Wolfspeed continues to streamline after poor Q1

US wide-bandgap semiconductor firm Wolfspeed has announced results for Q1 fiscal 2025, with a revenue of around $195 million (compared to $197 million in Q1 2024).

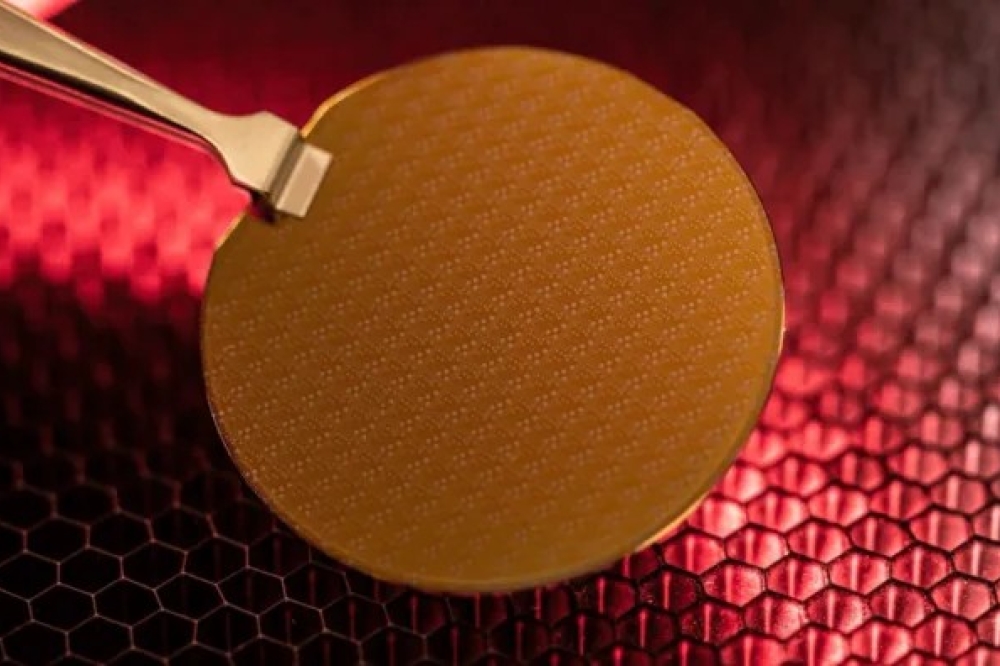

The new Mohawk Valley SiC Fab contributed around $49 million of this.

GAAP gross margin was -19 percent, compared to +13 percent in Q1 2024. According to this company, the margin was impacted by underutilisation in connection with the start of production at the Mohawk Valley Fab. Non-GAAP gross margin was 3 percent, compared to 16 percent in Q1 2024.

Power device design-ins this quarter were $1.5 billion, and design wins $1.3 billion.

The company announced a GAAP net loss of $282.2 million compared to $395.7 in Q1 2024.

