Foldable phones drive backplane technology

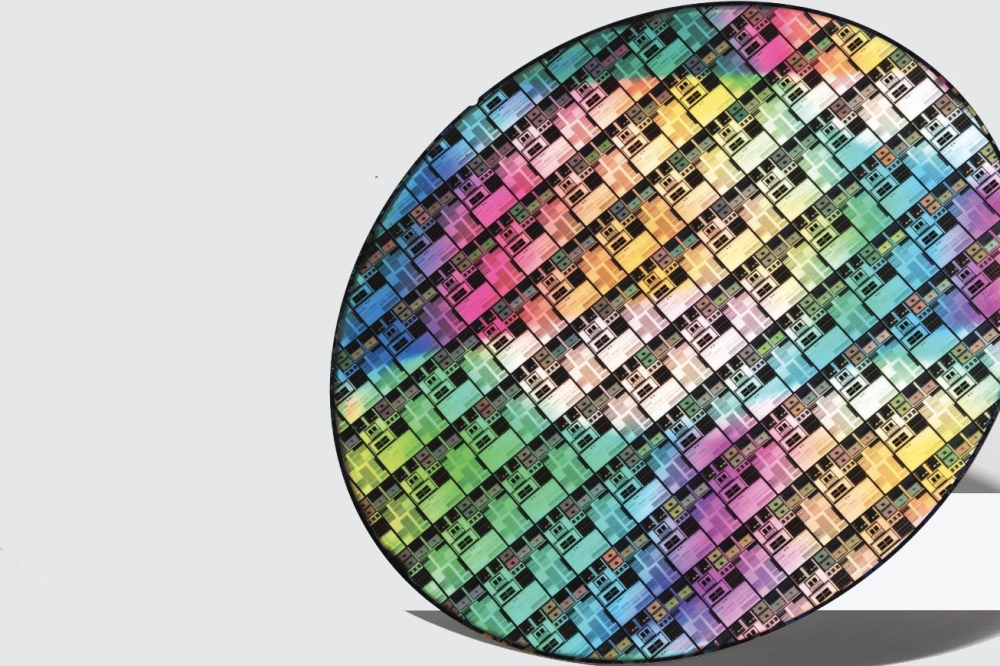

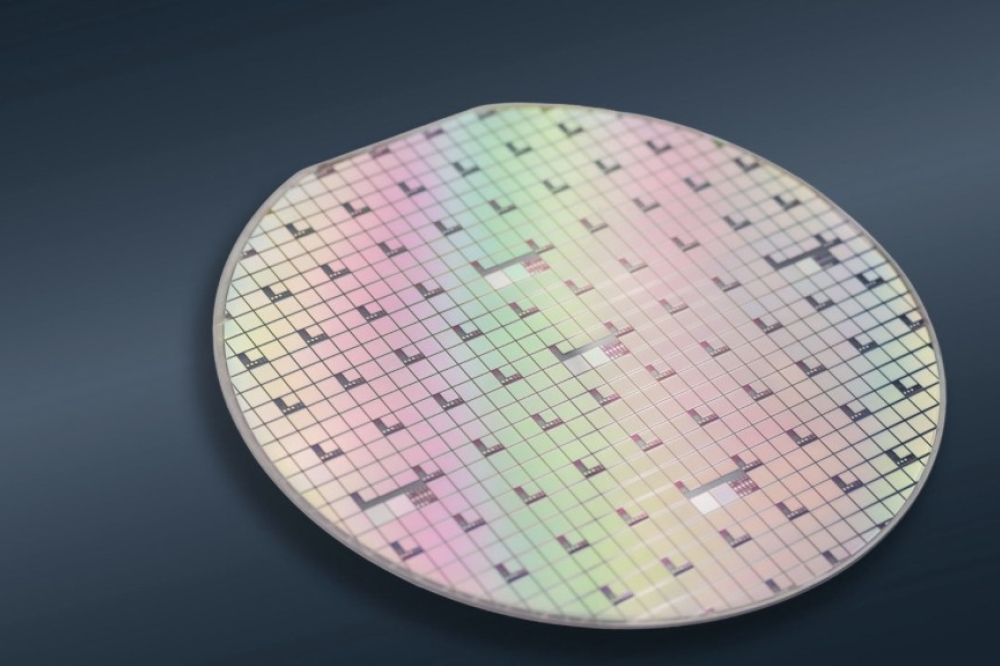

TrendForce’s latest investigations into backplane technology for displays reveal that OLED has become the mainstream display solution for smartphones, pushing the penetration rate of mid-to-high-end backplane technologies such as LTPS (Low Temperature PolySilicon) and LTPO (Low-Temperature Polycrystalline Oxide developed by Apple), in the smartphone market to nearly 57 percent in 2024.

The penetration rate is expected to challenge 60 percent in 2025, thanks to improvements in yield and effective