Aixtron delivers strong order intake in Q2

Aixtron SE has announced revenues of €250.1 million in the first half of the year, matching the previous year’s level and performing strongly against the weaker overall market dynamics.

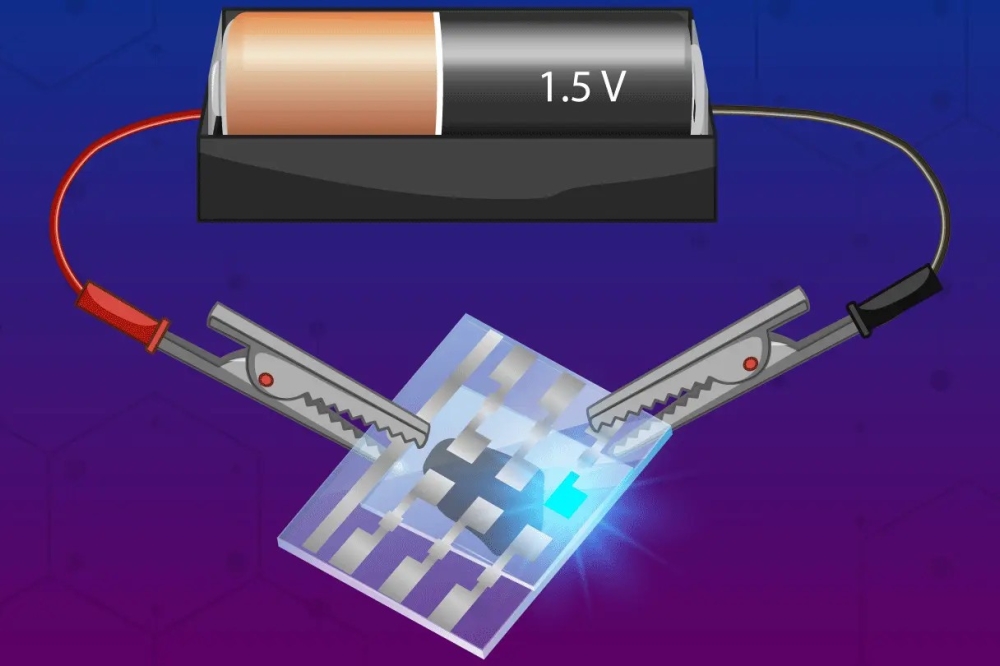

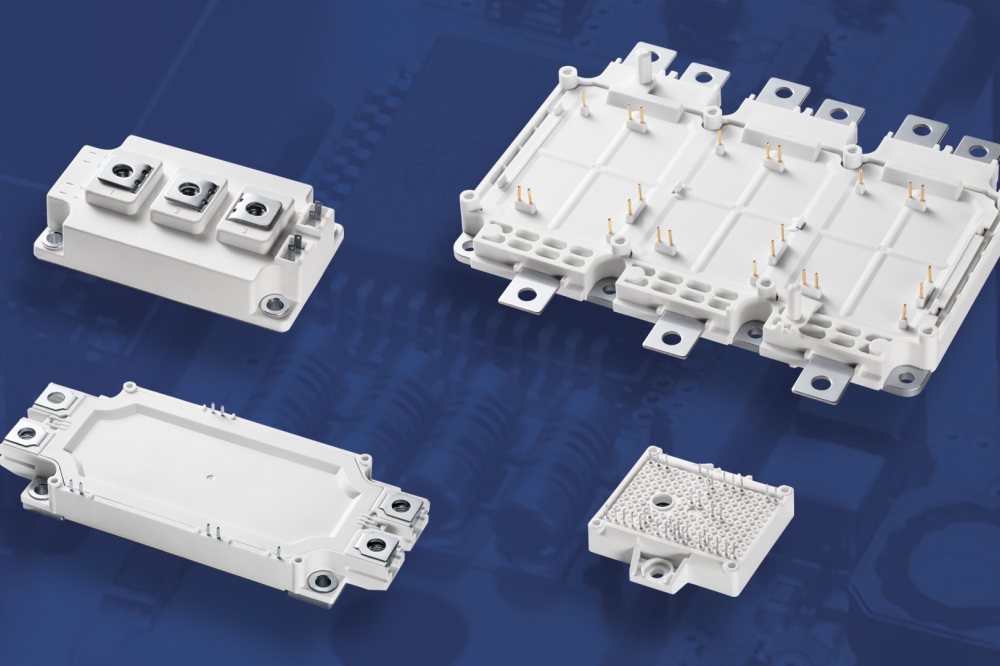

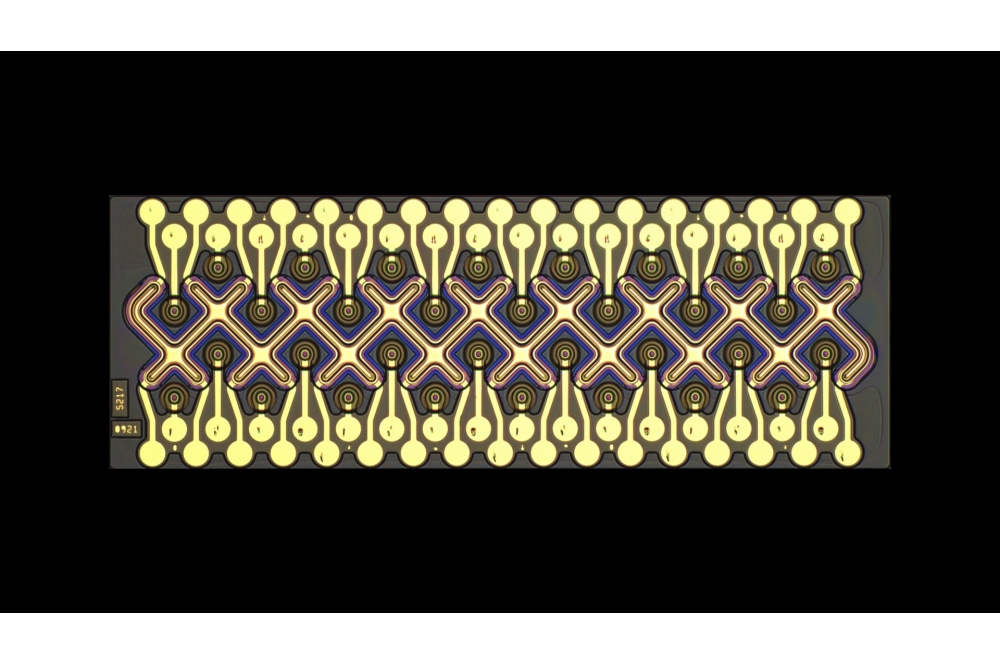

The G10 product family, consisting of G10-SiC, G10-GaN and G10-AsP, was the main driver in both the past quarter and the first half of the year.

The company recorded an order intake of €175.7 million in the second quarter 2024, matching the record level of the same quarter of the previous year (Q2/2023: €177.8 million).

