Silicon’s positive influence

While most players in the CS industry are suffering from significant falls in their share prices over the last 12 months, a few companies have risen in valuation, in one case due to opportunities within the silicon industry.

BY RICHARD STEVENSON, EDITOR, CS MAGAZINE

When glancing at this year’s compound semiconductor share price leaderboard, please heed the following advice: Don’t judge a book by its cover. By taking note of this English idiom you can avoid making an incorrect assumption as to why Veeco is at the top of the table, with a share price that has soared by more than 80 percent over the last 12 months.

I give this warning because it is tempting to think that Veeco, a well-known and significant supplier of epitaxial growth equipment, has grabbed top spot by increasing its market share in MOCVD tools, MBE tools, or possibly both. However, this part of its business, which not long ago provided a very considerable proportion of its sales, has actually suffered a small fall in revenue. The reason for the rocketing valuation of Veeco is ramping sales of equipment to the silicon industry, which accounts for the lion’s share of its revenue.

Commenting on this success in an earnings call on 14 February, 2024, to discuss results for the most recent fiscal year, Veeco’s CEO, Bill Miller, remarked: “Revenue from our semiconductor business reached a record in 2023, outperforming wafer fab equipment growth for the third consecutive year. Our strong results included multiple laser-annealing systems for advanced DRAM devices, despite industry-wide ‘capex’ reductions, as well as our first high-volume manufacturing laser-annealing systems to our third leading Logic customer.”

Over the last 12 months many companies in the compound semiconductor industry have seen a fall in their share price.

Veeco’s sales to the silicon industry are dominating its revenue, and brought in $413 million in fiscal 2023, which ending on 31 December last year. Sales from this part of the business have climbed 12 percent year-over-year to now account for 62 percent of total revenue. On these sales, totalling $666 million and up 3 percent year-over-year, Veeco had a gross margin of 43.5 percent, and realised a profit of $98 million.

Meanwhile, compound semiconductor revenue for fiscal 2023 declined to $87 million, contributing just 13 percent of total revenue. According to company CFO, John Kiernan, this decline is due to a fall in wet processing systems for 5G RF devices, resulting from softness in the handset market.

Veeco also generates revenue in other markets. Data storage contributed $88 million in fiscal 2023, over which time the company generated $78 million from what is described as scientific and other revenue.

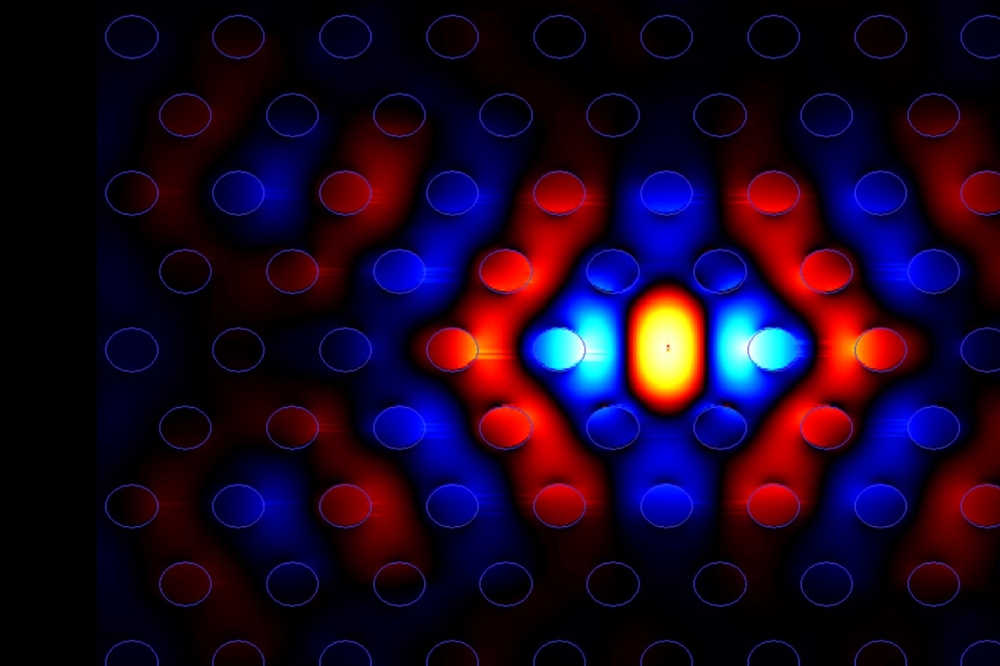

During the February earnings call, Miller championed two strategic milestones. “First, we launched our next-generation nanosecond annealing solution. And second, we launched our ion-beam deposition system for low-resistance metals.” Both technologies are claimed to support the production of devices with a higher performance and a lower power consumption.