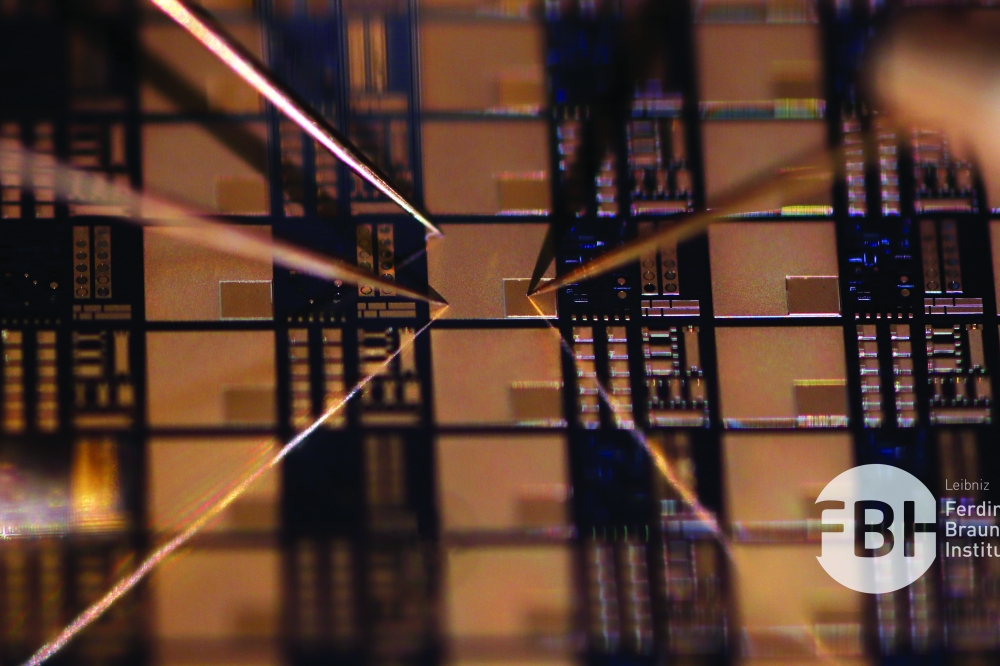

“This quarter we took action to solidify the capital structure, simplifying our business to accelerate structural profitability and support the build out of our state-of-the-art SiC facilities. We will have a 200mm SiC footprint at Mohawk Valley and North Carolina materials factories that we target to generate approximately $3 billion in revenue annually,” said Wolfspeed CEO, Gregg Lowe.

“Last month, we reached a significant milestone by signing a non-binding preliminary memorandum of terms (PMT) for up to $750 million in proposed direct funding under the CHIPS and Science Act and an additional $750 million from our lending group, demonstrating substantial progress towards our funding goals. With this announcement, we now have access to up to $2.5 billion of incremental funding to support our US capacity expansion plans.”

