A fatal blow for the microLED?

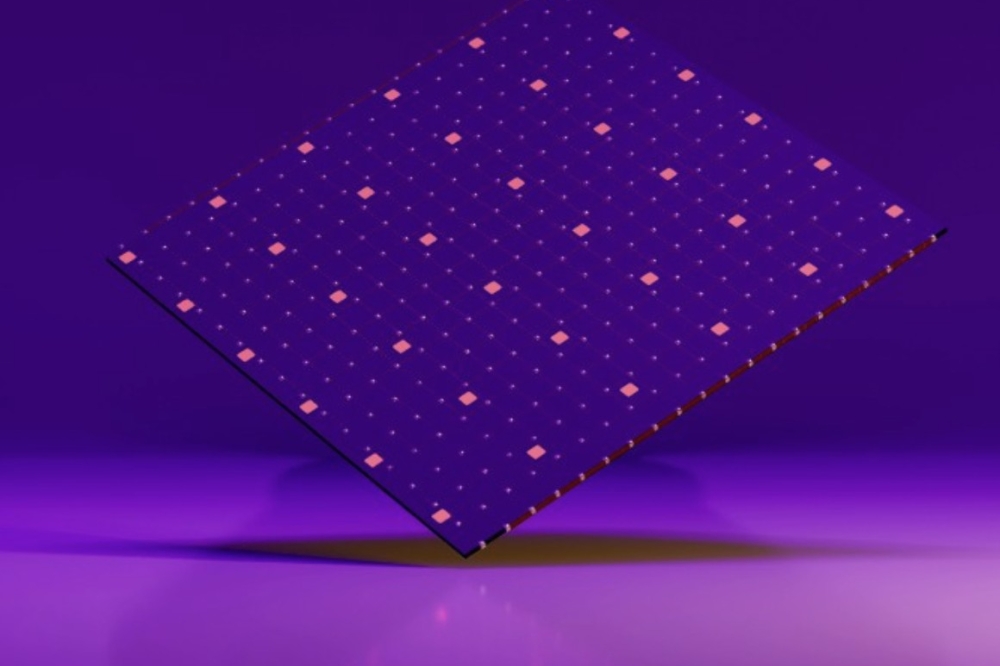

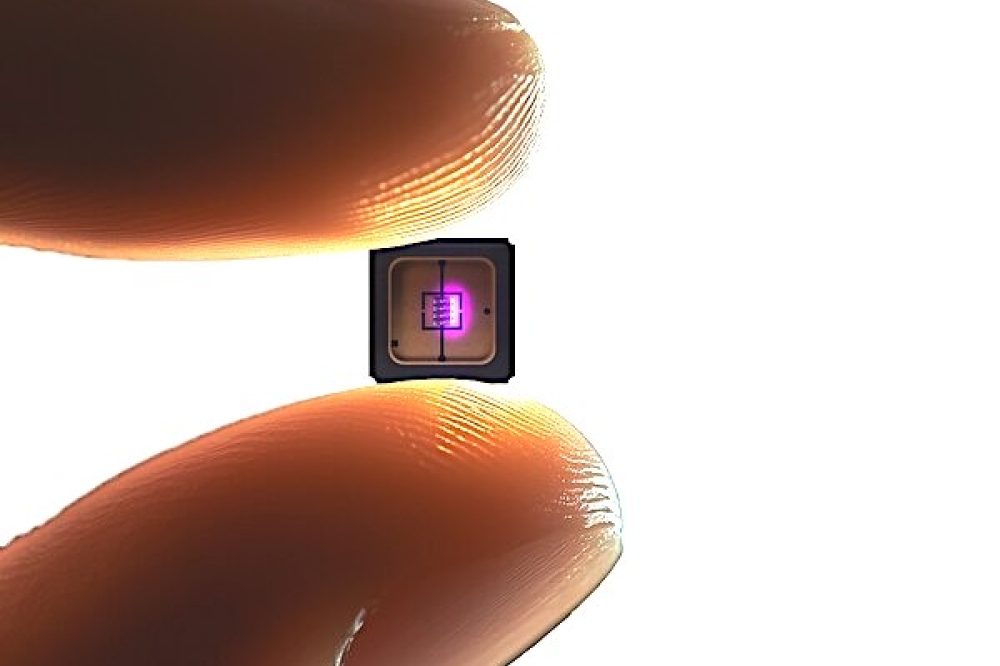

By pulling the plug on its supply agreement with Osram, Apple’s actions have sent shock waves through the fledgling microLED industry.