cost control. Additionally, AMOLED panels are rapidly expanding into other IT markets, which is projected to boost the penetration of oxide and LTPO backplanes.

LTPO improves the energy efficiency of displays

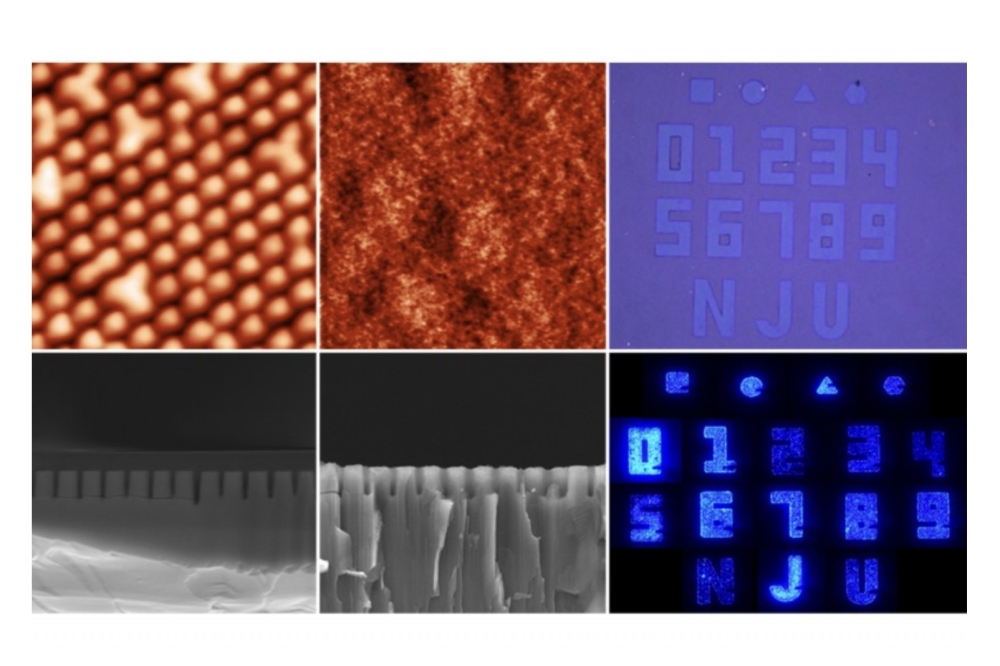

Backplane technology in displays not only affects visual quality but also determines a smartphone’s performance, energy consumption, and cost. Since Apple introduced Retina display to the iPhone, the industry has driven the development of low temperature poly-silicon (LTPS) backplanes to achieve higher screen resolutions, with this technology now becoming highly mature.

