Wolfspeed: Rejuvenated by restructuring?

After starting to address its colossal debt by converting loans into shares and filing for chapter 11 bankruptcy protection, has Wolfspeed taken the first steps to a revival?

BY RICHARD STEVENSON, EDITOR, CS MAGAZINE

Wolfspeed, and in its former guise Cree, has been at the very forefront of our industry for decades. Building on its initial expertise in SiC, this spin-out of North Carolina State University that founded in the late 1980s has been a trailblazer of SiC substrates, along with high-brightness LEDs and power and RF electronics.

In recent times, driven by the vision of Wolfspeed’s former CEO, Gregg Lowe, the company has streamlined its business, first carving out its LED division and then selling its RF business to Macom in December 2023.

While these moves that have shifted the focus to SiC substrates, epiwafers and power devices make much sense, given that the current portfolio is aligned with an electric vehicle market that is sure to climb over the coming years, it’s not prevented Wolfspeed from finding itself trapped in a particularly ferocious perfect storm. Peril has resulted from borrowing big to try and fully exploit growth in softening SiC markets, while facing increasingly stiff competition from Chinese makers of SiC substrates that are slashing prices to win sales in a sector suffering from overcapacity.

Now Wolfspeed is trying to extricate itself from this precarious position by starting to convert billion-dollar cash injections from BorgWarner, ZF and Renesas into shares, filing for Chapter 11 bankruptcy protection in late June, and trimming its wage bill by laying off a 20 percent of its workforce.

But will this be enough? And even if Wolfspeed soldiers on, has it already been inflicted with irreparable damage?

Offering insight into all this and more, including crucial details into why Wolfspeed has got itself into such dire straits, is Yole Group’s Principal Technology & Market Analyst for Compound Semiconductors, Poshun Chiu, who has been sharing his thoughts with Compound Semiconductor.

According to Chiu, Wolfspeed’s problems have been exacerbated by its incredibly aggressive investment in capacity expansion, spurred on by an outlook based on design-ins rather than design wins, and optimistic forecasts. “They targeted a larger market size, much higher than Yole's numbers at the time.”

