Where are we with MicroLEDs?

Success may hinge on disruptive architectural changes like Si -CMOS microdrivers, says Yole

Optimism surrounding microLED technology in 2017, with expectations of commercialisation by 2020-2021, has given way to a more extended timeline, according to Yole Intelligence.

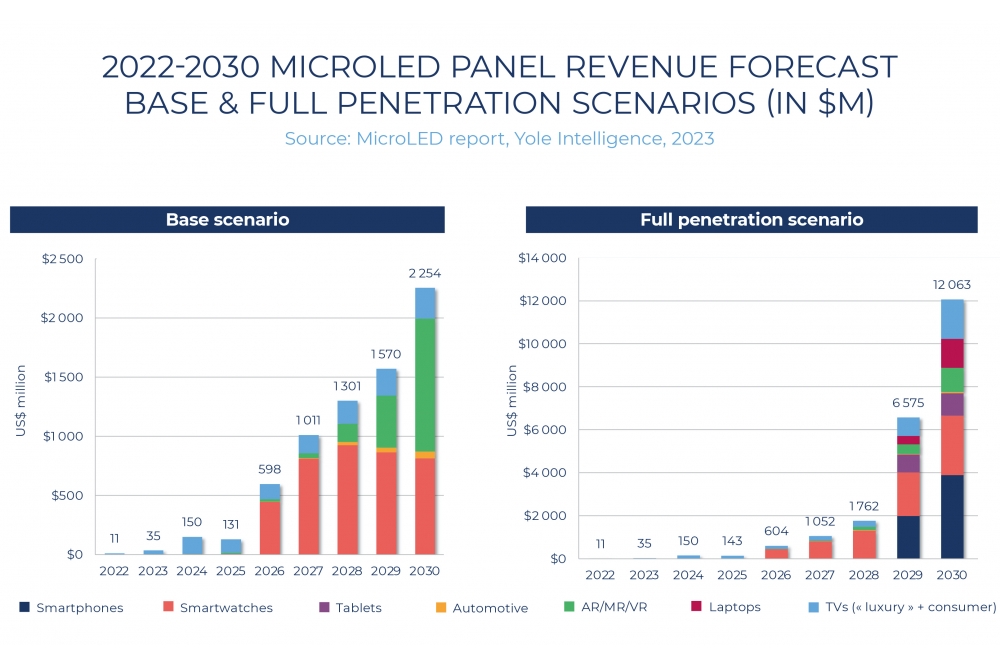

Meaningful production volumes are now predicted to be achievable in the next two to three years, with widespread consumer adoption potentially taking 5-10 years.

Eric Virey, senior market and technology analyst at Yole Intelligence say: “While the industry has seen substantial investment with over $11.5 billion spent by 2023, including $8.8 billion for R&D and startup funding and $2.7 billion for pilot lines and manufacturing preparations, the path to success has been marked by ups and downs, often due to challenges in achieving high-yield, low-cost, high-volume production.

He adds: "Cost models struggle to demonstrate that microLEDs can match OLED prices, and even if they do, the differentiation will be small, particularly in competitive markets like smartphones.”

Yole says that the urgency for microLED technology to succeed has grown as OLED technology continues to advance. With cost unlikely to be an element of differentiation, to establish itself as a strong alternative to OLED, microLED must deliver clear performances and functionality advantages.This includes higher brightness, colour depth, stability, modular displays etc.

MicroLED’s success may hinge on disruptive architectural changes like Si -CMOS microdrivers, which have the potential to enable advanced features like memory-in-pixel or integrated sensors, and significantly reduced power consumption. Microdrivers also have the potential to transform the display industry into a full semiconductor industry.

Raphaël Mermet-Lyaudoz, technology and market analyst, for displays at Yole Intelligence, says: “However, such changes may be driven by industry outsiders and require further optimisation to compete with traditional TFT architectures. In this evolving landscape, companies like Apple, with their hybrid microdriver + TFT approach, and innovators like X-Display, VueReal, Aledia, Sapien Semiconductors, Lextar and others are vying for a competitive edge, but pricing challenges persist, particularly for those outside of the largest players with Si-CMOS foundry access.”

Comprehensive supply chain management poses challenges. Few are likely to achieve full vertical integration, opting for sourcing CoW or CoC from LED manufacturers, according to Yole.

Beyond corporate competition, it’s an ecosystem competition, particularly evident in China and Taiwan. Taiwan’s ecosystem covers all aspects of microLED development and manufacturing, marked by the formation of a domestic microLED alliance in April 2023. China’s display and LED industries are fostering domestic tool makers for mass transfer, testing, and repair.

Korea lacks well-established ecosystems and clear alliances within the supply chain, but LG and Samsung leverage their influence over domestic equipment players to drive microLED tool and process development.