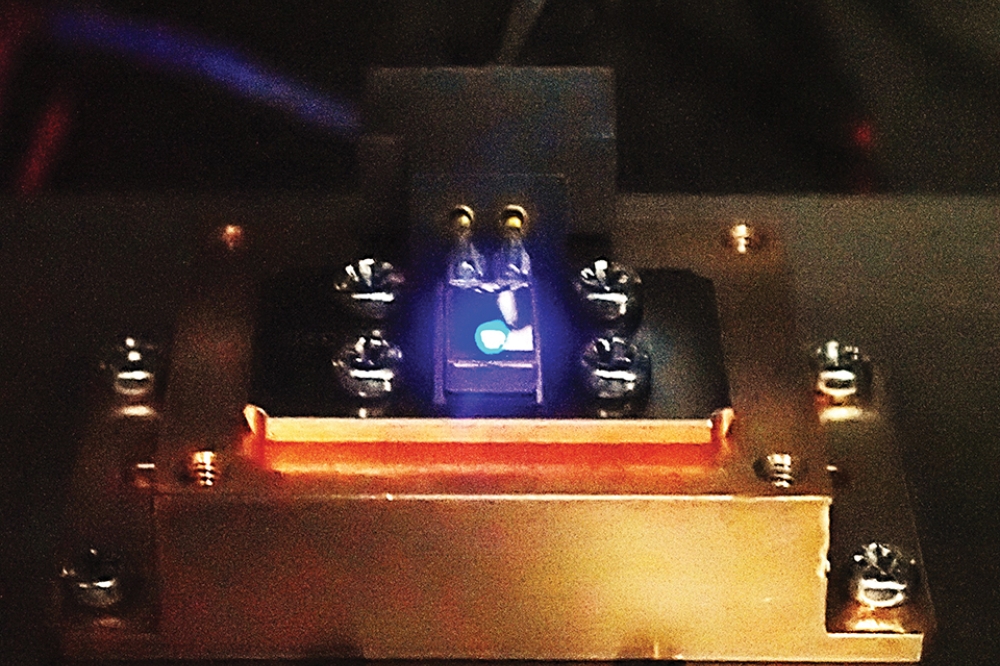

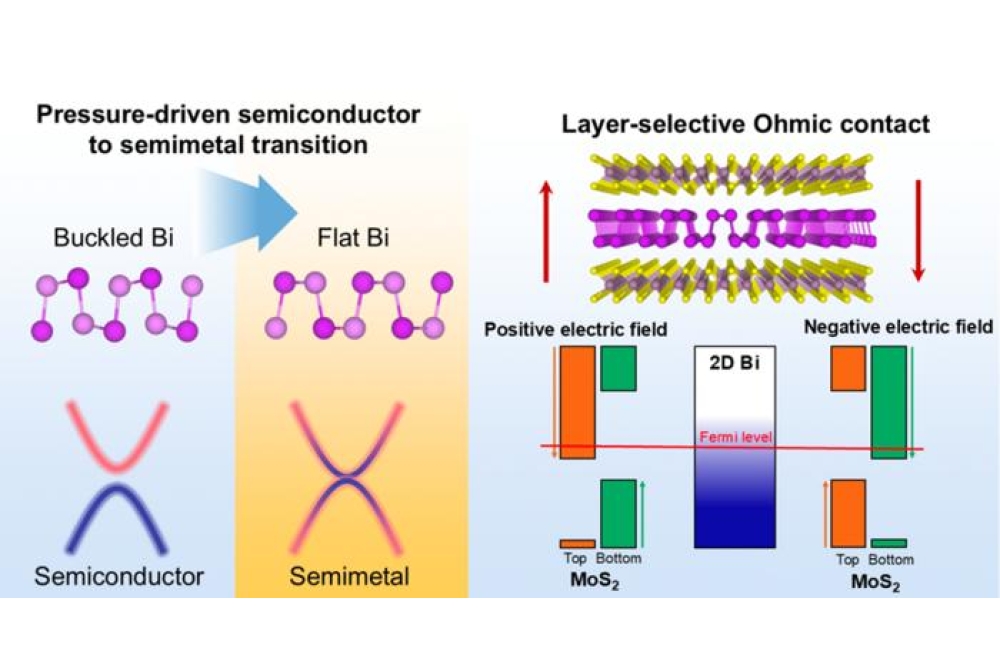

LTPS offers high electron mobility, which provides faster switching speeds and higher resolution, making it ideal for high-end smartphones. However, its high electron mobility also results in greater leakage current, preventing support for low-frequency dynamic refresh adjustment and leading to higher overall power consumption.

TrendForce highlights that most flagship smartphones currently use low temperature polycrystalline oxide (LTPO) backplanes. In larger foldable phones, LTPO enables split-screen functionality with different refresh rates, balancing multitasking capabilities and energy efficiency.