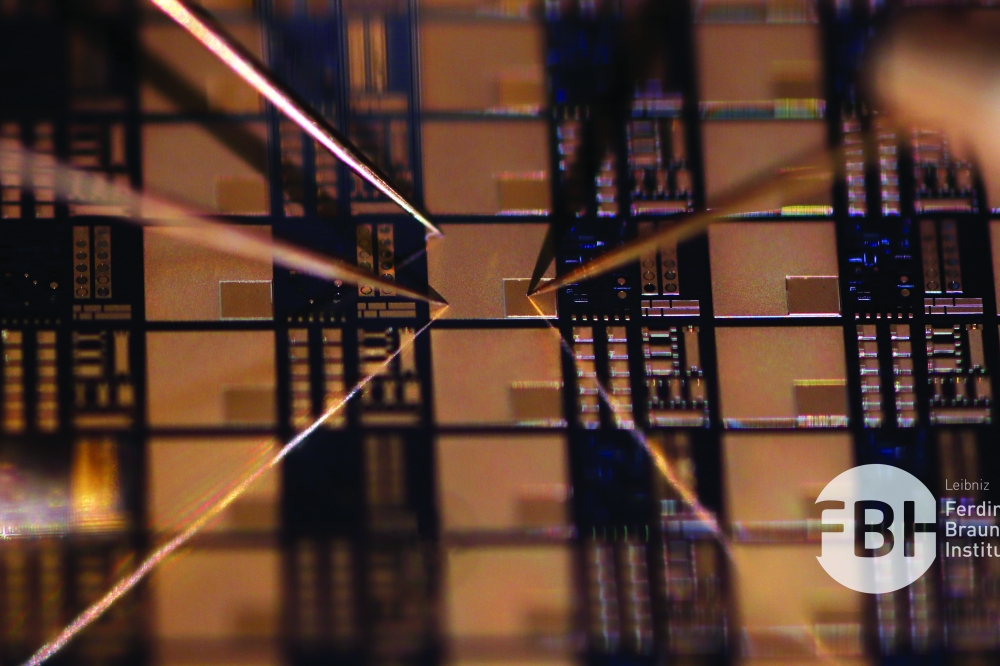

Driven by these enthusiastic predictions, Wolfspeed has been spent billions and billions expanding its capacity. In North Carolina, home of its materials and epiwafer businesses, Wolfspeed’s recently complemented a well-established facility with the John Palmour Manufacturing Center. Topped out last March, this latter addition, designed for the production 200 mm SiC wafers, cost $5 billion.

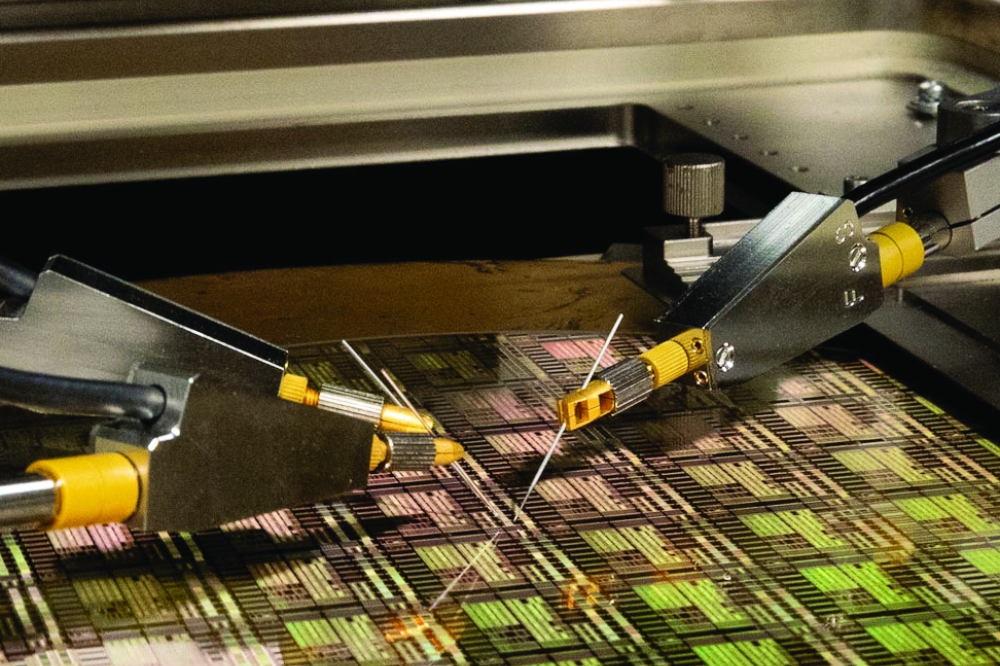

Some device production also occurs in North Carolina, using 6-inch material, but this is being phased out. “In the coming quarters they want to have 100 percent device manufacturing in Mohawk Valley,” says Chiu, explaining that the plan has been to add tools to this facility – opened in 2022 as the world’s first 200 mm SiC fab – over a number of years.

Underscoring how fast Wolfspeed intended to grow its business, the company also planned to build a second 200 mm fab in Mohawk Valley, plus another in Germany, with financial support from ZF.

It’s not yet clear exactly how ZF and another financial backer, BorgWarner, will recoup their substantial investments. But Wolfspeed has just announced a deal struck with Renesas, which in July 2023 loaned Wolfspeed $2 billion and agreed to a 10-year wafer supply contract. Now that loan has been converted into Wolfspeed shares, maturing in June 2031. Chiu expects similar outcomes for ZF and BorgWarner, given the lack of alternative options.