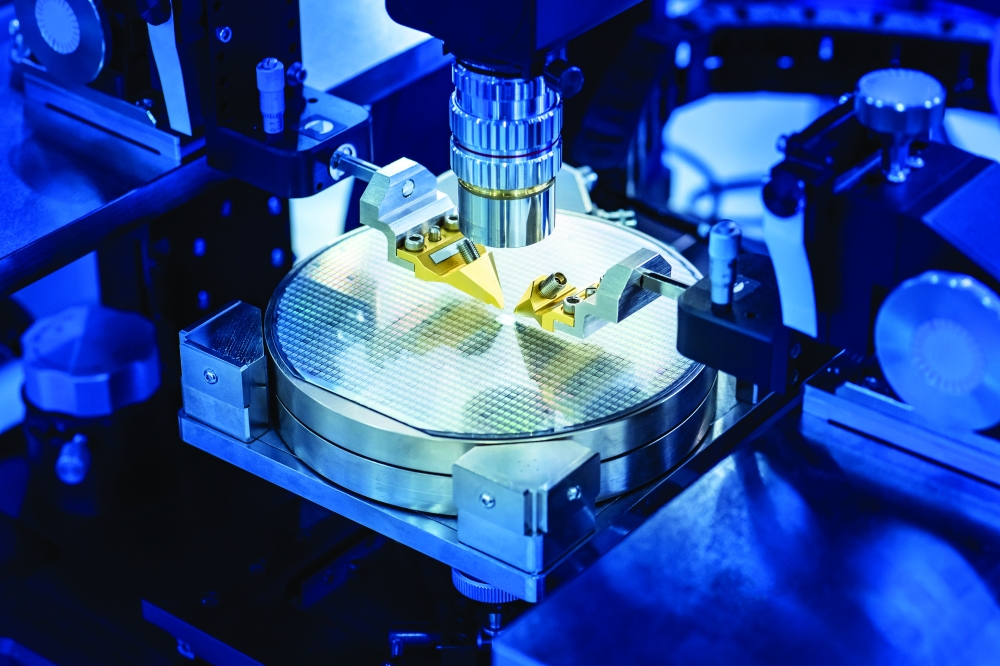

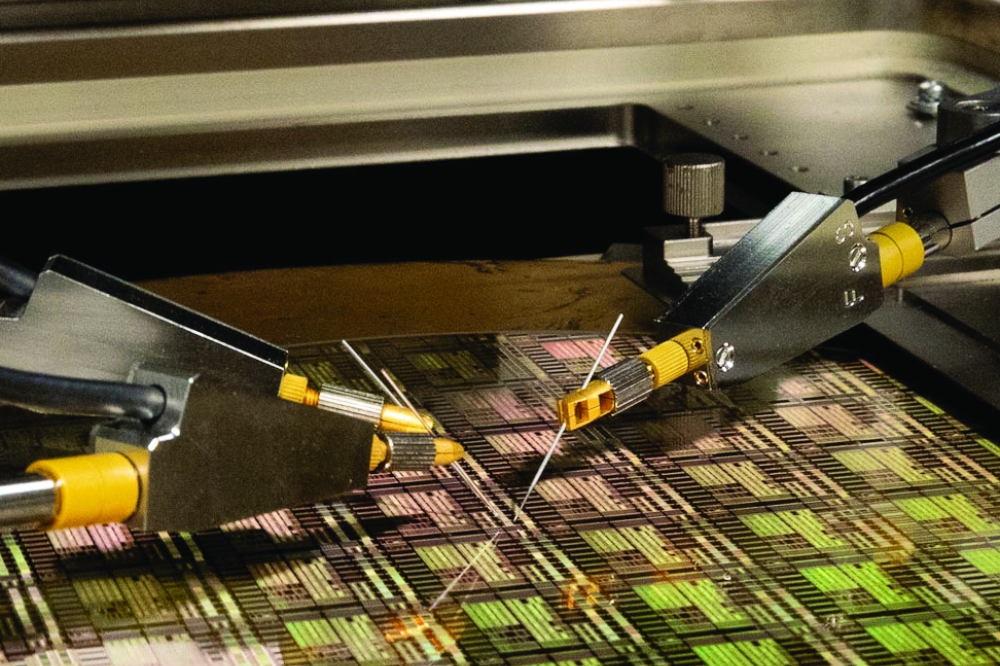

Lowe outlined further measures to enhance efficiency as the company becomes the first SiC company to transition to pure-play 200-mm. These included closing its manual Durham 150-mm fab, and reducing its workforce by around 20 percent. Its workforce was already reduced by 10 percent from attrition and voluntary early exits last quarter. The remaining 10 percent will come from current layoff notices.

The job reductions are part of the announcement in August that the 150mm production facility in Durham, would close, as well as a facility in Farmers Branch, Texas. Plans for a fab Germany will be suspended indefinitely.

The company expects these initiatives will yield approximately $200 million in annual cash savings.

Lowe added: “We delivered 2.5 times year-over-year growth in our automotive business in the first quarter, and we expect our EV revenue to continue to grow throughout calendar 2025, as the total number of car models using a Wolfspeed SiC solution in the power train increased by 4x from 2023 to 2024 and is expected to grow by another approximately 75 percent year over year in 2025."

He said that Wolfspeed remained confident in the long-term fundamentals of its industrial and energy business, and that trends and long-term growth drivers for the company's core end markets remain intact. "We expect the actions we are taking today will allow us to become a more efficient and agile organisation positioned to capture the long-term growth opportunities ahead,” concluded Lowe.

Business Outlook

For its second quarter of fiscal 2025, Wolfspeed targets revenue from continuing operations in a range of $160 million to $200 million. GAAP net loss is targeted at $401 million to $362 million, or $3.14 to $2.84 per diluted share. Non-GAAP net loss is targeted to be in a range of $145 million to $114 million, or $1.14 to $0.89 per diluted share.

During the first quarter of fiscal 2025, Wolfspeed initiated a facility closure and consolidation plan to optimise its cost structure and accelerate its transition from 150mm to 200mm SiC devices. The costs incurred were around $87.1 million, of which $34.3 million were recognised in cost of revenue, net and $52.8 million were expensed as operating expense in the statement of operations.

For the second quarter of fiscal 2025, the company expects to incur $174 million of restructuring-related costs, of which $34 million will be recognised in cost of revenue, net and the remaining $140 million will be recognised as operating expense.

Wolfspeed says it also incurring significant factory start-up costs relating to facilities the company is constructing or expanding that have not yet started revenue generating production. These factory start-up costs have been and will be expensed as operating expenses in the statement of operations.