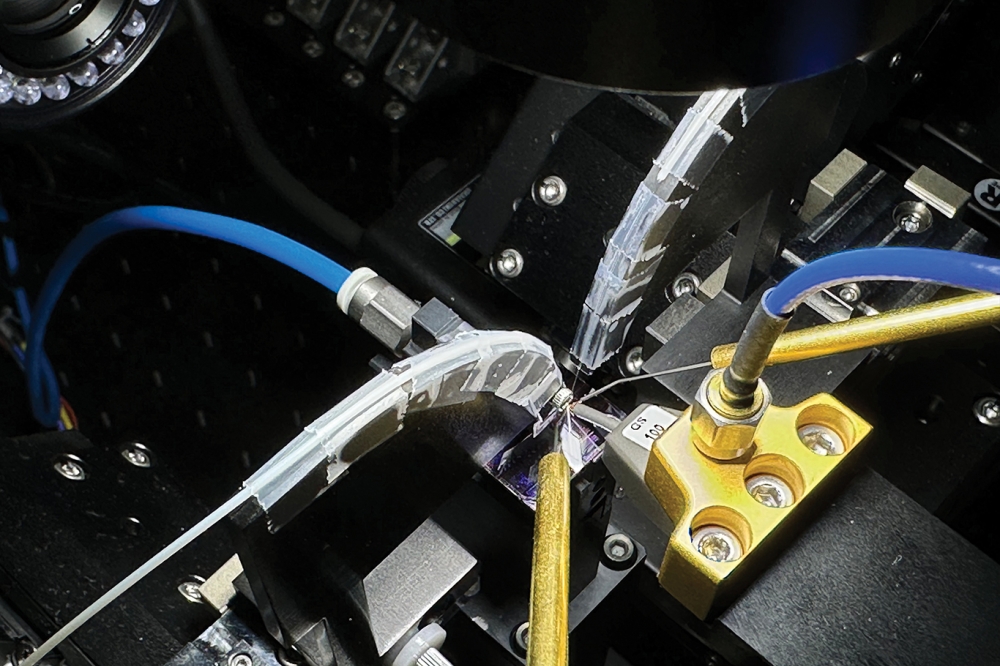

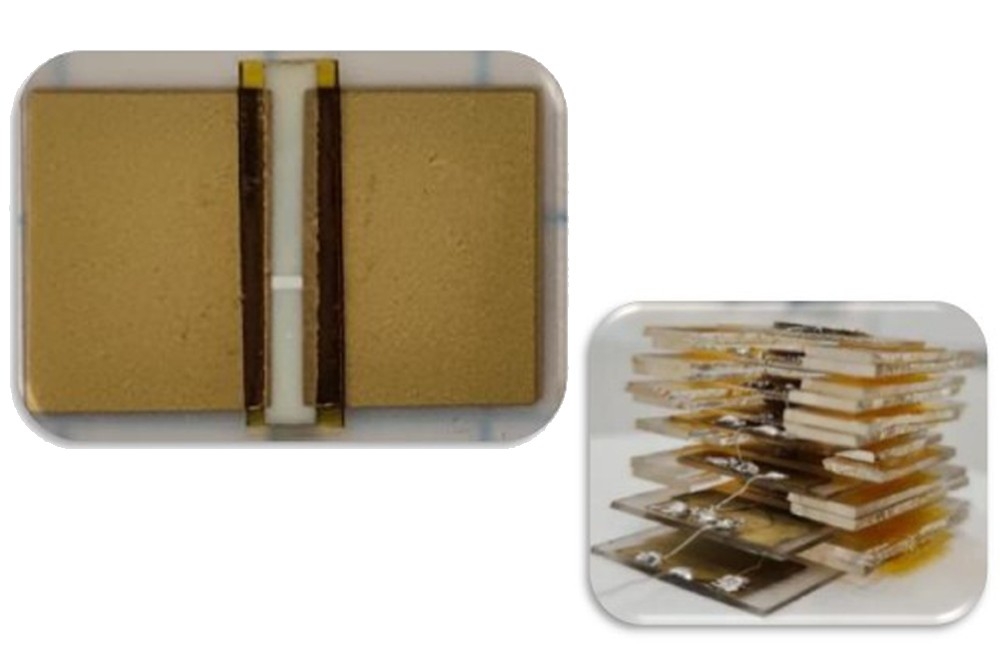

LTPO then builds on LTPS by adding oxide semiconductors to optimise display performance, including reducing leakage current when driving the display and adjusting the screen’s refresh rate based on content. However, producing LTPO backplanes involves stacking more layers, making them more complex and costlier to manufacture than LTPS.

