Wolfspeed reports Q4 and full year results

Wolfspeed has announced results for the fourth quarter of fiscal 2024 and the full 2024 fiscal year.

Consolidated revenue in Q4 was approximately $201 million, as compared to approximately $203 million in Q3. The Mohawk Valley SiC fab contributed approximately $41 million in revenue; with power device design-ins of $2.0 billion; and quarterly design-wins of $0.5 billion.

GAAP gross margin was 1 percent, compared to 29 percent in Q3; Non-GAAP gross margin was 5 percent, compared to 31 percent in Q4. GAAP and non-GAAP gross margins include the impact of $24 million of underutilisation costs from the new Mohawk Valley SiC fab.

Full year financial highlights (compared tol 2023) show a consolidated revenue of approximately $807 million, as compared to approximately $759 million. GAAP gross margin was 10 percent as compared to 32 percent; Non-GAAP gross margin was 13 percent as compared to 35 percent.

GAAP and non-GAAP gross margins for fiscal 2024 also include the impact of approximately $124 million of underutilisation costs from the new Mohawk Valley SiC fab.

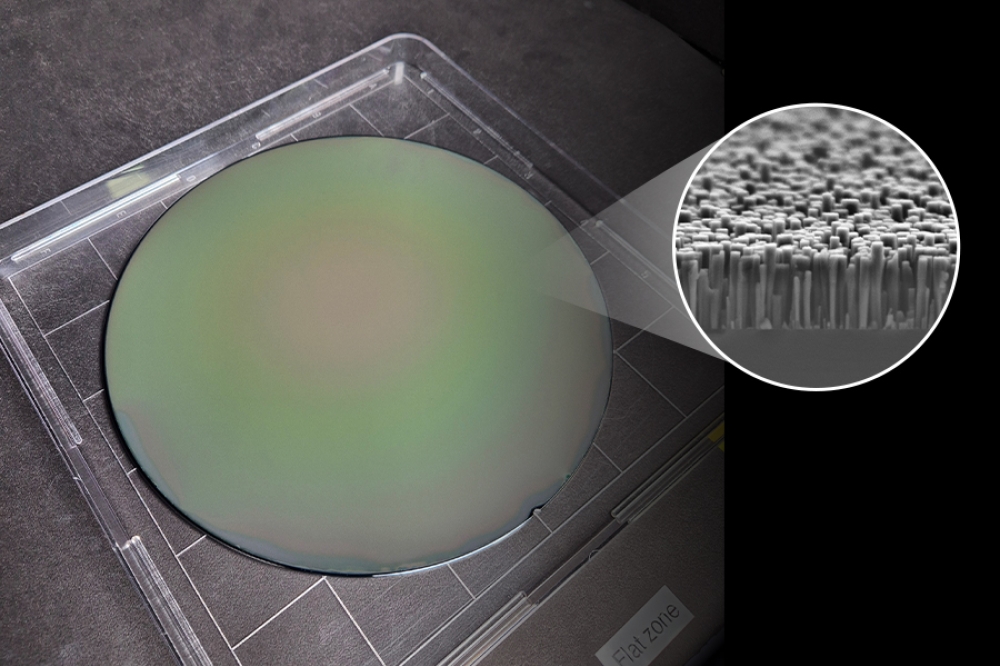

Wolfspeed CEO, Gregg Low said: “We have two priorities we are focused on: optimising our capital structure for both the near term and long term and driving performance in our state-of-the-art, 200mm fab, and this quarter was a step forward on both of these priorities. We achieved 20 percent utilisation at Mohawk Valley in June and continued to see strong revenue growth from that fab. Our 200mm device fab is currently producing solid results, which are at significantly lower costs than our Durham 150mm fab."

This improved profitability, he said, is giving Wolfspeed confidence to accelerate the shift of device fabrication to Mohawk Valley, while it assesses the timing of the closure of its150mm device fab in Durham. The company has also made progress in making SiC boules.

Low added: “At the same time, we are taking proactive steps to slow down the pace of our CapEx by approximately $200 million in fiscal 2025 and identify areas across our entire footprint to reduce operating costs. We also remain in constructive talks with the CHIPS office on a Preliminary Memorandum of Terms for capital grants under the CHIPS Act. In addition to any potential capital grants from the CHIPS program, our long-term CapEx plan is expected to generate more than $1 billion in cash refunds from Section 48D tax credits from the IRS, of which we’ve already accrued approximately $640 million on our balance sheet."

Business Outlook

For its first quarter of fiscal 2025, Wolfspeed targets revenue from continuing operations in a range of $185 million to $215 million. GAAP net loss is targeted at $226 million to $194 million, or $1.79 to $1.54 per diluted share. Non-GAAP net loss from continuing operations is targeted to be in a range of $138 million to $114 million, or $1.09 to $0.90 per diluted share.