“Our nanosecond annealing technology offers a substantial opportunity to expand our served available market to a broad range of new advanced node applications,” remarked Miller. “Due to our unique laser and architecture, our system can achieve a lower thermal budget and a shorter dwell time versus today’s most advanced annealing solutions.”

This tool produces a shallow anneal, impacting just tens to hundreds of nanometres into the wafer. It is argued that this attribute could be ideal for backside power delivery, and contact anneal for advanced nodes and three-dimensional devices.

“Our system has the capability to change the structure and properties of the device, enabling steps like void removal, re-crystallization, and grain growth,” informed Miller, who pointed out that Veeco shipped its first two nanosecond annealing evaluation systems to two leading logic customers at the end of last year. The company is anticipating initial high-volume manufacturing orders in 2025.

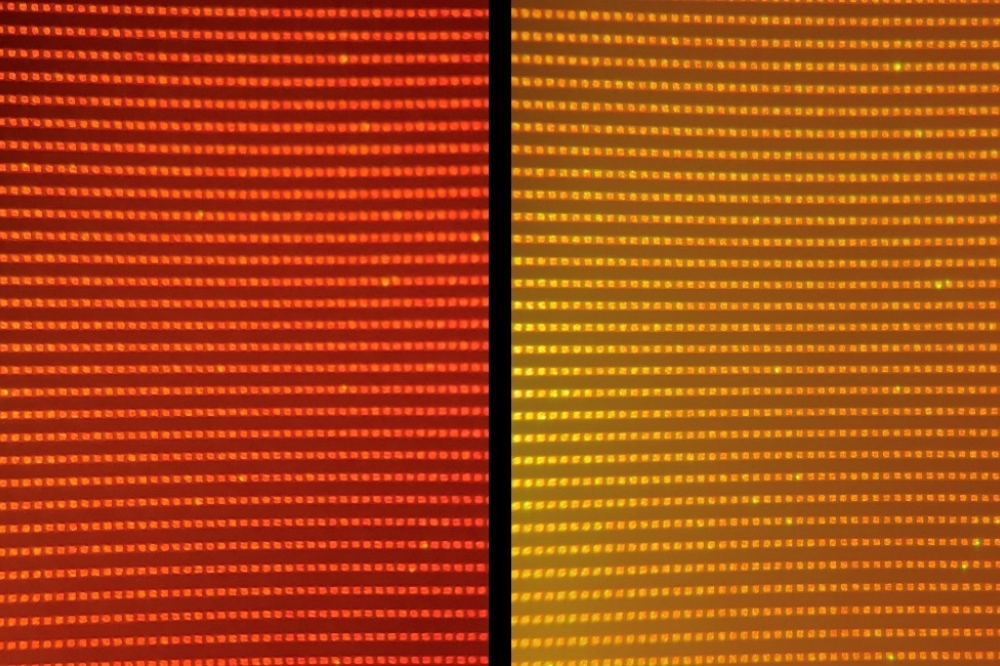

Released in February 2023, sales of Coherent’s 100G VCSELs are growing fast, with revenue already at $100 million per quarter.

The other tool that Miller has high hopes for, the new ion-beam deposition system, could see deployment in 300 mm fabs. He argued that as device geometries shrink, lower resistance materials are needed to maintain performance, a goal that is difficult to meet with traditional deposition technologies, such as PVD.

According to Miller, results from its tier-one customers have determined that compared with traditional PVD, films of tungsten and ruthenium have a resistance that’s around 20 percent lower.

“For DRAM, this enables tungsten bit-line scaling while maintaining electrical performance of the device,” said Miller. He pointed out that for those working on logic, ruthenium-based metallization can enable new integration schemes at future nodes.

In the last quarter of 2023, Veeco shipped its first two IBD300 evaluation systems to DRAM customers. “As we look ahead, we see potential for initial high-volume manufacturing orders in 2025,” added Miller.

