Aixtron delivers robust Q3

Deposition tools company Aixtron has reported robust revenue level in the first nine months of the year compared to the previous year, despite a weak market environment.

The company generated revenues of €406.4 million (9M/2023: €415.7 million). In the third quarter 2024, revenues were at €156.3 million (Q3/2023: €165.0 million), which is in the lower half of the guidance range of €150.0 million to €180.0 million, as the delivery of a major project was postponed from Q3 to Q4/2024 at the customer's request.

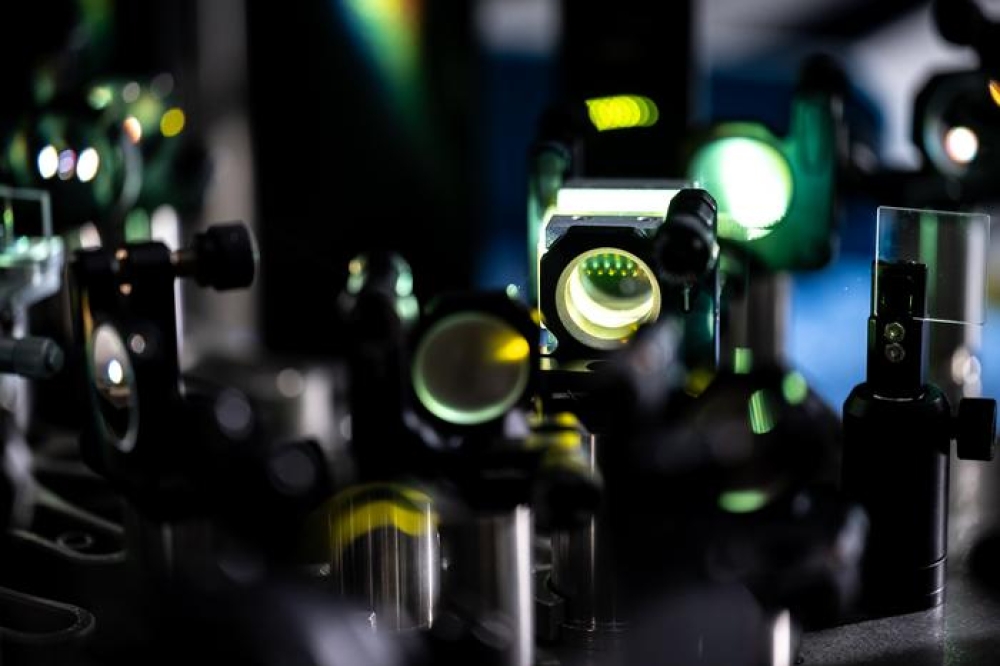

The current momentum in demand for equipment for efficient power electronics based on GaN and SiC is continuing, according to the company. The order intake in the third quarter 2024 reached €143.5 million, up 21 percent on the same quarter of the previous year (Q3/2023: €118.5 million). The order intake for the first nine months of 2024 was at €439.5 million, a slight increase year-on-year (9M/2023: €436.2 million). The equipment order backlog as of September 30, 2024 increased significantly year-on-year to €384.5 million (September 30, 2023: €368.0 million; June 30, 2024: €400.6 million).

