Rubicon's Q2 revenue drops

Rubicon Technology, a provider of sapphire substrates and products to the LED, semiconductor, and optical industries, has reported financial results for its second quarter ended June 30, 2015. Q2 revenue was $7.1 million, lower than the prior quarter revenue of $8.9 million due to weaker sapphire demand and lower pricing in the quarter.

Rubicon cited a combination of factors, including higher TV inventory levels and some seasonality in the LED light bulb market as likely contributing to the weaker demand in the quarter.

Both volume and price were affected by the lower demand. PSS wafer sales, however, nearly doubled from the prior quarter to $900 thousand. The company expects continued growth in PSS wafer sales throughout the year and recently received a $9.0 million purchase order for six-inch PSS wafers to be delivered over twelve months starting this October.

While the sequential price decline put additional pressure on operating results, loss per share in the second quarter was $0.33, similar to the prior quarter loss of $0.32.

Resource sharing

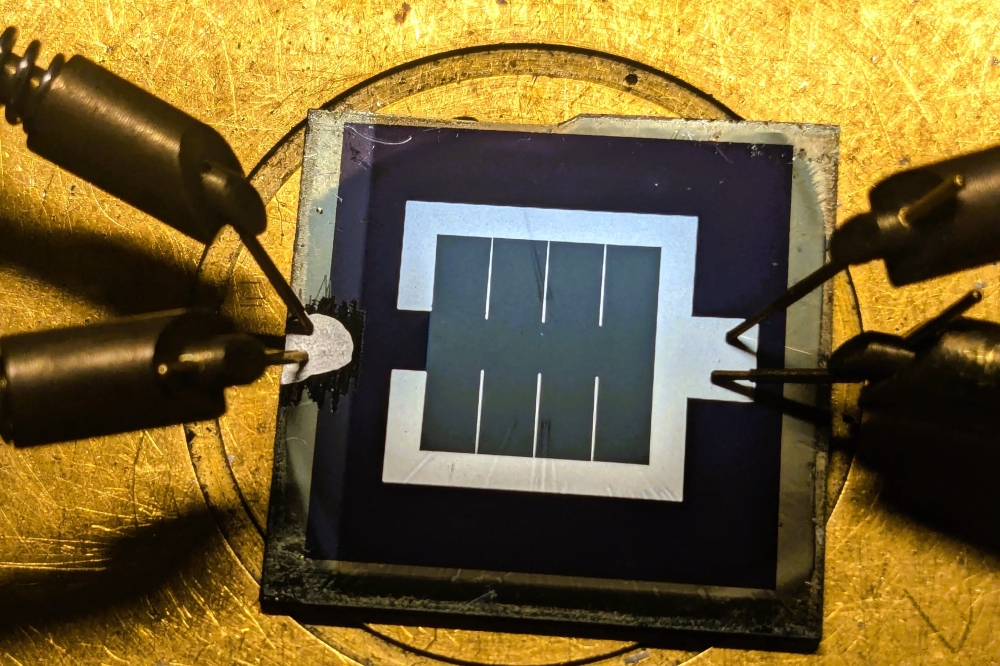

The company also announced the signing of a resource sharing agreement with another leading sapphire polisher. Under that agreement Rubicon will receive what it believes to be a lower cost four-inch polishing process in exchange for making available to the other party the use of a portion of its underutilised slicing and polishing capacity in Malaysia.

Rubicon will continue to use its existing six-inch polishing process but believes that some of the process modifications made for four-inch will be transferrable to six-inch and result in reduced cost for that product as well.

"During the current down cycle in the market, we have been focusing on a number of key initiatives: aggressively pursuing our PSS potential, targeting high margin optical applications, driving down product costs and developing new products; and we are making progress on each of these fronts," said Bill Weissman, president and CEO of Rubicon.

"We are focusing on PSS wafer sales because we believe this product has greater margin potential, however, we must reduce slicing and polishing costs in order to realise the potential. We believe the resource sharing agreement will allow us to reduce those costs faster than internal development, especially for four-inch wafers."

Outlook

The company expects the challenging market to continue in the third quarter. While PSS wafer sales are expected to increase, visibility on two-inch and four-inch core sales is limited, so third quarter revenue is expected to be at or below second quarter levels. Revenue from PSS sales is expected to continue to grow in the fourth quarter and the Company believes demand for two-inch and four-inch core should also strengthen in the fourth quarter.

Process changes associated with the resource sharing agreement will be made over the course of the remainder of the year. The extent and timing of cost reductions from these changes will be better understood as the changes are implemented. For the third quarter, loss per share is also expected to be at or higher than the second quarter.

The company also reported temporarily scaling back some of its raw material and crystal growth operations. Mardel Graffy, Rubicon's CFO commented: "Reducing raw material and crystal inventory will improve cash flow in the near-term and we are retaining key personnel to ensure we can scale back up to full production quickly as market conditions improve."