BY RICHARD STEVENSON, EDITOR, CS MAGAZINE

The nascent microLED industry has been plunged into jeopardy, following Apple’s decision to terminate its supply deal with ams Osram. Apple’s action, which caused Osram share price to plummet by 40 percent, has led this chipmaker to consider selling its second fab in Malaysia, built solely for the production of microLEDs for Apple Smartwatches.

According to Eric Virey, a Principal Analyst from Yole Group, Apple’s move has widespread implications, including delivering a massive and devastating blow to the microLED industry.

Virey points out that Apple has played a major role within this space for many years, having created the microLED industry through the acquisition of start-up Luxvue in 2014. “From that moment, dozens of startups and most OEM and display makers started investing in the technology.”

However, Virey believes that there is still a possibility that Apple has not inflicted a fatal blow to the microLED industry.

“If Apple had pulled the plug two or three years ago, we are confident this would have been a death sentence for the industry. However, the situation is different now: we consider that with sizable investments across all players and continents, the microLED industry has now gained enough momentum to continue on its own, although on a different path, with an immediate focus on applications where microLEDs can offer highly differentiating performance and functionalities.”

Promising opportunities for the microLED exist in the automotive industry, in augmented reality, and a variety of display technologies, according to Virey.

Despite ditching its partnership with Osram, Virey does not expect Apple to turn its back on the microLED: “We believe the company is still very interested in the technology, but will no longer try to develop its own technology and supply chain.”

Instead, Virey expects Apple to continue evaluating technologies and products developed externally, and to potentially adopt microLED displays developed by suppliers in some of its products, if and when it makes sense for them.

For Virey, Apple’s recent decision did not come as a great shock, as he viewed the project as challenging and risky.

“The multiple slips in Osram’s microLED fab ramp-up timeline indicated that Apple and its other partners were encountering problems and delays downstream, especially with the mass transfer and assembly of the microLED on the backplane and overall process integration,” remarks Virey, adding: “Yields remained low, which was a major challenge in meeting cost targets.”

Over the last two years, Virey and his colleagues have been arguing that the microLED Smartwatch project at Apple has been an incubator, not only for the company and its partners, but for the whole microLED industry.

“We continually warned the industry that the failure of this project remained a possibility despite the strong commitment and sizable investments made by Apple and its partners.”

The levels of investment are certainly eye-wateringly. Apple spent more than $2.6 billion to develop microLED displays, plus $420 million acquisition of Luxvue, and Osram invested $1 billion on its Kulim 2 fab. In addition, Apple’s partners, such as LG and Kullicke & Soffa had spent considerable sums to prepare to ramp manufacturing for the first microLED Apple watch, which had been scheduled to hit the market in 2026.

A state of shock

Responding to Apple’s decision, Osram’s leaders held a conference call to discuss the implications on 29 February.

Osram’s CTO, Rainer Irle, highlighted the company’s progress, saying that it had built Kulim 2, the world’s first high-volume 200 mm LED fab, in record time, and had made a huge commitment to deliver microLEDs to its former partner.

“We thought everything is on track, and then came that sudden change in the strategy of our customer. We don't understand where that suddenly came from, so we're very disappointed.”

Echoing this view, company CEO Aldo Camper added that while there was still some work to do, he had confidence that all the remaining ‘riddles’ could be solved.

Osram has calculated that the impairment cost associated with the Kulim 2 fab, its equipment, and the R&D expenditure associated with developing the microLED technology totals €1.3 billion.

