IQE releases half year results

Compound semiconductor wafer company IQE plc has announced its interim results for the six months ended 30 June 2024. Revenue for the period had grown to £66.0m, with an adjusted non-GAAP EBITDA of £6.6m.

Americo Lemos, CEO of IQE, commented: "IQE delivered a consistent performance in the first half of 2024, with a 27 percent rise in revenue year-on-year and a return to a positive adjusted EBITDA position.

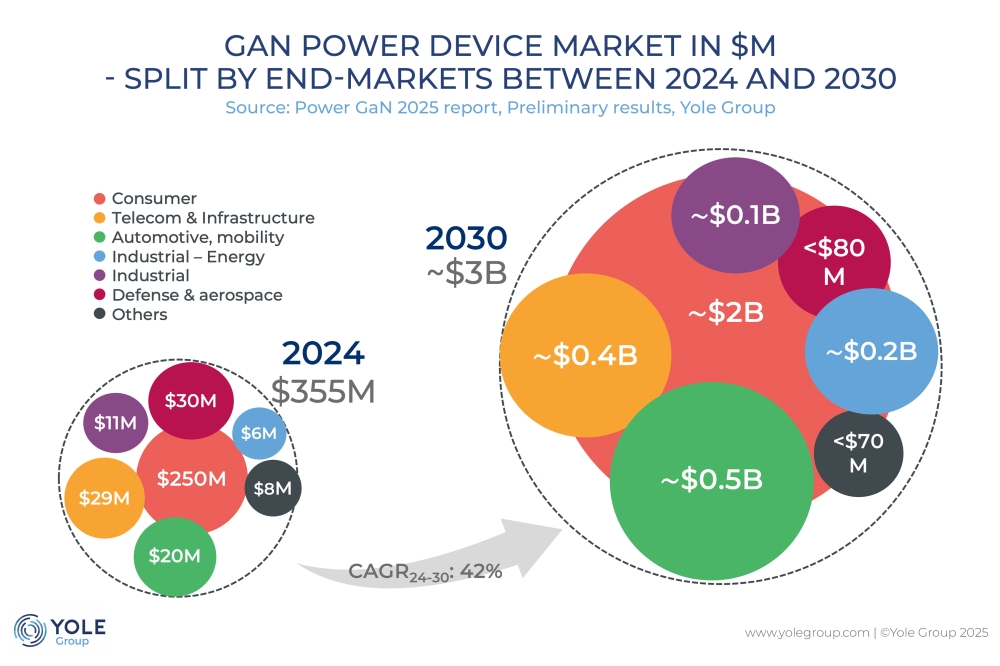

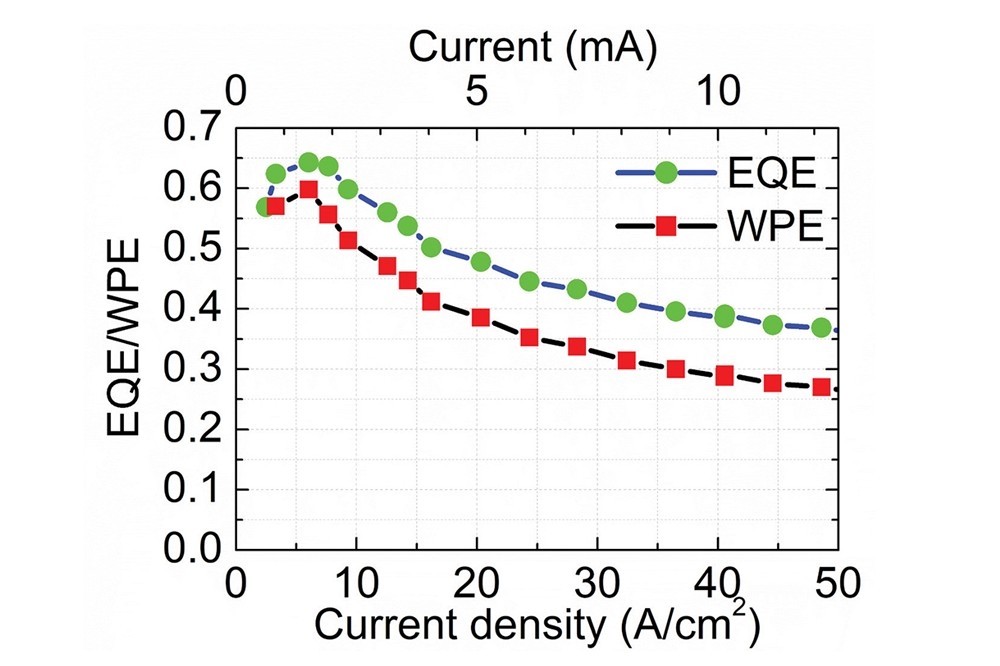

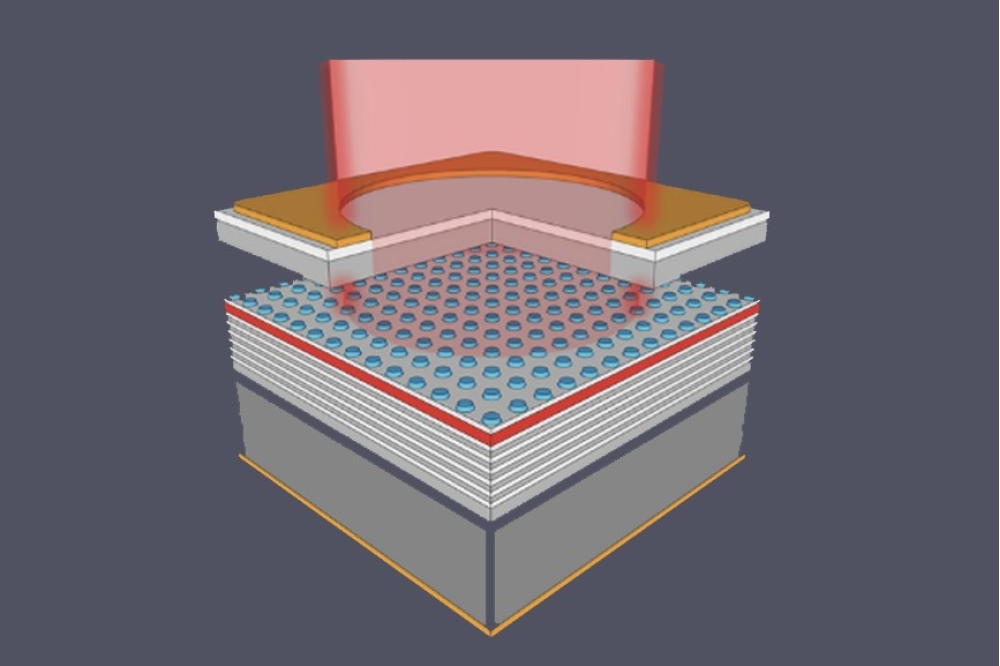

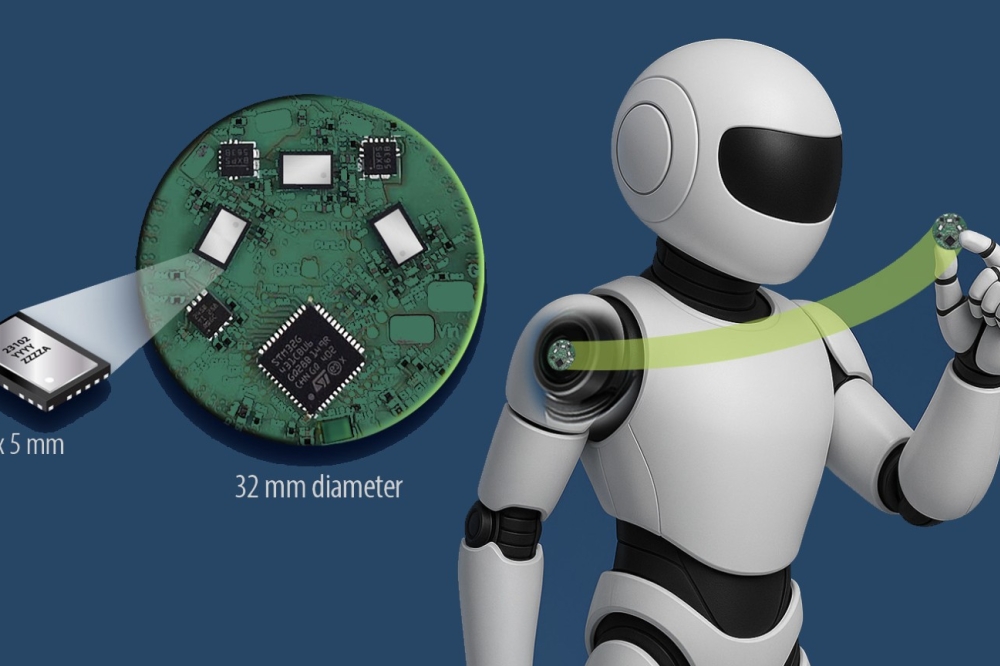

"We expect the market to continue to show pockets of recovery during the second half, resulting in more moderate growth for 2024 on a full-year basis. We look forward to progressing the planned IPO of our Taiwanese subsidiary, which will help to accelerate our diversification strategy into the GaN Power market and microLED, and will provide additional significant cash resources for the company."

