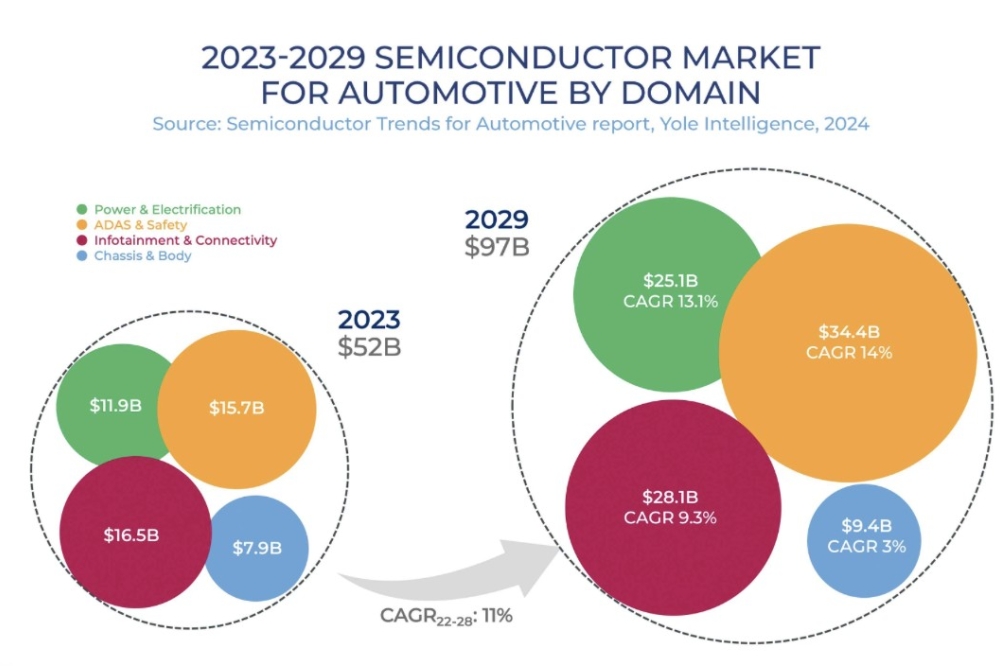

Semiconductor value per car to reach $1k by 2029

Automotive OEMs moving up the semiconductor supply chain

The automotive semiconductor market is expecting a CAGR of 11 percent between 2023 and 2029 to almost $100 billion at the end of the period, with a semiconductor device value per car of about $1000, according to the Yole Group’s ‘Semiconductor Trends in Automotive report, 2024 edition’.

The most invested automotive semiconductor segments by OEM are power electronics, high-performance SoCs for ADAS, cockpit, and MCUs for future E/E architectures.

The 2024 analysis says that OEMs are becoming more deeply engaged in the semiconductor sector. Another trend is that Chinese OEMs are making broader investments in various types of chips and are more deeply involved in the upstream supply chain. Power modules, which are critical enablers for EVs, serve as a prime example.

Nearly all Chinese OEMs have investments in this segment across various formats. In addition to power modules, high-performance processors and MCUs are also highly favoured by OEMs. Yole's report offers a detailed discussion of each OEM’s strategy.

Pierrick Boulay, Yole's senior technology and market analyst, Automotive Semiconductors said: “The market currently represents a semiconductor device value of around $590 per car in 2023. With this figure growing to about $1,000 per car, semiconductor technology and its latest innovations become essential.”

Yole Group has highlighted significant trends linked to ADAS and electrification in the report. For example, the move towards EVs is driving demand for SiC MOSFET modules, crucial for efficient power conversion. While global growth in BEVs is starting to slow, the gap is being filled by a range of hybrid technologies, all of which also rely heavily on advanced power electronics.

Yu Yang, principal analyst, Automotive Semiconductor at Yole Group said: “The global automotive market is growing slowly, leaving some OEMs and suppliers in more challenging situations during the transformation. However, the mid-term picture still brings a significant 11 percent growth to the semiconductor device market, which will reach almost $100 billion in 2029.”

This year, the report’s ‘Triple-C’ model (a tool designed to help OEMs develop their individual semiconductor strategies) has been expanded to include all of the top 20 global OEM groups, along with leading Chinese EV startups such as Nio, XPeng, and Li Auto.