Within Wolfspeed’s current portfolio of SiC substrates, epiwafers and devices, over the last few years emphasis has shifted to the production of power electronics. Yole Group estimates that back in 2020, sales of SiC power devices netted around $100 million – about a fifth of the company’s revenue – and by 2024 this figure had climbed to nearly $400 million, positioning Wolfspeed as the fourth biggest supplier of this class of device. Note that this astonishing growth has been far from linear, with Wolfspeed’s sales of SiC power devices flat-lining from 2023 to 2024.

The company’s growth in SiC power devices over the last five years is crucial to its long-term prospects, given that Wolfspeed’s stranglehold on the substrate market is loosening fast. As well as using substrates for internal production, the company has been selling to many of the leading producers of power electronics for decades, but its share of this market is in decline, and is now less than 30 percent, compared to around 50 percent in 2021, according to Yole Group

Behind Wolfspeed are few Chinese companies. One is SICC, now in second spot, followed by TanKeBlue and other Chinese peers. Taken together, they have grown their market share from 10 percent in 2021 to nearly 40 percent, according to Yole Group.

“The Chinese companies have improved quality a lot, and the price compared to the international players is much lower,” says Chiu, explaining the additional capacity provided by Chinese SiC substrates makers contributed to overcapacity in 2024, and a price drop of 30 percent.

Chiu says that the Chinese companies are striving to win market share by compromising the gross margin. Some new entrants are even selling the substrate at a price below cost. Despite this aggressive approach, prices are not expected to fall as fast in the near future – Chiu is expecting reductions of around roughly 10 percent per annum – because all the players in the SiC market are currently managing cash very carefully.

In Wolfspeed’s favour is the high quality of its substrates, particularly valued for producing MOSFETs for the automotive industry. The quality of Chinese material was not as high, arguably making it better-suited for less demanding Schottky barrier diode production. However, the quality of substrates from Chinese players is getting better and better, spurred on by competition between Chinese suppliers, and the diameter of these wafes is getting larger. In 2025, at Semicon China, many domestic producers of SiC boules demonstrated 300 mm wafers. This size could unlock an opportunity to use SiC as the backplane in AR glasses, an application that promises to drive volumes to new highs.

What will also concern Wolfspeed is that the SICC and TanKeBlue have been qualified by market leaders of SiC device, such as Infineon and Bosch. Given the uncertainty surrounding the future of Wolfspeed, there is more importance than ever for chipmakers to mitigate risk by securing multiple suppliers – but once multiple vendors are qualified, all suppliers will have to compete for sales.

As a device manufacturer, Wolfspeed is focusing on the most demanding application, electric vehicles, and supplying MOSFETs for use in inverters. Here, Chiu argues that Wolfspeed is competitive, with a 10 percent share of the SiC power electronics market.

“What Wolfspeed has achieved is quite significant, but it's not enough to sustain or support their ambitions, like to build a huge fab in the US, and another fab in Germany,” says Chiu. “They have achieved a certain level of revenue, but somehow it's not sufficient compared to the level of investment announced.”

Those now in charge of Wolfspeed will be hoping to retain existing customers and find new ones, while restructuring capital to ensure a cash flow that provides a sustainable business.

In Wolfspeed’s favour is that when it comes to chip manufacture it’s still the market leader for device production on a 200 mm line. Thanks to this edge over its rivals, Chiu believes that if Wolfspeed can navigate through these difficult times, it could grow its revenue, or at least its shipments, over the next few years.

While such success would be very modest when judged against the big and bold plans of yesteryear, it might allow the company to turn a page and eventually provide some good news for its investors. They have suffered in recent years, seeing shares tumble from over $140 in late 2021 to trade below a dollar, reflecting the severe downturn in fortunes. And although the recent chapter 11 filing went down well with markets, helping to deliver some significant hikes in valuation, existing equity holders are going to have their shares cancelled, and receive 3 percent to 5 percent of the new equity. They will be hoping that Wolfspeed’s survives – and on its new footing, they have good reason to be hopeful – but whether it will ever thrive again is hard to say.