Wireless revenue was £38.8m (H1 2023: £22.4m) showing an increase of 73 percent year-on-year. This was a result of inventory normalisation and design wins in Android RF Front End markets. Photonics revenue was £26.8m (H1 2023: £28.0m), down 4 percent year-on-year . A reduction in segments of InP telecoms markets was partially offset by strength in GaAs Photonics and infrared sensing product sales, according to IQE.

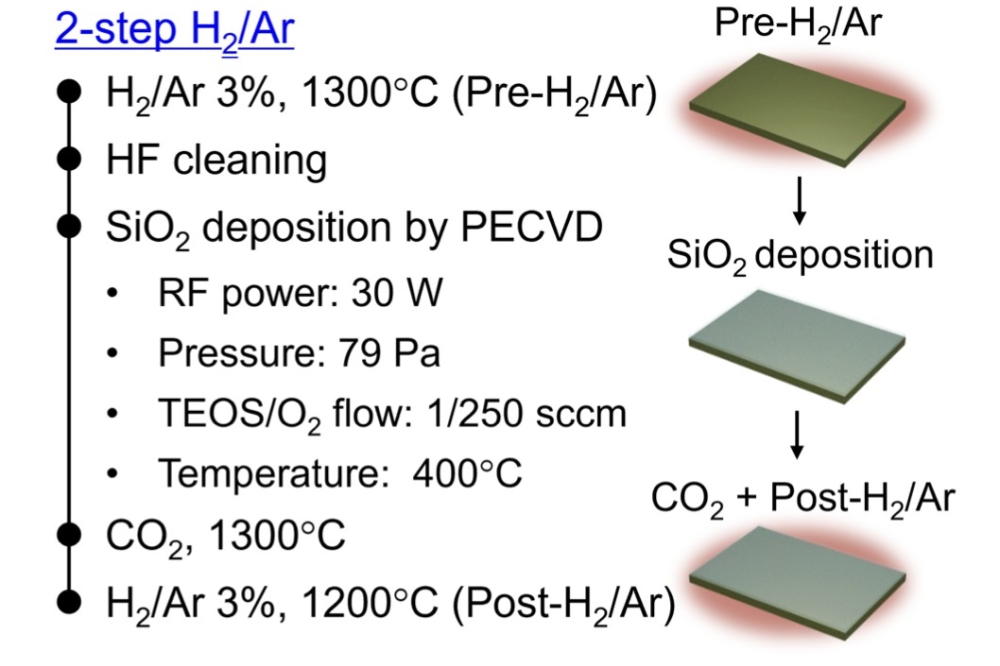

CMOS++ revenue was £0.5m (H1 2023: £1.6m) down 70 percent. This reflects a strategic rebalancing of IQE's product portfolio and a shift in focus towards diversification into GaN Power and MicroLED.

Current trading and outlook

IQE says that it is continuing to see signs of recovery in the semiconductor industry, despite the pace of progress varying between regions and market segments.

The company expects year-on-year growth in both revenue and adjusted EBITDA for FY 2024. With some markets remaining in recovery in H2 2024, it expects performance to be at the lower end of the range of analyst forecasts for the full year1.

It says it will maintain a tight focus on structural cost controls, footprint optimisation and operational efficiencies to allow the business to continue to improve its profitability while building its technology roadmap in partnership with key customers.

In July 2024, the group announced plans for the IPO of its Taiwan operating subsidiary on the Taiwan Stock Exchange. It reports a positive reaction from its first round of engagement with investors in the region, and expects to list on the Emerging Market Board of the Taiwan Stock Exchange in H1 2025.