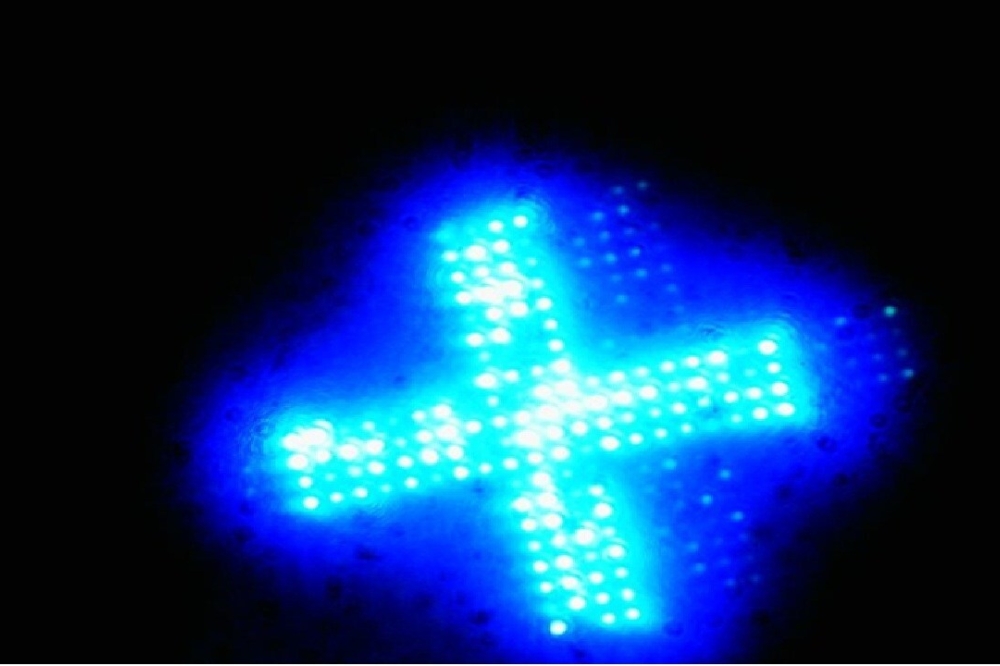

In the first nine months of 2024, Aixtron recorded a gross profit of €160.0 million (9M/2023: €180.8 million) with a gross margin of 39 percent (9M/2023: 43 percent). In the third quarter 2024, gross profit and gross margin amounted to €67.1 million and 43 percent (Q3/2023: €76.2 million, 46 percent). The change compared to the same period of the previous year is mainly due to a change in the product mix, which included a high proportion of lower-margin LED systems.