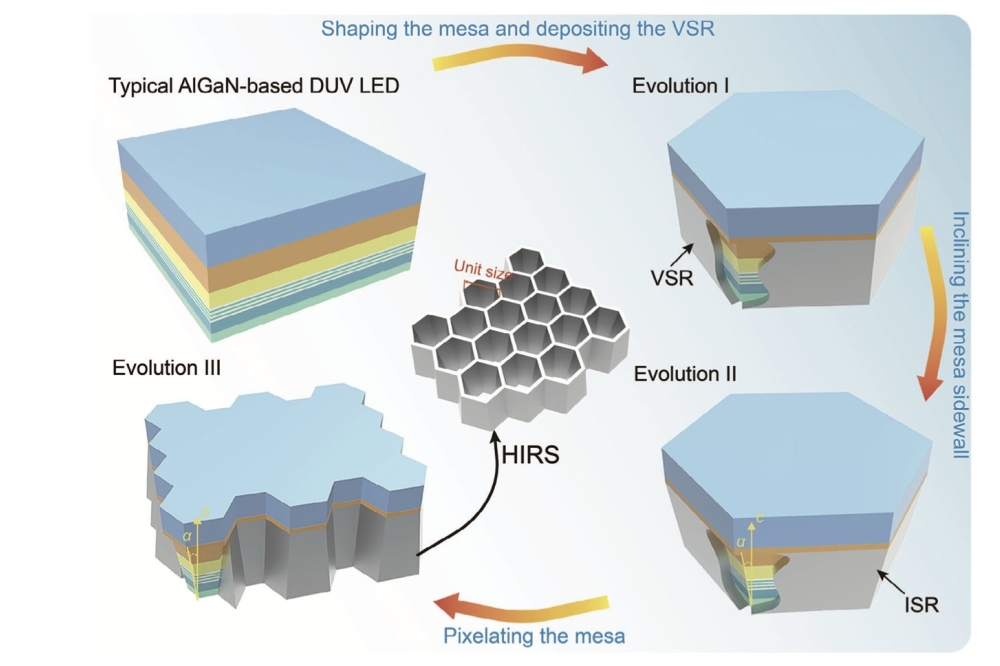

He is also upbeat regarding long-term opportunities for the company in the compound semiconductor sector, viewing 2024 as one for evaluations. This year the company anticipates that customers will be evaluating two SiC systems, as well as a 300 mm GaN-on-silicon system, plus another for making microLEDs.

Veeco is anticipating an increase in sales for fiscal 2024. Revenue is forecast to be between $680 million and $740 million.

A significant proportion of Riber’s revenue is coming from the sale of its production tools. The company continues to expand this portfolio, with the recent addition of the MBE 8000, developed in collaboration with US epiwafer provider Intellepi and targeting the growth of VCSEL epiwafers

Riber’s ramping revenue

In second place on this year’s leaderboard is Riber, the French manufacturer of MBE tools. The rise in its share price can be attributed to increases in both its global sales of MBE tools, and its share of this market.

Riber reported results for the first fiscal quarter on 26 April. Sales totalled €4.5 million, up 20 percent over the equivalent quarter of the previous year.

The company, which is celebrating its fiftieth anniversary this year, has a growing order book. At the end of March this totalled €34.4 million. Orders for 10 machines, including 7 production machines, accounted for €27.9 million, with the remaining €6.5 million associated with service and accessories.

Riber does not discuss results in quarterly earnings calls, so less insight is provided into the drivers behind the company’s financial position and its prospects. However, when reporting the latest results, Riber revealed it expects further growth in revenue and earnings for 2024.

Coherent benefits from AI

Third on this year’s leaderboard is Coherent, a company that combines activities in the compound semiconductor sector with a number of other ventures, particularly related to optics.

This February, in a letter to shareholders that coincided with the release of results for the second fiscal quarter, Coherent identified five recent highlights: improving margins; increasing its position in the AI-driven datacom market; improving its ramp for its 800G datacom transceivers; increasing demand in telecom and communications markets; and closing SiC transactions with Mitsubishi Electric and Denso, an activity that lays the foundation for a new business.

The later involves a total investment of $1 billion, with 75 percent from Coherent and 12.5 percent from Mitsubishi Electric and from Denso. For the two smaller investors, the new venture will support their demands for SiC substrates and epiwafers.

Commenting on this venture on 6 February, 2024, during an earnings call to discuss results for the second fiscal quarter, Sohail Khan, Executive Vice President Silicon Carbide LLC, the newly created subsidiary for the SiC business, remarked: “We are quite bullish about the silicon carbide market and the growth prospects over the next five to ten years. The announcement with Mitsubishi and Denso has strengthened our position, and we are seeing more engagements, and especially a lot of interest, from both existing and new customers for 200 millimetre [material]”.

Due to these encouraging prospects, the plan to invest and expand proceeds. “We will continue to see the growth of our business quarter-over-quarter and year-over-year.”

