Wolfspeed reports Q3 results

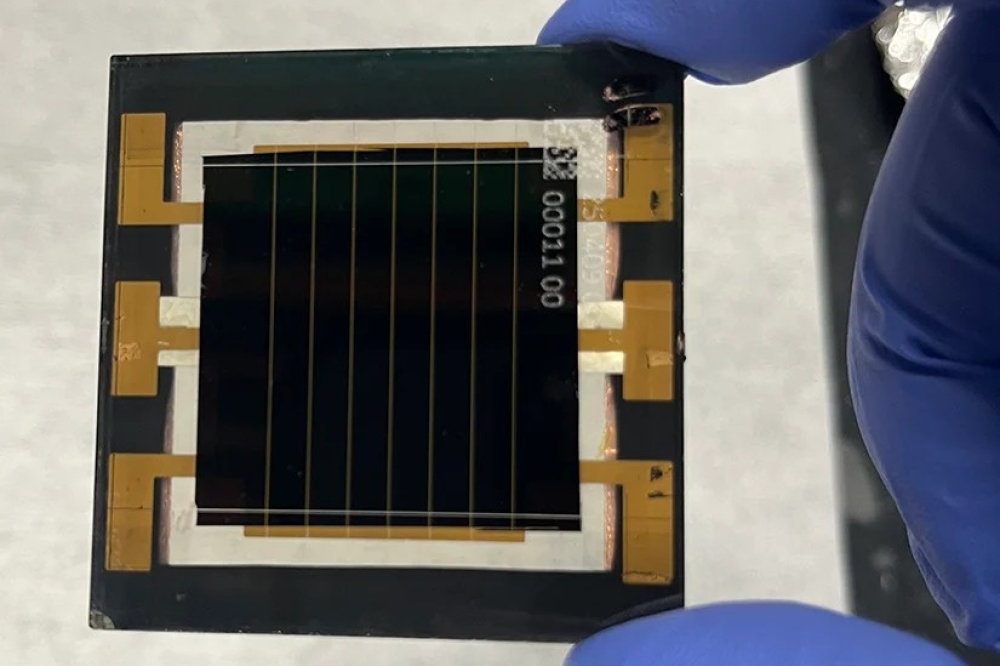

Mohawk Valley SiC fab revenue has more than doubled sequentially

Wolfspeed, has announced its results for the third quarter of fiscal 2024 with revenue of approximately $201 million, compared to approximately $193 million in Q3 2023.

The Mohawk Valley SiC fab contributed approximately $28 million in revenue, over a 2x increase from the prior quarter. Materials revenue was approximately $99 million - second highest quarter on record, and power device design-ins were $2.8 billion. Of the $0.9 billion quarterly design-wins, 70 percent were related to EV applications

GAAP gross margin was 11 percent, compared to 31 percent compared to Q3 2023, and non-GAAP gross margin 15 percent, compared to 34 percent in Q3 2023. GAAP and non-GAAP gross margins for the third quarter of fiscal 2024 include the impact of $30 million of underutilisation costs (see later).

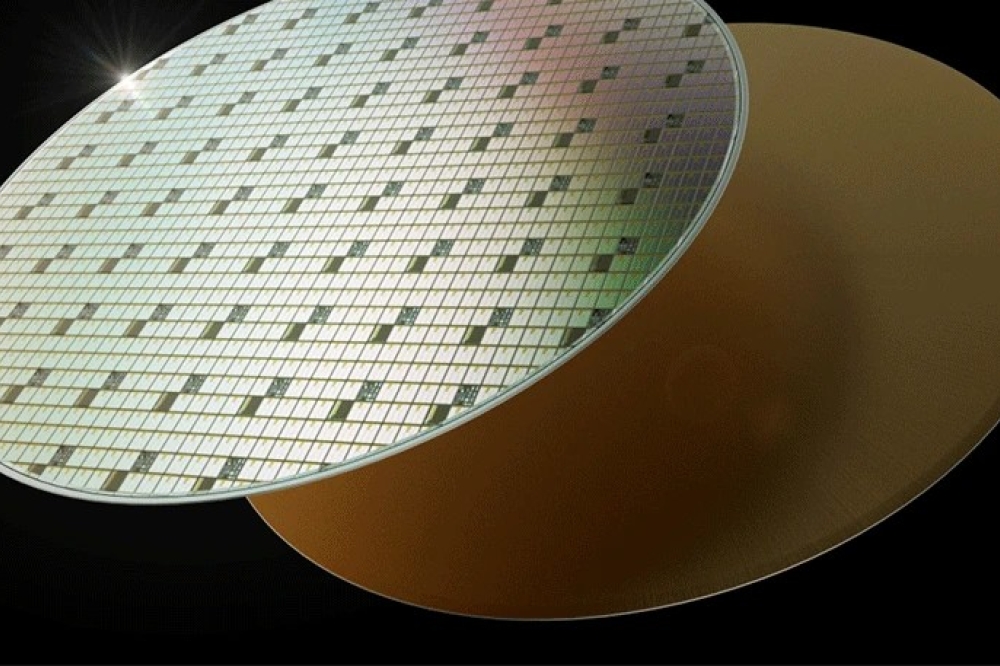

"We are pleased with the significant operational milestones achieved in the quarter for Wolfspeed as we continue to be the world’s first fully, vertically integrated 200-millimeter is player at scale,” said Wolfspeed CEO, Gregg Lowe. "We are making progress on our Mohawk Valley ramp, more than doubling revenue sequentially in the quarter and reaching more than 16 percent wafer start utilisation in April, giving us confidence in our ability to achieve our 20 percent utilisation target in June 2024. Construction continues at the JP, our 200mm materials factory in North Carolina.

"During the quarter, we started installing furnaces and connected the facility to the power grid, and we recently hosted our topping out ceremony. As we’ve said before, Mohawk Valley will be the flywheel of growth for Wolfspeed, and the JP will be instrumental in supplying it with high-quality materials. We are encouraged by the operational progress these facilities have made and how it will support our long-term growth trajectory."

Lowe continued, "While there have been headlines around general demand weakness in EVs, we still have more demand than we can supply for the foreseeable future. Our second highest quarter of design-ins to date and more than $5 billion of design-wins so far this fiscal year, tell a compelling story. While the industrial and energy end markets pose short-term headwinds to our results, we firmly believe in the strength of our long-term prospects as the electrification of all things continues across a broad set of applications."

Business Outlook:

For its fourth quarter of fiscal 2024, Wolfspeed targets revenue from continuing operations in a range of $185 million to $215 million. GAAP net loss from continuing operations is targeted at $166 million to $189 million, or $1.32 to $1.50 per diluted share. Non-GAAP net loss from continuing operations is targeted to be in a range of $91 million to $109 million, or $0.72 to $0.86 per diluted share.

As part of expanding its production footprint to support expected growth, Wolfspeed says it is incurring significant factory start-up costs relating to facilities the company is constructing or expanding that have not yet started revenue generating production. These factory start-up costs have been and will be expensed as operating expenses in the statement of operations.

Wolfspeed says it incurred $14.4 million of factory start-up costs and $30.4 million of underutilisation costs in the third quarter of fiscal 2024. No underutilisation costs were incurred in the third quarter of fiscal 2023.

For the fourth quarter of fiscal 2024, operating expenses are expected to include approximately $20 million of factory start-up costs primarily in connection with materials expansion efforts. Cost of revenue, net, is expected to include approximately $29 million of underutilisation costs primarily in connection with the Mohawk Valley Fab.