RF to be a $70b market by 2030

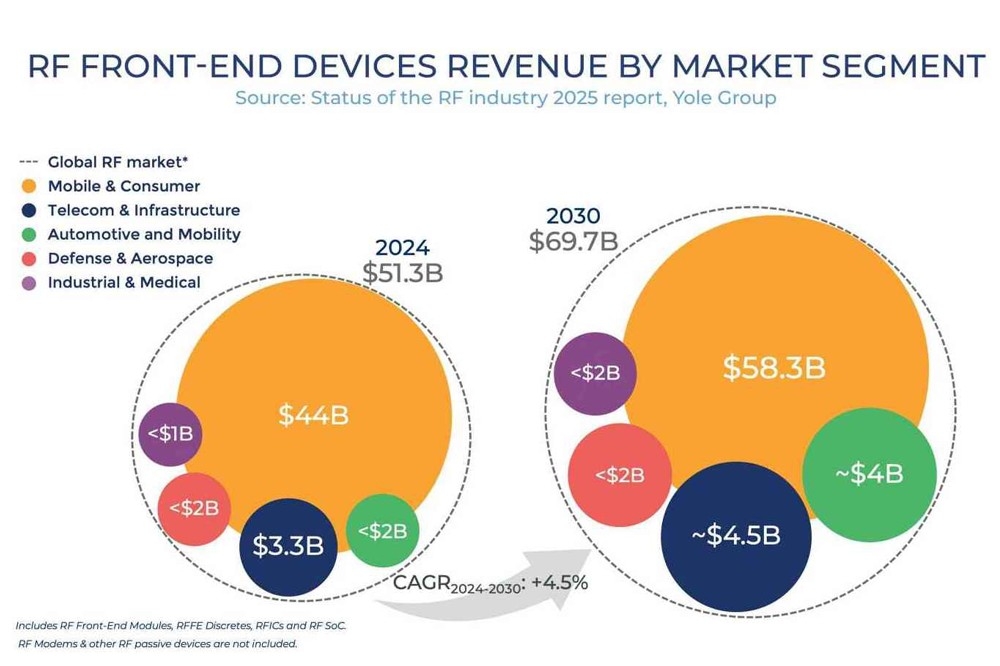

In it's first Status of the RF Industry report, the Yole Group's forecasts a $70b RF market by 2030, growing from $51.3b in 2024. This ~4.5 percent CAGR will be driven by 5G, consumer connectivity, and emerging 6G technologies.

Cyril Buey, senior technology & market analyst for RF at Yole Group said: "RF technologies are everywhere, from your smartphone to your car, and from telecom towers to defense radars. This first report synthesizes decades of RF innovation and provides forward-looking guidance for an industry under major transformation."

The mobile and consumer segments lead the RF market, accounting for the highest share in both revenue and volume. US giants like Qualcomm, Broadcom, Skyworks, and Qorvo dominate, offering advanced RFFE modules and RF SoCs for smartphones and connected devices. In parallel, Samsung and MediaTek serve high-volume markets across Asia, with varied integration strategies.

Chinese RF companies are also a key part of the mix. Moreover they are accelerating efforts to reduce foreign dependency, through leading players like Maxscend, Vanchip, and Smarter Micro. HiSilicon also confirms its return with dedicated in-house RFFE and SoC solutions.

Yole's analysts forecast two fast-growing subsegments by 2030:

- RFFE modules: more than $17b,

- RF SoCs for cellular + Wi-Fi/Bluetooth/GNSS exceeding $23b,

Discrete RF devices including PAs, LNAs, switches, and filters with almost $14b are also part of this RF landscape.

Filters represent the most dynamic segment and the second largest part of the RF front-end market in terms of value. (A new Yole comparison report on filters is now available: SAW Filter Comparison 2025).

Telecoms, automotive, and defence

In telecom infrastructure, GaN technology is gradually replacing LDMOS in massive MIMO base stations. Companies such as NXP, Qorvo, SEDI, and Analog Devices lead this market segment internationally. However, China is scaling up domestic production of GaN-based RF solutions and LDMOS with suppliers like Sanan IC, Wuatek, and Dynax. The global 6G race is now a critical driver of RF sovereignty strategies, with government-backed programs underway in the US, China, Japan, Korea, and Europe.

RF is becoming essential in automotive ADAS, infotainment, and connectivity. NXP and Infineon Technologies lead with SiGe, CMOS solutions, and GaAs-based radar ICs. In parallel, UWB adoption is accelerating, with Apple, Qorvo, and NXP anchoring the ecosystem across smartphones, smart homes, and vehicles.

In defence, RF innovation focuses on high-power broadband systems for radar, satcom, and EW. Once again, GaN-based designs dominate this market segment. Meanwhile, industrial and medical applications prioritise reliability and low power, but have long certification cycles.

Yole Group will be on-site to share its market expertise and connect with key players shaping the future of high-frequency technologies at European Microwave Week (EuMW) 2025. It will also participate in the Automotive Forum, with a dedicated presentation on September 23, focused on automotive radar markets and technologies, by Hassan Saleh, senior technology and market analyst, RF, at Yole Group.