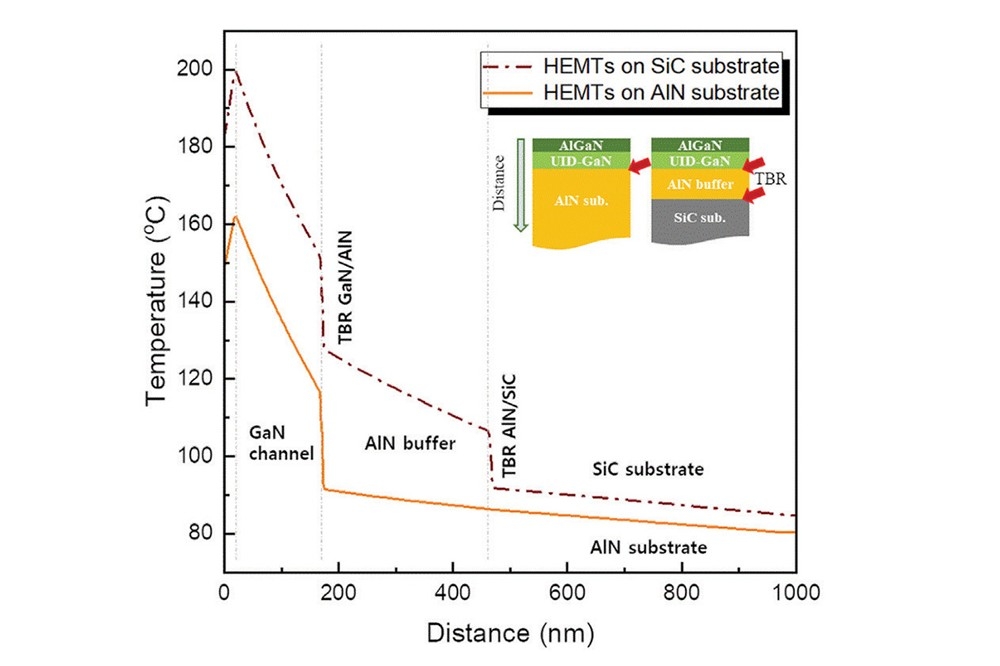

The strong order intake in the second quarter of 2024 is in particular due to the high demand from the power electronics sector. SiC-based systems accounted for 57 percent of incoming equipment orders, while GaN-based systems made up 29 percent.

While important new SiC customers drove business in the first quarter – including one of the top five suppliers of SiC components and customers from China and Japan – in the past quarter Aixtron also secured major follow-up orders from existing SiC customers, among others.

"We maintained our strong position in the first half of the year, and this despite the overall trend. The strong demand for our technology continues across all addressed end markets, particularly in the SiC segment, " said Felix Grawert, CEO and president of Aixtron SE.

"We have not only succeeded in acquiring new customers, including one of the top five suppliers of SiC components. We were also able to secure major follow-up orders from important existing customers. Here, Nexperia is a good example in the field of power electronics, where we were able to impress with both, our SiC and GaN systems. This momentum is reflected in our Q2 order intake," he concluded.

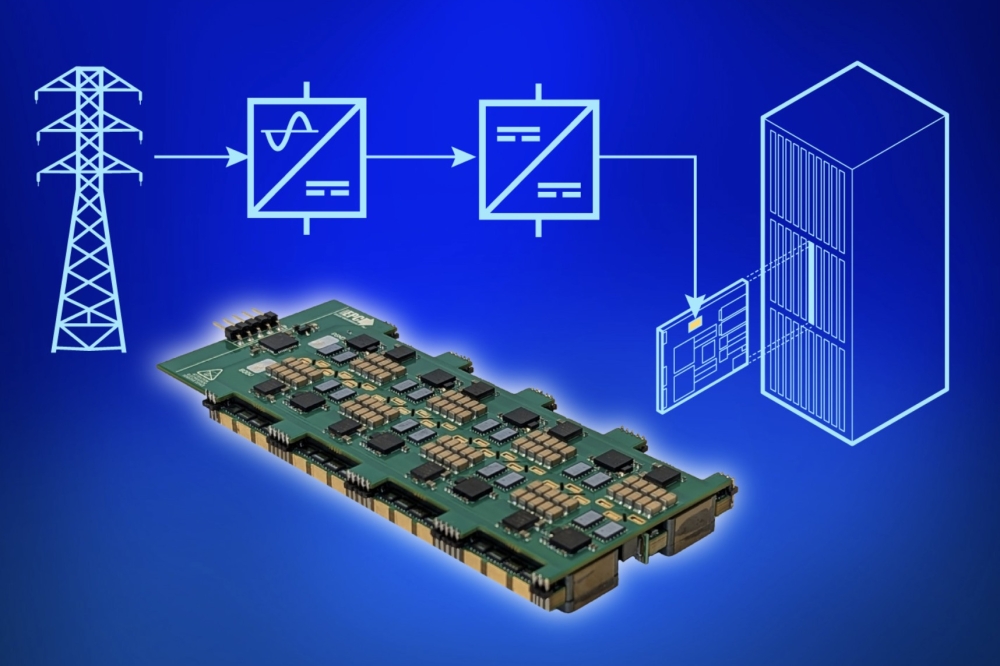

In June, Aixtron announced the purchase of a new site near Turin, Italy. With an investment in the low double-digit million euro range in an existing building, the company is creating the opportunity to quickly expand its production capacities – and potentially double its volume in the future. The company is thus addressing the expected increase in demand from major customers and will be able to cover future order peaks at all times.