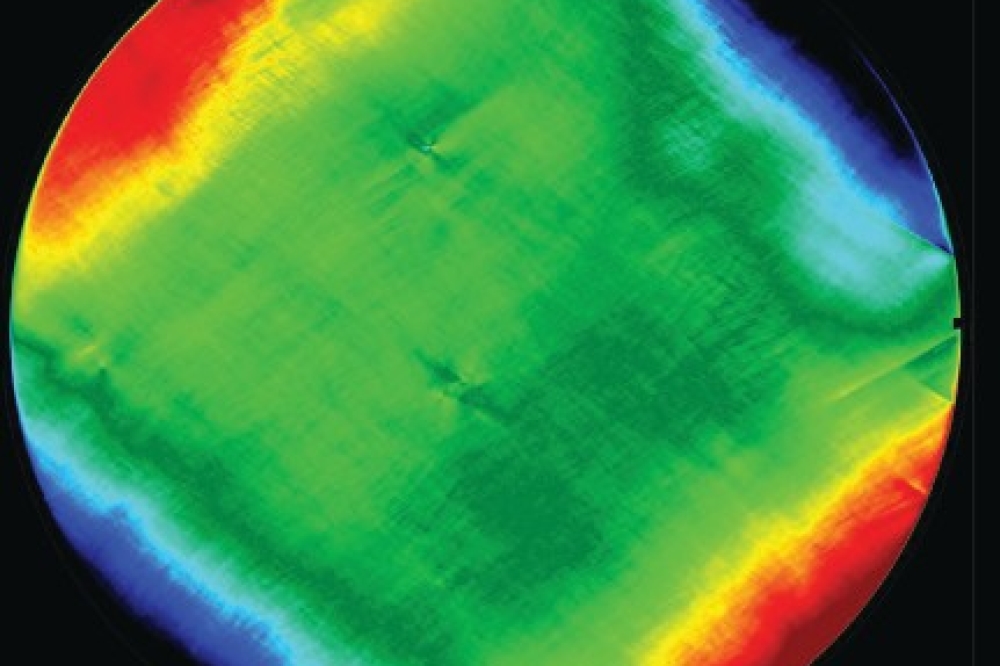

TrendForce also notes that oxide backplanes—which primarily use materials like zinc oxide (ZnO) or indium gallium zinc oxide (IGZO)—commonly appear in high-end displays, such as Apple’s iPad and MacBook series. Oxide backplanes are expected to be well-suited for future applications in transparent displays due to their lower leakage current.

Large-generation AMOLED panels to prioritise oxide and LTPO

While OLED dominates smartphone displays, AMOLED panels are quickly expanding into other IT markets, including tablets and notebooks. TrendForce posits that when IT device brands choose their preferred backplane technology, they consider display quality, energy consumption, cost, and product positioning. Panel makers preparing new large-generation AMOLED production capacity are likely to prioritise oxide or LTPO backplanes to meet the diverse specifications required by different brands.

For example, Chinese phone company BOE has already introduced LTPO backplanes in its 8.6-generation line. Although initial production costs were high due to the high equipment setup threshold and complexity, the scale and cost efficiency achieved as the technology matures will help BOE target flagship products and expand its market share, potentially even capturing a portion of the mainstream market. Conversely, while oxide backplanes have lower initial setup costs, they struggle to improve yield; however, once these are overcome, oxide technology could penetrate deeper into the mainstream market.

TrendForce concludes that as production scales up, the manufacturing costs of high-end backplanes like LTPO and oxide are expected to decrease. This will enable mid-sized AMOLED displays incorporating these technologies to penetrate various product segments more competitively, ultimately expanding their market share across different products.