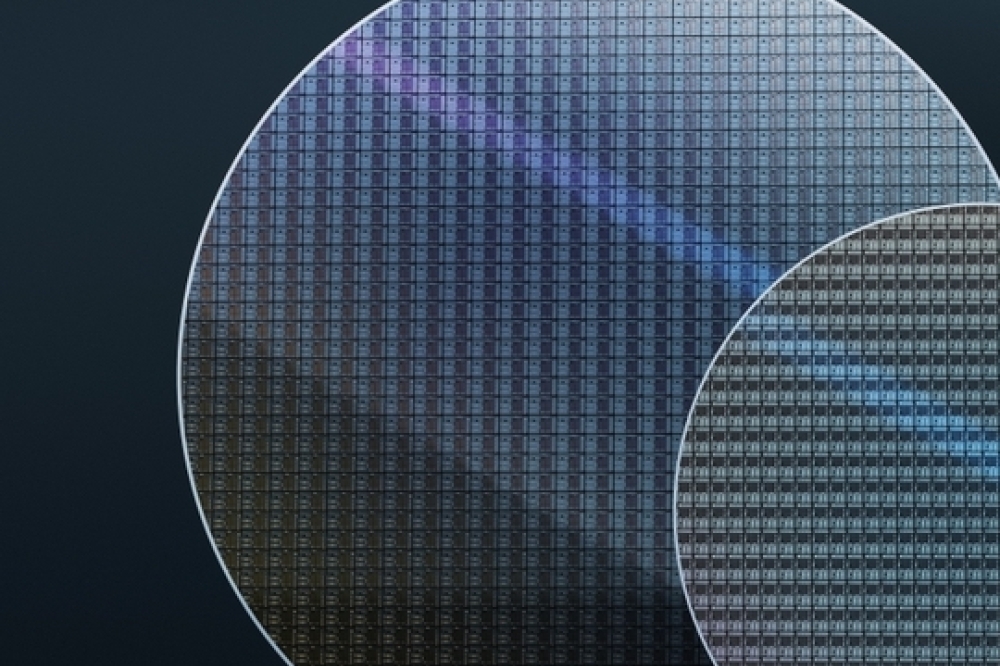

Battle for 8-inch SiC heats up

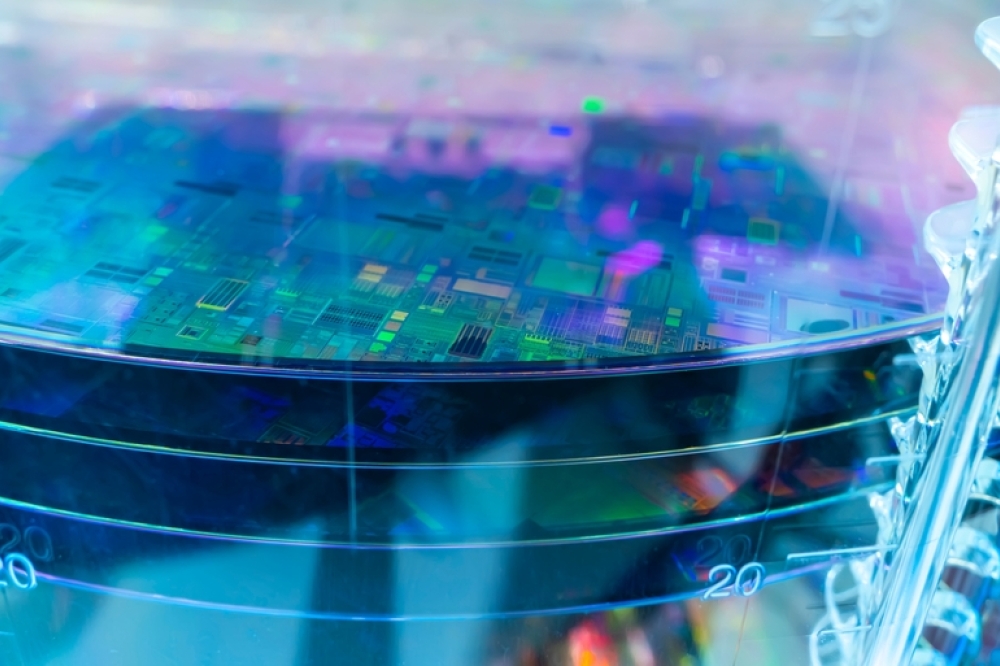

Although 6-inch wafers currently dominate the SiC market, transitioning to 8-inch is an inevitable trend expected from 2026 to 2027, according TrendForce.

Today, the market share of 8-inch SiC products is currently less than 2 percent, but TrendForce forecasts it will to grow to around 15 percent by 2026.

And the 8 inch wafer battle is already heating up.

On September 17, Japan’s NGK Insulators (NGK) announced on its official website that it had successfully produced 8-inch SiC wafers. The company plans to showcase these wafers, along with related research results, at ICSCRM 2024 in the US later this month.

Reportedly, Resonac has achieved 8-inch SiC epitaxial wafers of the same quality as its 6-inch products. Currently, the company is working to reduce costs by improving production efficiency, and sample evaluations have reached the final stages of commercialiation.

Once the cost advantage surpasses that of the 6-inch products, Resonac is expected to transition to producing 8-inch products. Besides mass production of 8-inch SiC epitaxial wafers, Resonac plans to start mass production of 8-inch SiC substrates in 2025.

Additionally, Onsemi is set to accelerate the production of 8-inch SiC wafers, with capacity adjustments based on market demand expected to start in 2025. The company plans to launch its 8-inch SiC wafers later this year and begin production in 2025. Onsemi’s president and CEO, Hassane El-Khoury, stated that the company is proceeding as planned and will complete the certification of 8-inch wafers this year, covering the entire process from substrate to wafer fab.

On September 9, Wolfspeed launched a 2300V bottomless SiC power module for 1500V DC bus applications, using its most advanced 8-inch SiC wafer technology. This product aims to drive development in renewable energy, energy storage, and high-power fast charging by improving efficiency, durability, reliability, and scalability.

In China, Sanan Optoelectronics’ Chongqing Sanan project (an 8-inch SiC substrate support factory) has successfully lit up its production line. The substrate plant built by Sanan Optoelectronics using its own SiC substrate technology, is operated by its wholly-owned subsidiary Chongqing Sanan Semiconductor. The plant plans to produce 480,000 8-inch SiC substrates annually.

SICC’s 8-inch conductive SiC wafers have recently achieved mass production, and products are being continuously delivered. Additionally, in July, SICC announced a plan to raise invest in its 8-inch automotive-grade SiC substrate technology improvement project.

Looking ahead, TrendForce notes that, SiC as a crucial development in future power electronics is rapidly penetrating markets such as automotive and renewable energy, where power density and efficiency are paramount. Over the next few years, overall market demand is expected to maintain growth, with predictions that the global SiC power device market could reach $9.17 billion by 2028.

According to Tankeblue data, upgrading from 4-inch to 6-inch can reduce unit costs by 50 percent, and moving from 6-inch to 8-inch could further cut costs by 35 percent.

Market reports suggest that the price of mainstream 6-inch SiC substrates in China has dropped by nearly 30 percent, now referencing international prices of $750-$800 per wafer.

TrendForce has pointed out that with the entry of Chinese companies into the SiC market, the price drop for SiC substrates has accelerated.

SICC chairman commented that SiC substrate prices will fall due to technological advancements and economies of scale, leading to lower costs. Additionally, the high price of SiC substrates compared to silicon substrates has hindered wider adoption, and price reductions will help expand downstream applications, pushing SiC into broader use.