AXT Q3 up 36% compared to 2023

AXT, a manufacturer of compound semiconductor wafer substrates, has reported financial results for the third quarter, ended September 30, 2024.

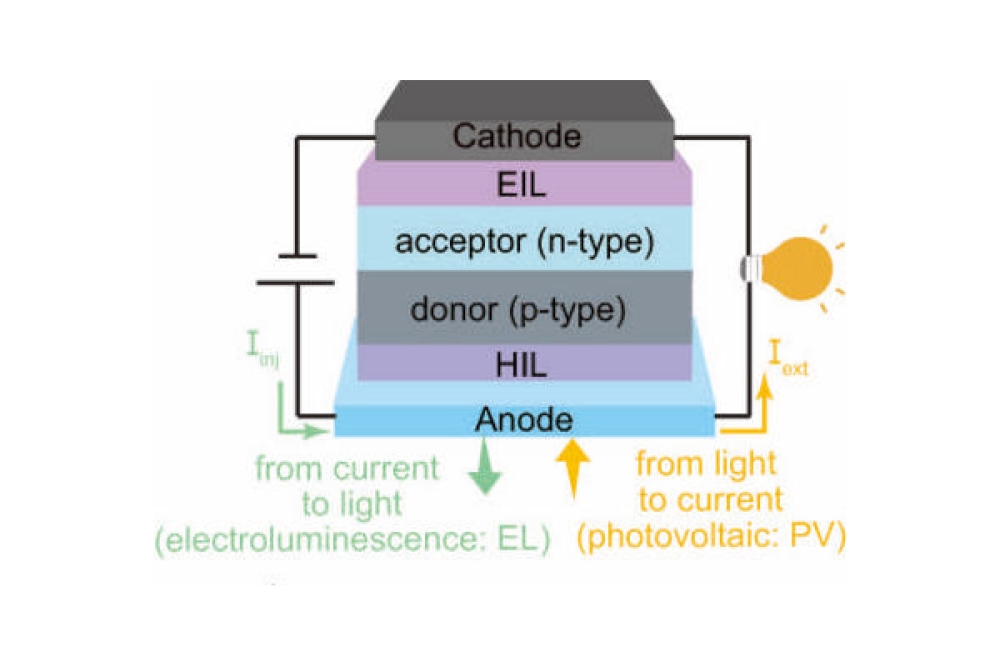

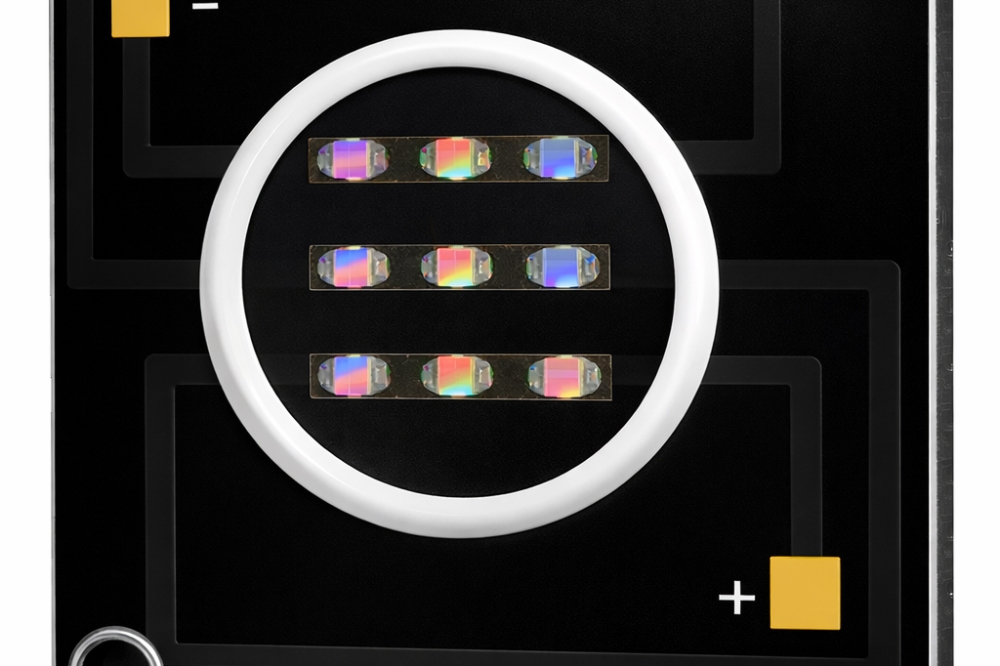

“Q3 came in largely in line with our expectations, coming off a strong quarter in Q2,” said Morris Young, CEO. “By comparison to the year ago quarter Q3 2023, our revenue in Q3 of 2024 increased over 36 percent and we are pleased to see that every product, including raw materials, had double digit year-over-year growth. Data centre-related demand remained solid, and we are anticipating new order momentum in InP substrates for photodetectors in AI applications.”

He added: “This year-over-year revenue improvement benefited our GAAP gross margin significantly, moving from 10.7 percent in Q3 2023 to 24.0 percent in the recent quarter. The impact on the bottom line reduced the GAAP net loss from ($0.14) per share in Q3 2023 to ($0.07) per share in the recent quarter. As we move into 2025, we are optimistic about the growth and expansion of our business. Across our portfolio of products, the signs of recovery are tangible, and we are strongly positioned for success in this highly dynamic technology landscape.”

Revenue for the third quarter of 2024 was $23.6 million, compared with $27.9 million for the second quarter of 2024 and $17.4 million for the third quarter of 2023.

GAAP gross margin was 24.0 percent of revenue for Q3 2024, compared with 27.4 percent of revenue for Q2 2024 and 10.7 percent for Q3 2023.

Non-GAAP gross margin, after excluding charges for stock-based compensation, was 24.3 percent of revenue for Q3 2024, compared with 27.6 percent of revenue for Q2 2024 and 11.3 percent for Q3 2023.

GAAP net loss, after minority interests, for Q3 2024 was a net loss of ($2.9) million, or ($0.07) per share, compared with a net loss of ($1.5) million, or ($0.04) per share, for Q2 2024 and a net loss of ($5.8) million, or ($0.14) per share, for Q3 2023.

Non-GAAP net loss for Q3 2024 was a net loss of ($2.1) million, or ($0.05) per share, compared with a net loss of ($0.8) million, or ($0.02) per share, for Q2 2024 and a net loss of ($4.9) million, or ($0.12) per share, for Q3 2023.

STAR Market update

On January 10, 2022, AXT announced that Beijing Tongmei Xtal Technology , its subsidiary in Beijing, China, submitted to the Shanghai Stock Exchange its application to list its shares in IPO on the SSE’s Sci-Tech innovAtion boaRd (the STAR Market) and the application was accepted for review.

Subsequently, Tongmei responded to several rounds of questions received from the SSE. On July 12, 2022, the SSE approved the listing of Tongmei’s shares in an IPO on the STAR Market. On August 1, 2022, the China Securities Regulatory Commission accepted for review Tongmei’s IPO application. The STAR Market IPO remains subject to review and approval by the CSRC and other authorities. The process of going public on the STAR Market includes several periods of review and, therefore, is a lengthy process. Subject to review and approval by the CSRC and other authorities, Tongmei hopes to accomplish this goal in the coming months.