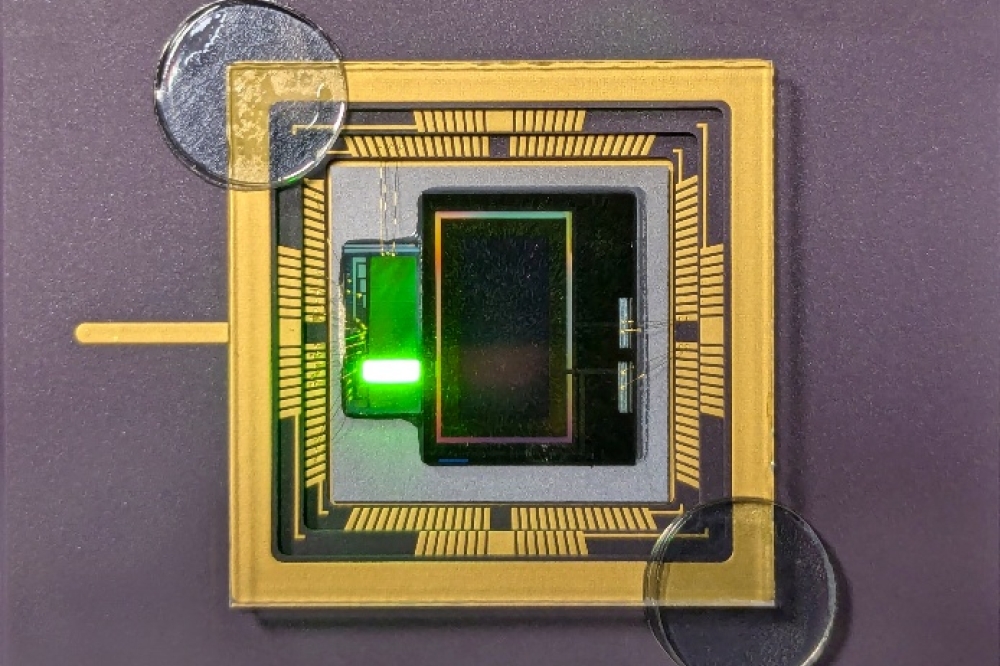

Operating expenses decreased slightly in the third quarter 2024, totaling €29.6 million, down 4 percent from the same quarter of the previous year (€30.9 million). At the end of September, operating expenses for the year to date amounted to €99.7 million, an increase of 14 percent compared to the same period in 2023 (€87.4 million). The largest share of this continued to be investments in research and development. Accordingly, in the first nine months of 2024 R&D expenses increased by 15 percent to €68.7 million (9M/2023: €59.8 million). In Q3/2024, R&D expenses amounted to €21.2 million, an increase of 2 percent (Q3/2023: €20.8 million).

Financial position

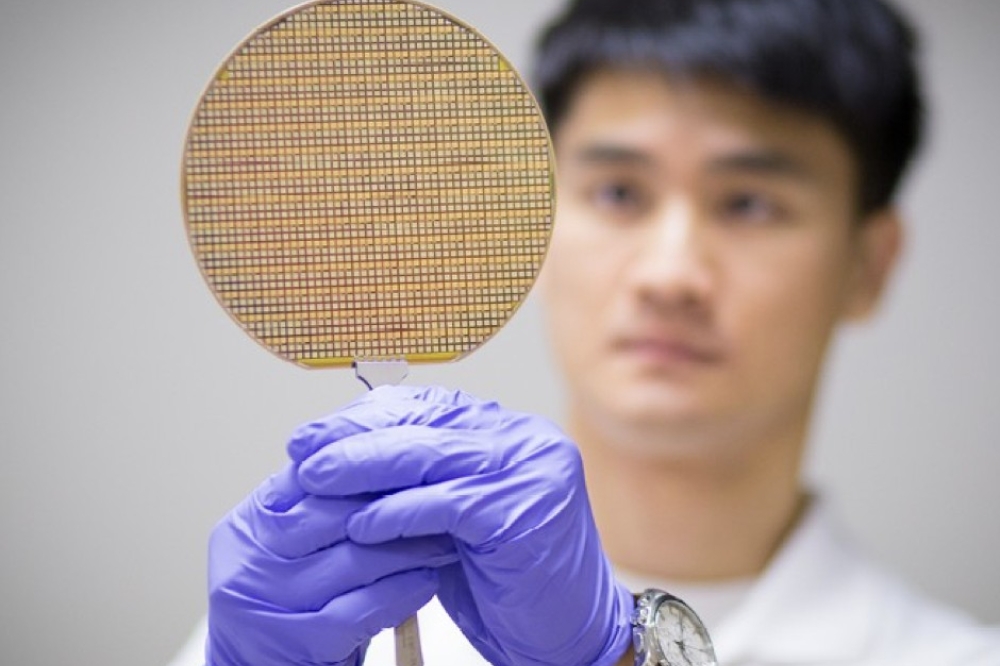

The cash flow from operating activities was significantly higher than in the same periods in the previous year: For Q3/2024, it amounted to €15.4 million (Q3/2023: €4.9 million) and in the first nine months of 2024 to €28.2 million (9M/2023: €-65.6 million). This was positively impacted by the incipient reduction in inventories. The free cash flow was €-1.5 million in Q3/2024 (Q3/2023: €-2.2 million) and €-58.0 million in the first nine months of 2024 (9M/2023: €-82.3 million), a significant improvement on the previous year despite the signficantly higher capital expenditure for the innovation center for 300mm technology and the expansion of production capacities in Italy.

As of September 30, 2024, Aixtron reported cash and cash equivalents including other current financial assets of €78.1 million (June 30, 2024: €79.4 million; December 31, 2023: €181.7 million). The high equity ratio of 79 percent at September 30, 2024 underscores Aixtron's financial strength (December 31, 2023: 75 percent).