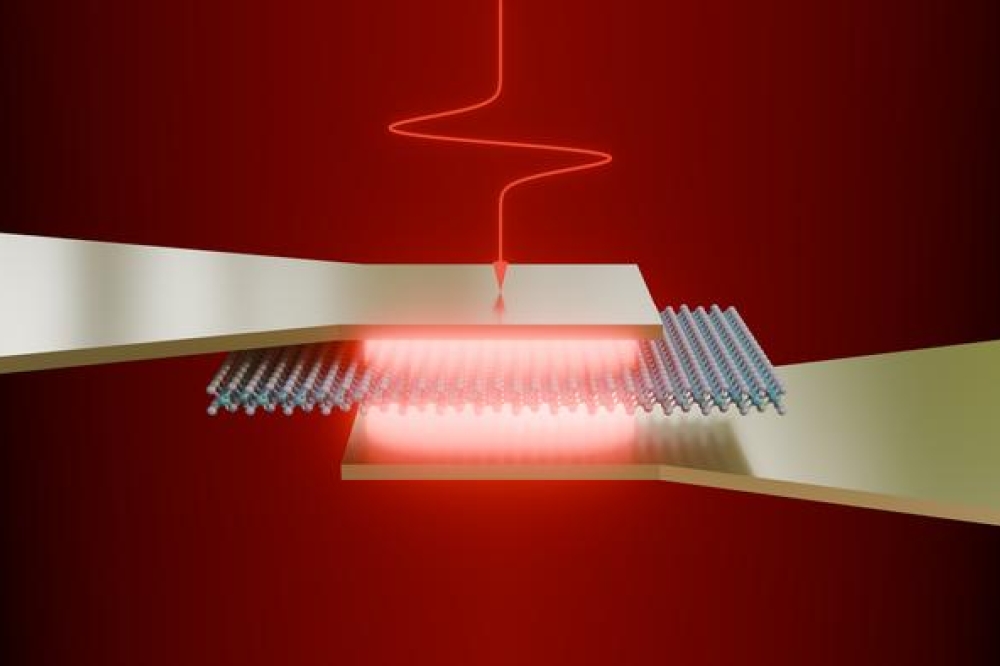

While this divesture is an important element of Coherent’s future, its leaders, and the investment community, are more excited by the prospects of the company’s 800 G datacom transceivers. Quarterly revenue for this product portfolio, which only started to ship just over a year ago, has increased sequentially by over 100 percent to cross the $100 million mark, driven by orders related to AI and machine learning. This phenomenal growth is set to continue, with Coherent forecasting that the market will expand at an compound annual growth rate of 65 percent over the next five years, fuelled by AI.

