Gaming driving 86% growth in OLED monitor shipments

TrendForce’s latest investigations show that robust gaming demand, coupled with aggressive promotion from brands and panel makers, will boost OLED monitor shipments across all regions in 2025.

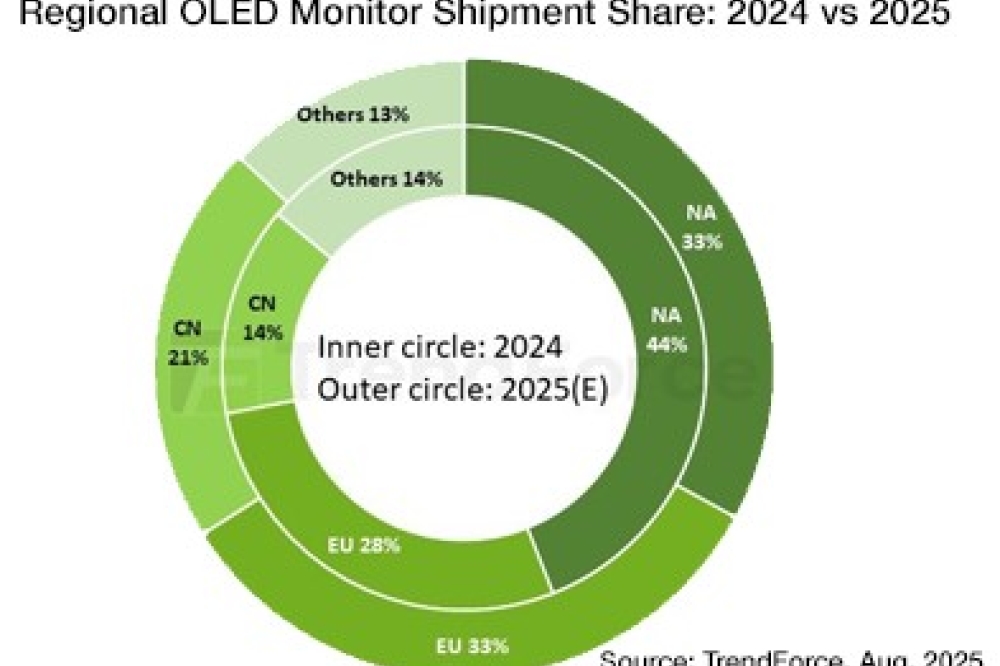

However, Europe’s market share is expected to climb to match North America’s while China’s share is projected to exceed 20 percent due to impacts from tariffs.

TrendForce forecasts that OLED monitor shipments will reach 2.66 million units in 2025, representing an 86 percent YoY increase, with a penetration rate of around 2 percent in the overall monitor market. Growth momentum is expected to persist over the next few years, with penetration potentially reaching 5 percent by 2028.

The primary markets for OLED monitors—North America, Europe, and China—account for over 80 percent of global shipments. Despite higher prices compared with LCD monitors, these three regions boast strong customer purchasing power and large customer bases, making them key markets for OLED adoption.

In 2024, brands concentrated their OLED monitor expansion efforts in North America, driving its share to 44 percent—the highest globally. In 2025, however, uncertainty from US tariff policies is likely to push brands to diversify risks by ramping up shipments to Europe and China, while reducing North America’s share to 33 percent.

With gaming brands intensifying marketing and promotional efforts, Europe’s share of OLED monitor shipments is expected to rise from 28 percent in 2024 to 33 percent in 2025. China, meanwhile, not only shows strong gaming demand but also benefits from internet cafés continuously upgrading to high-spec monitors. This positions OLED, targeted at the premium segment, as a product with significant growth potential.

TrendForce projects China’s OLED monitor market share to expand from 14 percent in 2024 to 21 percent in 2025.