MicroLED has momentum despite Apple withdrawal

The cancellation of Apple’s project beginning of 2024 has shaken confidence in microLED technology, leaving the industry at a critical juncture. As delays continue and OLED advances, microLED’s value proposition is shrinking.

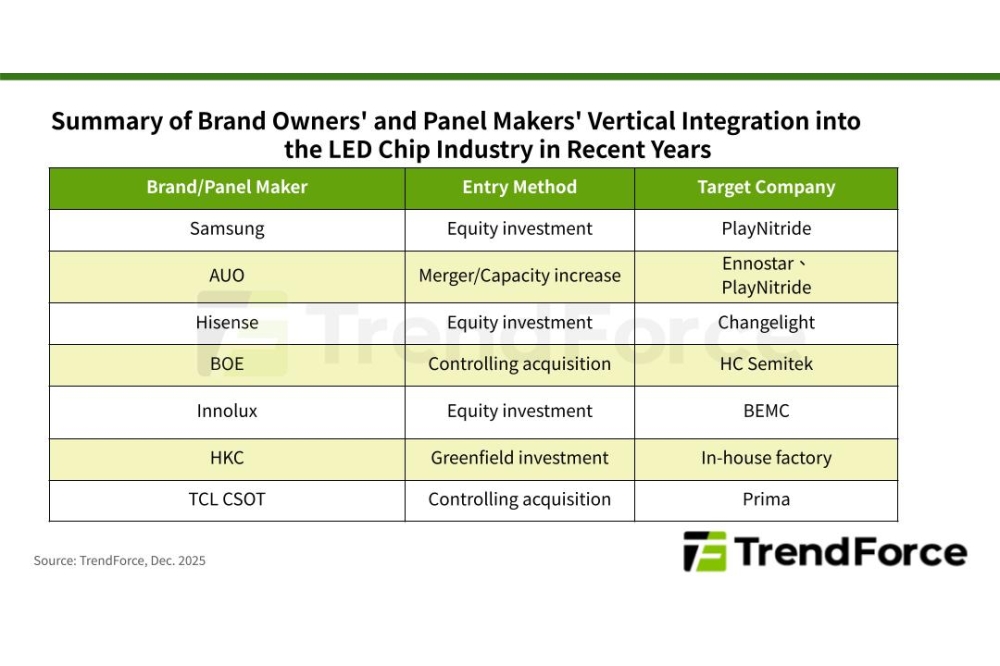

In response, companies are rethinking their strategies—some are slowing down or stopping, while others are accelerating their efforts, taking advantage of less competition. Alliances are forming along geographic lines, with around thirty fabs or pilot lines still moving forward, according to the Yole Group which has published three recent reports on microLED markets, technologies and IP.