Aixtron is investing around €100 million in a new 1,000m² cleanroom complex at its Herzogenrath site, where the technology leader will work with customers on next generation systems in the future. Construction of the new Aixtron Innovation Center is progressing well. The first systems are scheduled to be installed during the second half of the year.

Aixtron recorded a high order intake of €296.0 million for the first half of 2024 (H1/2023: €317.7 million). A large proportion of the equipment orders booked in the second quarter 2024 will be delivered in the next fiscal year. The system order backlog as of June 30, 2024 increased significantly to €400.6 million (March 31, 2024: €355.0 million; June 30, 2023: €412.5 million).

Revenues in the upper half of the guidance range

Revenues in the first half of 2024 amounted to €250.1 million matching the previous year's level (H1/2023: €250.7 million). In the second quarter 2024, revenues reached €131.8 million (Q2/2023: €173.5 million), which was in the upper half of the guided range of €120.0 million to €140.0 million.

Aixtron achieved a gross profit of €92.9 million in the first half of 2024 (H1/2023: €104.6 million), with a gross margin of 37 percent. The change compared to the same period of the previous year (H1/2023: 42 percent) is mainly due to a shift in the product mix, which included a high proportion of lower-margin LED systems in the first half of the year. Gross profit in Q2/2024 amounted to €49.1 million, with a gross margin of 37 percent (Q1/2024: €43.8 million, 37 percent; Q2/2023: €73.5 million, 42 percent).

Investment in R&D remains high

Operating expenses in the first six months of the current year amounted to €70.1 million (H1/2023: €56.5 million), primarily due to increased R&D expenses, which totaled €47.5 million in the first half of 2024 (H1/2023: €39.0 million). In the second quarter 2024, operating expenses amounted to €36.3 million (Q2/2023: €28.9 million), of which R&D expenses accounted for €24.6 million (Q2/2023: €19.8 million).

The operating result (EBIT) in the first half of 2024 was €22.8 million, corresponding to an EBIT margin of 9 percent (H1/2023: €48.1 million, 19 percent). In Q2/2024, Aixtron achieved an operating result (EBIT) of €12.9 million and an EBIT margin of 10 percent (Q2/2023: €44.6 million; 26 percent). The profit for the period in the first six months of 2024 reached €22.0 million (H1/2023: €43.9 million; Q2/2024: €11.2 million; Q2/2023: €40.4 million).

Financial position

At €20.2 million, the cash flow from operating activities in Q2/2024 was significantly higher than in the same quarter of the previous year (Q2/2023: €-76.3 million; H1/2024: €12.8 million; H1/2023: €-70.5 million). In the second quarter 2024, the free cash flow amounted to €-23.4 million (Q2/2023: €-82.0 million; H1/2024: €-56.5 million; H1/2023: €-80.1 million). This is mainly due to investments in the Innovation Center and the expansion of production capacities in Italy.

After payment of the dividend of €45.0 million, Aixtron reported cash and cash equivalents including other current financial assets of €79.4 million as of June 30, 2024 (December 31, 2023: €181.7 million). The equity ratio at June 30, 2024 was 75 percent and underscores Aixtron's financial strength (December 31, 2023: 75 percent).

Full year guidance adjusted

To reflect the current business environment in power electronics, the Executive Board adjusted the guidance for the fiscal year 2024 on July 4, 2024. Based on the development of the order intake, the Executive Board now expects to generate revenues in the in the range of €620.0 million to €660.0 million (previously: €630.0 million to €720.0 million), a gross margin of around 43 percent to 45 percent (unchanged) and an EBIT margin of around 22 percent to 25 percent (previously: 24 percent to 26 percent) for the 2024 fiscal year. For the third quarter of 2024, the Executive Board expects revenues in the range of €150.0 million to €180.0 million.

"We are investing in the future. The additional site in Italy serves to strategically secure our growth plans. And our new innovation center will further strengthen our research and development activities. This will enable us to offer technologies that not only meet the current high demands of the semiconductor industry but also anticipate and serve future trends," said Christian Danninger, CFO of Aixtron SE.