Steady growth for power electronics

Total power electronics market expected to grow to $33.3 billion by 2028, according to Yole

Renewables, increased efficiency, and government regulations for different segments will driving steady growth of around 8 percent for power electronics over the next five years, according to Yole Intelligence's annual power electronics report, Status of the Power Electronics Industry 2023.

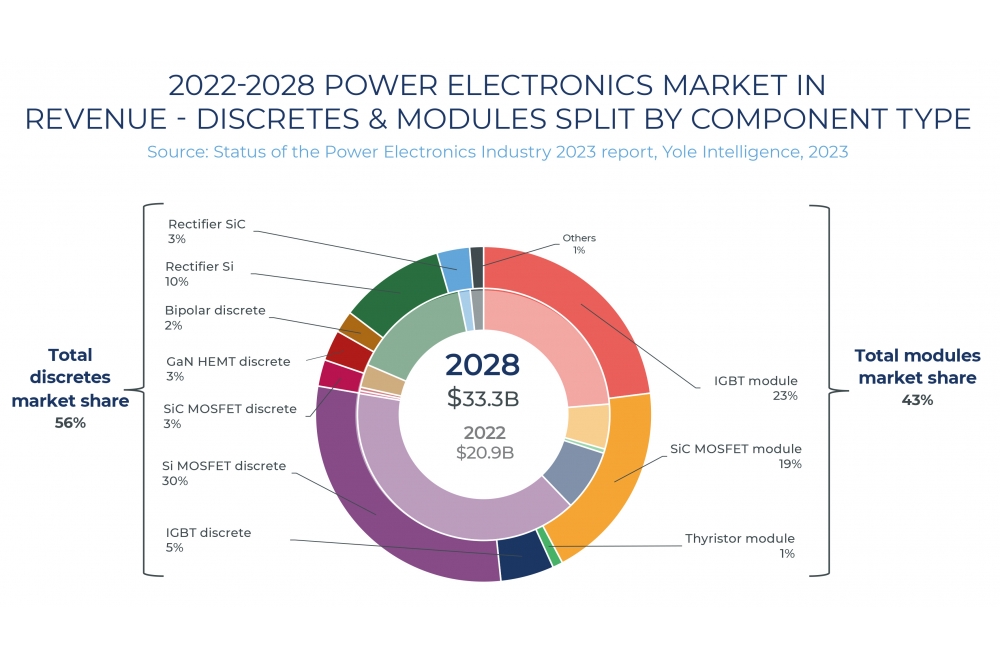

In 2022, the total power electronics market was worth $20.9 billion, including discretes and modules. Yole expects it to grow to $33.3 billion by 2028.

Worth $14.3 billion in 2022, the discrete market is expected to reach $18.5 billion by 2028. The main applications driving this growth are xEV , DC charging infrastructure, and automotive . Consumer remains the largest market for discrete devices even if it is in decline.

In parallel, the module market is pushed by xEV and renewables applications. It includes both photovoltaic and wind. According to Yole Intelligence, this market should reach $14.8 billion by 2028.

China is the largest buyer of power components, with about 38 percent of the market in 2022. The top three companies remain the same as the previous year: Infineon Technologies, Onsemi, and STMicroelectronics, who show significant SiC revenue boosts.

Ana Villamor, team lead analyst, power electronics at Yole Intelligence said: “The power device market is split into three different materials: Si, SiC, and GaN . Without doubt, silicon is the major part of this market, though SiC is gaining momentum. At Yole Intelligence, we see the growing demand for modules for xEV. In parallel, GaN’s main application will continue to be consumer power supplies.”

In the long term, total wafer production is increasing alongside the growing power electronic device demand from renewables, automotive and industrial applications. To meet this demand, silicon wafers for power applications will grow to about 47 million 8-inch equivalent wafers per year. Meanwhile, wafer players are focusing on 12-inch. SiC’s transition to 8-inch is taking place, and in the coming years, this will take a greater share of the market.

Today, China is the largest buyer of power components, followed by Asia/Pacific and Europe. New growth areas, previously less active in semiconductor manufacturing, are found where major companies are investing to supply Asia, other than China, such as Malaysia, Vietnam, and Singapore.

A detailed look shows that the silicon wafer market is dominated by five leading players, with 88 percent of the market. The three major players are Sumco, Siltronic, and Global Wafers. Most of the manufacturers are in Asia/Europe. At the device level, the top manufacturers are pushing the three different device technologies: Si, GaN, and SiC. “We have noticed that a few players pushing GaN have stepped back on R&D to wait for a market increase before investing further, such as Onsemi and Alpha and Omega,” adds Villamor .

From the manufacturing side, China remains the leader in investments for manufacturing expansion in 300mm, as well as in 200 and 150mm. Main power IDMs and foundries are constructing/expanding 300mm lines. Infineon Technologies, Bosch, Toshiba, Nexperia, etc., are part of the ecosystem. A few 200mm lines are being built worldwide, and 150mm lines are being re-furbished to 200mm. Apart from that, Wolfspeed, Infineon Technologies, CRCC, etc., are among the list of power IDMs pushing for 200mm SiC capacity.