RF front-ends driving car innovation

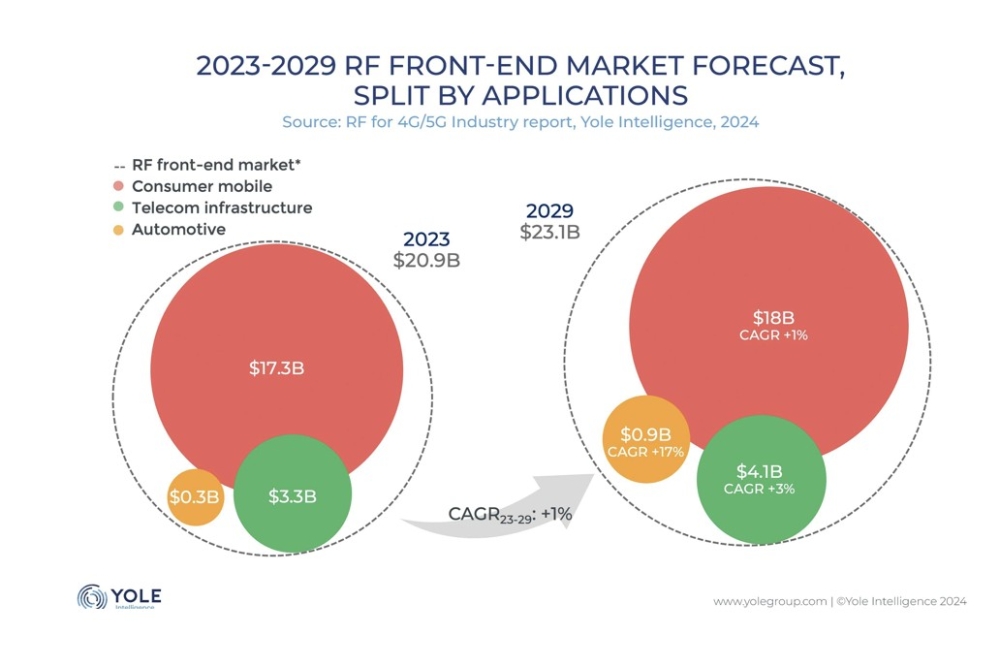

The $21 billion RF front end (RFFE) industry, initially driven by mobile and infrastructure, is evolving to embrace growth in the automotive market, according to a new Yole Group report 'RF for 4G/5G Industry 2024'.

After a difficult 2022, the smartphone market is showing signs of recovery, with expected year-over-year growth of 4 percent, projected to reach 1.2 billion units by 2024.

The mobile RFFE market is predicted to hit $18 billion by the end of 2024, says Yole, though it may face stagnation due to market saturation and pricing pressures.

Cyril Buey, technology and market analyst, radio frequency at Yole Group said: “In the automotive industry, connectivity plays a vital role in enabling software-defined vehicles, which in turn fuels demand for automotive RF devices. This market is expected to expand, with the 2027 launch of RedCap bringing 5G to mid-range vehicles and the increasing need for connected vehicle technology”.

In parallel, despite a recent deceleration, the telecom infrastructure market is projected to recover by 2026, with the RFFE market expected to reach $4 billion by 2029, spurred by the adoption of massive MIMO technology and radio unit enhancements.

Additionally, the small cell market, bolstered by private networks, has contributed for approximately $300 million in RFFE content in 2023.

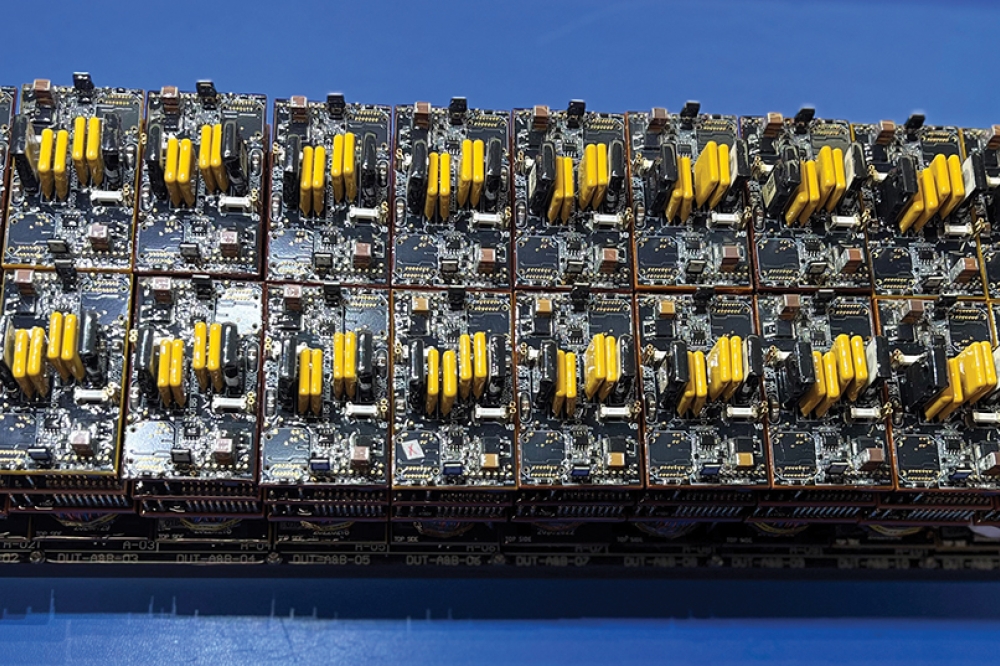

The RFFE supply chain spans a broad range of devices and technologies and is following the growing trend of miniaturisation and integration into multifunctional modules to reduce space and costs in mobile and infrastructure systems.

The RF component market for 4G/5G is highly fragmented, resulting in a complex technological landscape made more intricate by the number of players involved. The industry’s latest technological shift, spurred by 5G, has begun to consolidate the fragmented market around a few major players.

The ecosystem is led by a small number of key companies, including Qualcomm, Broadcom, Skyworks, Qorvo, Murata, and NXP, alongside newer companies like Maxscend, Vanchip, and Smarter Micro, which recently emerged from the dynamic Chinese market. These eight companies account for over 80 percent of the RFFE devices targeting the 4G/5G economy, with a total value of $16 billion.

The automotive segment is primarily dominated by Qualcomm. This company uses its end-to-end approach to provide complete RF bundles, from modem to RFFE, to its clients. Qualcomm also holds a significant share in the fixed wireless access CPE market. Meanwhile, Qorvo and Skyworks are expanding into the infrastructure and automotive markets. These emerging sectors are particularly profitable, although the volume of end systems remains relatively small.