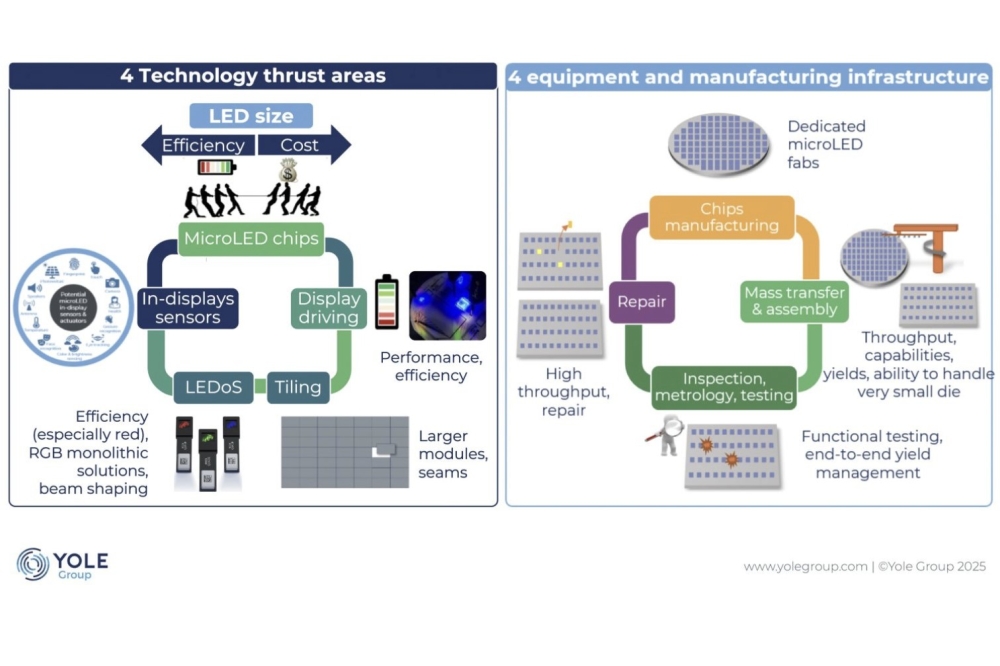

According to Eric Virey, principal analyst, display at Yole Group: “The industry now faces the challenge of moving from proof-of-concept to mass production. It must prove it can deliver high-performance, defect-free displays at scale while achieving economies of scale to remain viable.”

Yole says that MicroLED’s immediate growth driver is LEDoS microdisplays for AR , with AI reigniting optimism after the 2021–2023 'AR winter'.

AUO is supplying smartwatch samples to Tag Heuer and Garmin, while Century Display is setting up a pilot line. However, OLED dominates the smartphone market, leaving little room for microLED to compete. Without Apple, no company seems capable of pushing microLED forward in smartphones or creating a suitable supply chain. In TVs, OLED and miniLED also overshadow microLED, though there is potential for ultra-large screens over 100 inches.

In parallel, automotive applications hold promise, but high costs and an immature supply chain are delaying adoption. MicroLED’s transparency and modularity offer potential for niche applications in areas like retail, transportation, and military simulators.

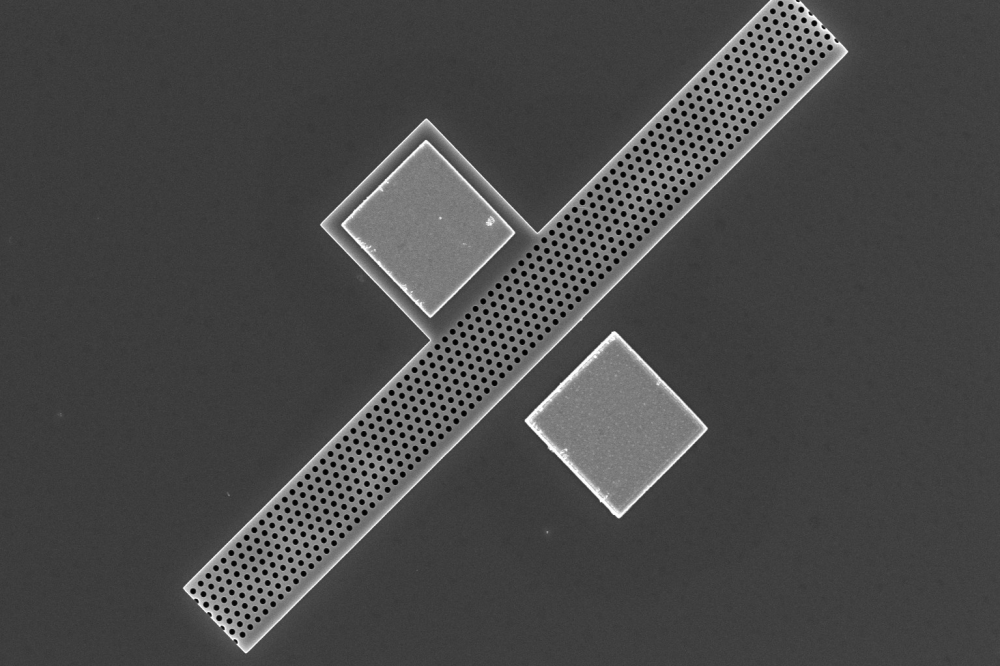

To succeed, microLED must deliver superior performance at a cost comparable to OLED. “This requires breakthroughs in efficiency for small die sizes and a robust supply chain, including specialised fabs,” says Virey.

With the closure of Osram’s microLED fab and Apple’s exit, the industry faces a familiar dilemma: mass production will require significant investment to drive prices down and make the technology viable. However, Apple is unlikely to reenter the microLED space unless third-party solutions meet its high standards.