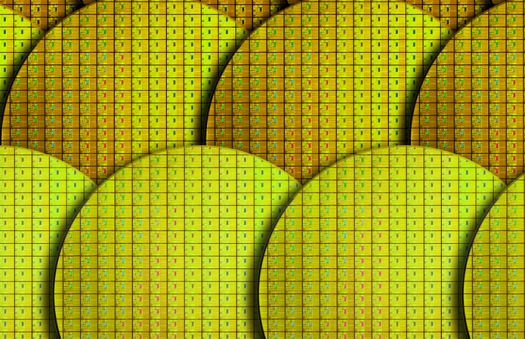

Utilisation of wafer operations improving

Rubicon Technology, a provider of sapphire substrates and products to the LED, semiconductor, and optical industries, has reported its Q2 financial results, ending June 30, 2014.

Q2 revenue was $14.5 million as compared with $14.3 million in Q1. Revenue from polished and patterned wafers increased by $1.8 million sequentially while revenue from cores declined by a similar amount.

The decline in core sales was due to more crystal production being directed into wafer products and because the company had exhausted its excess boule inventory in the first quarter.

Four-inch core pricing increased approximately 10 percent sequentially due to strong demand from the LED market and the result of LED chip manufacturers moving from two-inch to four-inch substrates in order to increase throughput from their existing facilities.

Raja Parvez, President and CEO of Rubicon, commented, "Now that MOCVD utilisation rates are high, many LED chip manufacturers are looking for ways to increase throughput from existing operations, and moving to a larger substrate is one of the most effective ways to do that. We view the recent move to four-inch substrates as validation of our belief that we will soon see greater adoption of six-inch and even eight-inch substrates. This is important for Rubicon because of our strength and expertise in larger diameters."

The company also reported progress with its patterned sapphire substrates (PSS) product introduction, an important part of Rubicon's go-forward strategy. Mr. Parvez said, "A significant development in the introduction of our PSS product came this quarter with the initial qualification of our four-inch and six-inch PSS wafers at three customers, two of which are major, international LED chip manufacturers. This is significant because we believe these customers have the potential to contribute significant revenue next year."

The company reported a per share loss of $0.39 in the second quarter as compared with a loss of $0.43 per share in the prior quarter. Wafer costs continued to be higher than normal due to the large number of PSS samples produced and the cost of establishing a four-inch polishing line.

William Weissman, Rubicon's CFO, commented, "While idle plant and development costs at our wafering facility continued to be a drag on earnings in the second quarter, we are making progress in continuing to improve our overall cost position. Utilisation of our wafer operations is improving and we expect wafer costs to decline as we move from development to production in our new product lines."

Outlook

Commenting on the outlook for the third quarter of 2014, Mr. Parvez said, "We expect continued progress in growing the wafer business in the third quarter with additional volumes in both polished and PSS wafers. However, we are seeing very limited demand for two-inch core in the third quarter as our polishing customers currently have excess inventory. In addition, we believe that recent capacity additions in the sapphire market, which are primarily targeted at the developing mobile device market, are temporarily impacting the two-inch market. We expect third quarter revenue of between $8 and $12 million with an expected loss per share in the third quarter between $0.39 and $0.44. This relatively wide range of expected revenue is due to the near-term uncertainty in the two-inch market. We expect two-inch inventories at our polishing customers to be reduced over the course of the third quarter and for demand for that product to improve in Q4."

Finally, Mr. Parvez stated, "We continue to execute on our vertical integration strategy and are making good progress with the wafer business. The recent initial qualification of our PSS product at three new customers this quarter was an important step in the introduction of that new product line and qualification efforts continue with a number of other major LED manufacturers. With increasing volume and experience, and as customer specifications become better defined, we will reduce our idle plant costs and our wafer product cost. Furthermore, while pricing for certain product groups may take a step back from time to time for various reasons, we believe the general pricing trend for sapphire will continue to improve for some time. We believe that the market opportunities ahead of us are substantial and the work we are doing now will result in significant improvement in financial performance in the future."