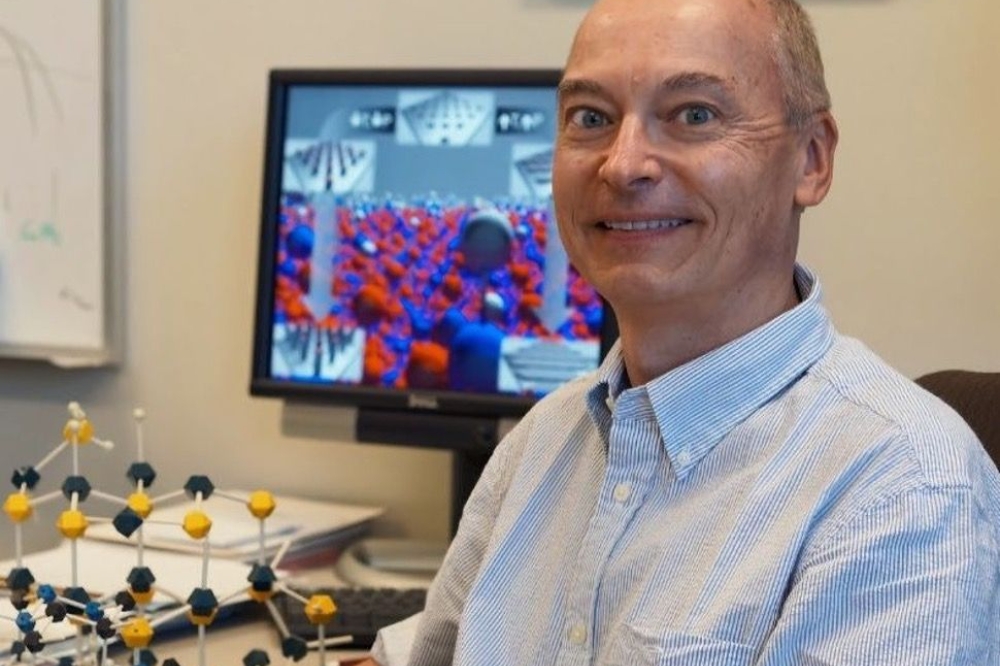

Such strong growth in demand is not always easy to fulfil. However, Coherent is well placed to deal with this, according to Giovanni Barbarossa, the company’s Chief Strategy Officer and President Materials segment. “We are the most vertically integrated player in the space,” argued Barbarossa, who pointed out that concerns within the industry over a VCSEL shortage are not worrying Coherent, because it is the biggest supplier of these devices in the world.

“We think that we will have always the best margin profile, versus those that have to pretty much buy everything on the merchant market,” claimed Barbarossa. He believes that Coherent has the most comprehensive profile of 100G and 200 G devices, which will continue to expand.

Another area where Coherent is active is in the nascent microLED industry. The company has received multiple orders from China, Taiwan and Korea for a laser-based tool that transfers microLEDs from a wafer to a display. These microLEDs can be as small as 10 µm, and in future could be just 5 µm in size.

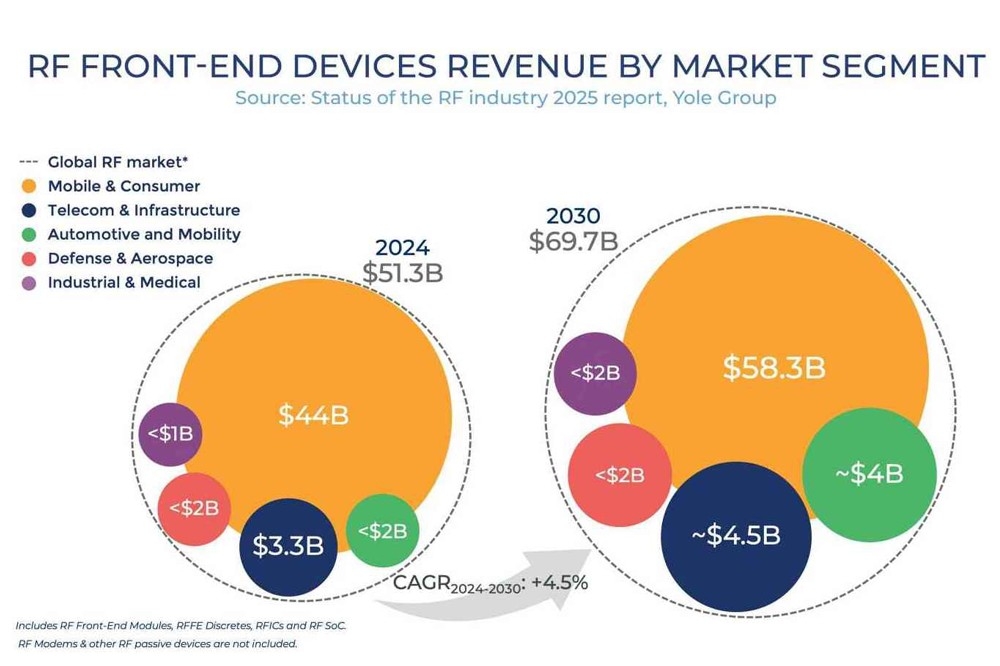

Figure 1.The automotive industry is now the most significant market for

the LED. Source: TrendForce LED Industry Demand and Supply Database 1Q24

“We’re seeing increasing customer engagement and are very excited about the impact of microLEDs on the television market,” remarked Chris Dorman, Executive Vice President, Lasers. “This is a very high level of engagement now and a market that will be growing over the next three-to-five years.”

The total revenue from all of Coherent’s activities is on an upward trajectory. For the second fiscal quarter, ending on 31 December, 2023, sales totalled $1.131 billion, above the mid-point of guidance. The company posted a gross margin for those three months of 36 percent, with much effort being devoted to improve this figure, according to the soon-to-retire CEO Mattera.

Commenting on this, Mattera explained that actions have been implemented across virtually all of Coherent’s businesses, in a drive to enhance operational efficiency. “These actions, along with rigorous cost and expense control across the company, helped drive our sequential improvement in gross and operating margin in the second quarter.”

While progress has been made, there’s more to do. “We are on a roll, but we’re far from done,” argued Mattera. “As we continue to transform the company to improve operating performance, we will optimise our production footprint and enhance operating resiliency, while completing the integration of legacy Coherent.”