“Out of the 1.3 billion, we have to write off 600 to 900 million. That includes the equipment that is still on order,” said Irle.

As Osram will no longer produce any samples in its Kulim 2 fab, the operating costs of running this facility will fall. However, the company will have to keep running the heating, ventilation and air-conditioning system to maintain the value of the cleanroom.

Despite the axing of future business from Apple, Osram’s future is not in jeopardy, due to its strong position in other markets that use LEDs. According to Kamper, Osram is the well-established leader in the production of LEDs for the automotive market, and enjoys healthy sales in medical, industrial and consumer sectors. Sales of microLED sales to Apple would only have started to make a small impact to revenue in 2026 – and for that year the revised revenue growth is 6-8 percent, down from 6-10 percent.

With available capacity at Kulim 1 and Osram’s fab in Regensburg, Germany, the company has no plans to use Kulim 2 to produce its existing LED portfolio. Selling Kulim 2 is an option, but negotiations are complicated by a sale-and-leaseback arrangement for the facility, initiated in October 2023 to release proceeds of around €400 million.

As well as having to consider the future of that fab, Osram’s management will need to consider what lies ahead for the 200 or so staff that have been working on the microLED development programme. Kamper is keen to retain these “bright minds”. They may well shift to projects involving the development of new headlamps or sensors.

Future prospects

For many, the big question now is who might take over leading the commercialisation of the microLED. Virey and his colleagues say that the epicentre of the microLED industry has now shifted to Taiwan, which has a strong domestic ecosystem, thanks to AUO, PlayNitride and Ennostar.

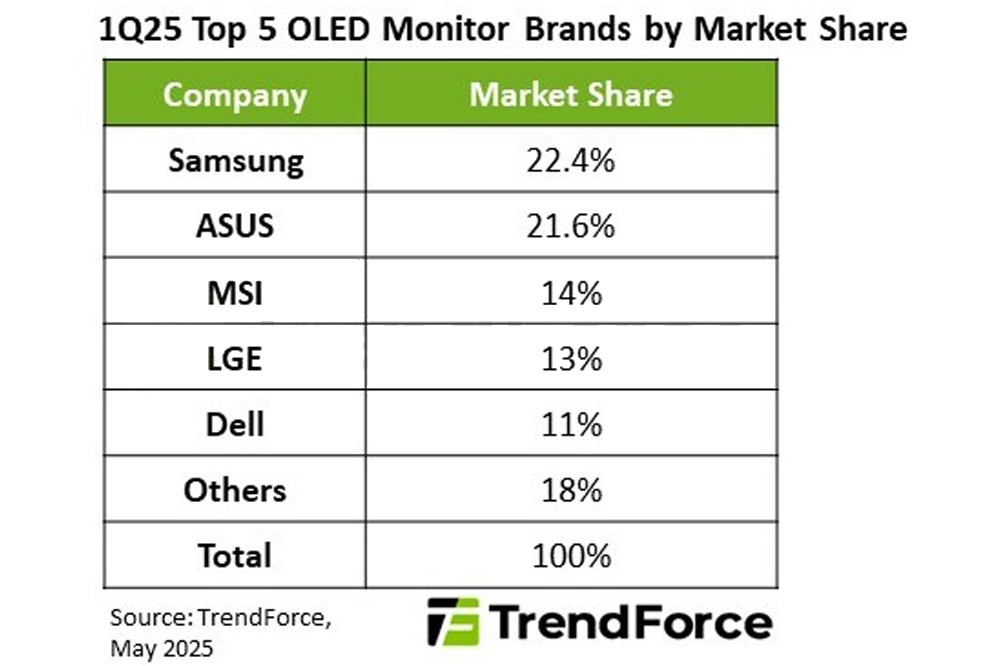

However, for these and other players, there is a limited window for success. Displays based on OLEDs are improving on many fronts, including cost, efficiency, brightness and lifetime, and as this rival becomes increasingly entrenched, this reduce the chances of success for the microLED.