“The positive development of our operating cash flow, triggered by the optimization of our inventories, is particularly pleasing. The aim is to reduce inventories to a normal level within the next twelve months. In addition, we are continuing to focus on the technologies of tomorrow and are already making the necessary investments today, particularly in research and development. The best proof of this is our new innovation center, which we are financing from our own resources,” says Christian Danninger, CFO of Aixtron SE.

2024 full year guidance confirmed

Based on the current market development, the executive board confirms the guidance for the fiscal year 2024 from July 4, 2024. The Executive Board expects revenues in a range of €620 million to €660 million, a gross margin of around 43 percent to 45 percent and an EBIT margin of around 22 percent to 25 percent for the 2024 fiscal year. For the fourth quarter of 2024, the board expects revenues in a range of around €215 million to €255 million.

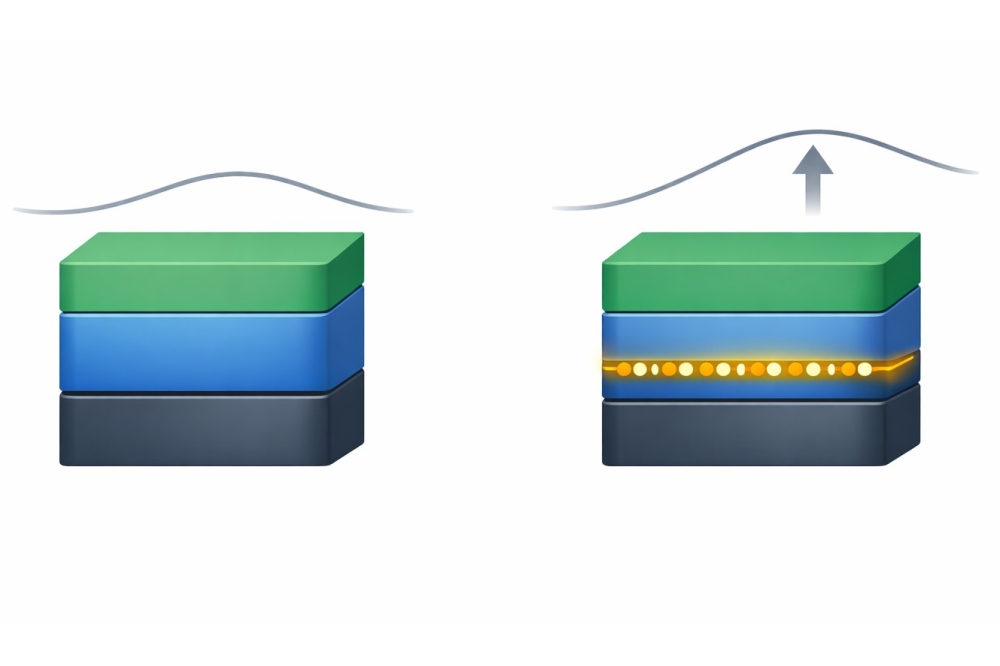

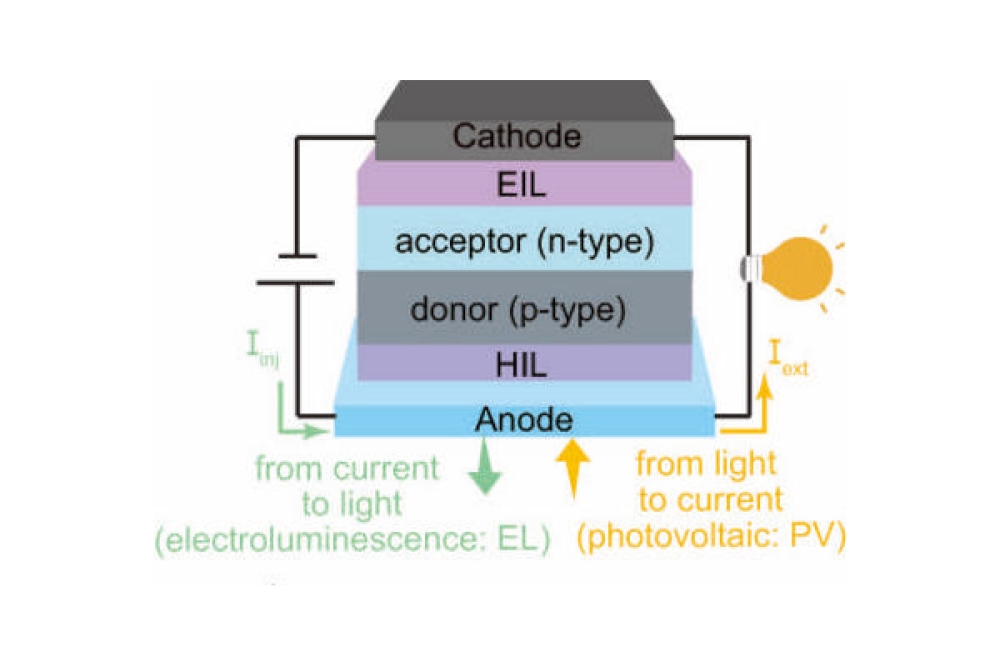

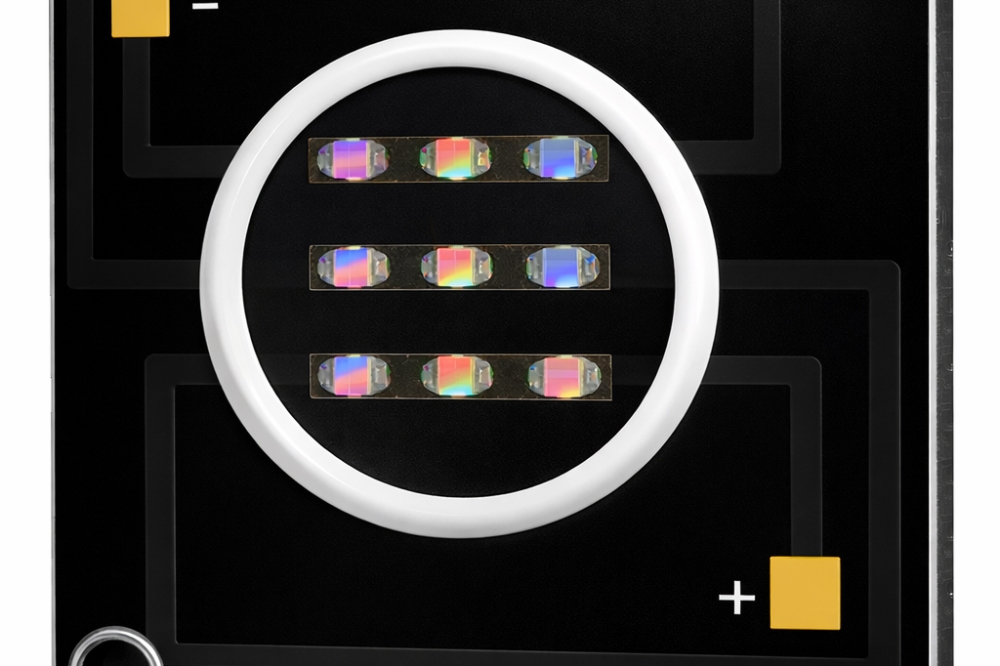

The medium and long-term drivers for Aixtron's revenue growth remain intact: efficient power electronics for IT and AI applications, SiC technology for e-mobility, and Micro LEDs for next-generation displays. In the short term, however, momentum in the end markets remains slow, so that, as things stand today, revenues for fiscal year 2025 are likely to be at the level of fiscal year 2024 or slightly below.