The third fiscal quarter will probably produce an increase in revenue, with guidance in the range $1.12 billion to $1.20 billion. Earnings per share is also likely to increase. For fiscal 2024, the latest revenue guidance is $4.55 billion to $4.70 billion.

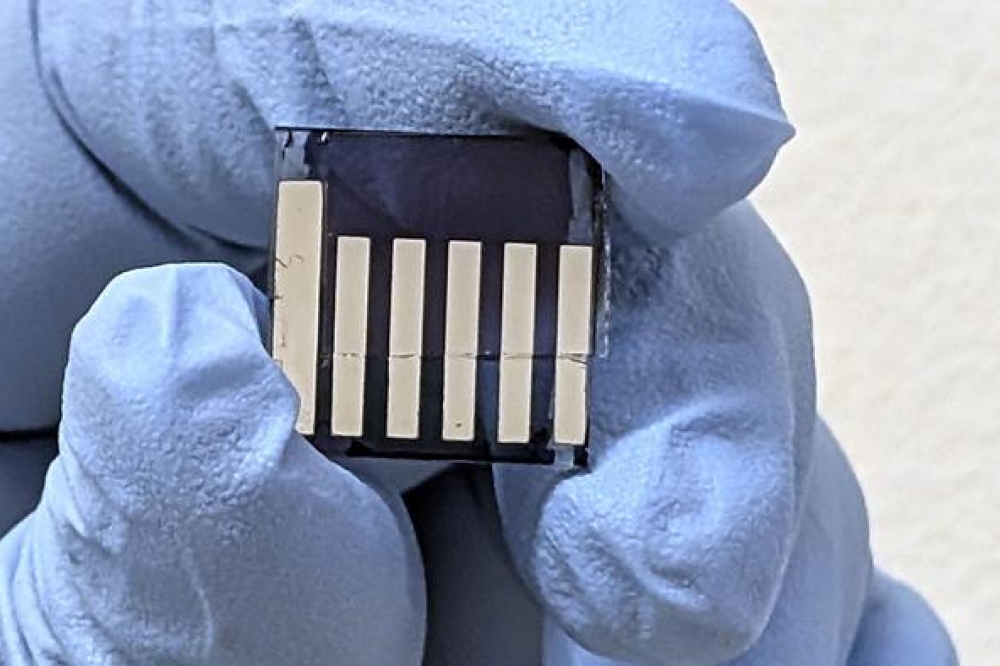

Osram: microLED misfortunes

Footing this year’s leaderboard is ams Osram. Its opportunities for long-term growth were dealt a hefty blow earlier this year when Apple cut it ties with this chipmaker, which had invested $1 billion in the construction of Kulim 2, the world’s first high-volume 200 mm LED fab. This fab had been built to produce microLEDs for Apple products, particularly smartwatches, and the breaking of the deal led to a 40 percent fall in Osram’s valuation. Even before then, the share price had been trending downwards, possibly over concerns related to the microLED venture with Apple.

Commenting on the future for the company on 26 April, when Osram released its results for the first fiscal quarter, 2024, CEO Aldo Kamper remarked: “We intend to step out of the 8-inch factory and focus our microLED development on automotive needs.”

More than 500 employees in Malaysia and Germany were involved in microLED development. Some have now moved to working on automotive LEDs, which has recently become the largest segment of the LED market, according to the analyst TrendForce (see Figure 1).

One of Osram’s priorities is to exit its sale-and-lease-back contract for Kulim 2. If successful, it will reduce the company’s long-term debt by €400 million.

Osram has initiated a ‘re-establish-the-base’ programme, designed to deliver cost savings, partly by exiting some non-core semiconductor businesses that provided revenues of between €300 million and €400 million in 2023. The company will focus on its core portfolio in automotive, industrial and medical markets, where it holds strong positions, according to TrendForce. Figures by this market research firm indicate that Osram is: the second biggest LED supplier in the world, behind Nichia; the leader in light sensors, with more than 29 percent of the market; and the leading supplier of traditional automotive lamps and bulbs.

For the first fiscal quarter of 2024, Osram reported revenue of €847 million, and a loss of €35 million. For the next quarter, sales may decline, due to typical seasonality. Revenue is forecast to be in the range €770 million to €870 million.

It will take time for Osram to execute its strategy, revive its fortunes, and drive growth in its share price. If it progresses on these fronts over the next 12 months, it’s unlikely that it will foot the table in 2025.