New signs of price stability and improved availability

But complexity, uncertainty, and unevenness persist, driving need for the power of intelligence.

Supplyframe’s latest Commodity IQ insights reveal positive signs for a normalized supply-demand balance and reduced pricing and availability challenges as we advance into the new year. Excluding memory devices, 85% of semiconductor pricing dimensions will be stable and the remainder will move squarely in favor of buyers for the second half of 2023. But Supplyframe Commodity IQ indicates that extended lead times for semiconductors, including programmable logic devices and passive components like automotive-specific resistors, will continue into the second half of the year.

“New Commodity IQ insights, the resilience of world economies to inflation and threats of recession, and China’s reopening economy in the second half suggest there is reason to be optimistic. Commodity IQ indicates that component availability has largely improved, and prices across many commodities and sub-commodities have stabilized,” said Supplyframe CEO and founder Steve Flagg. “But electronic component lead times remain longer than historical norms. Component lead times are improving faster than prices as demand in some markets deteriorates. And in this age of macroeconomic uncertainty, where it is becoming increasingly difficult to forecast demand amid mixed end-market signals, further intensification of the Russia-Ukraine war, continuing COVID-19 challenges in China or any number of other disruptions could emerge.”

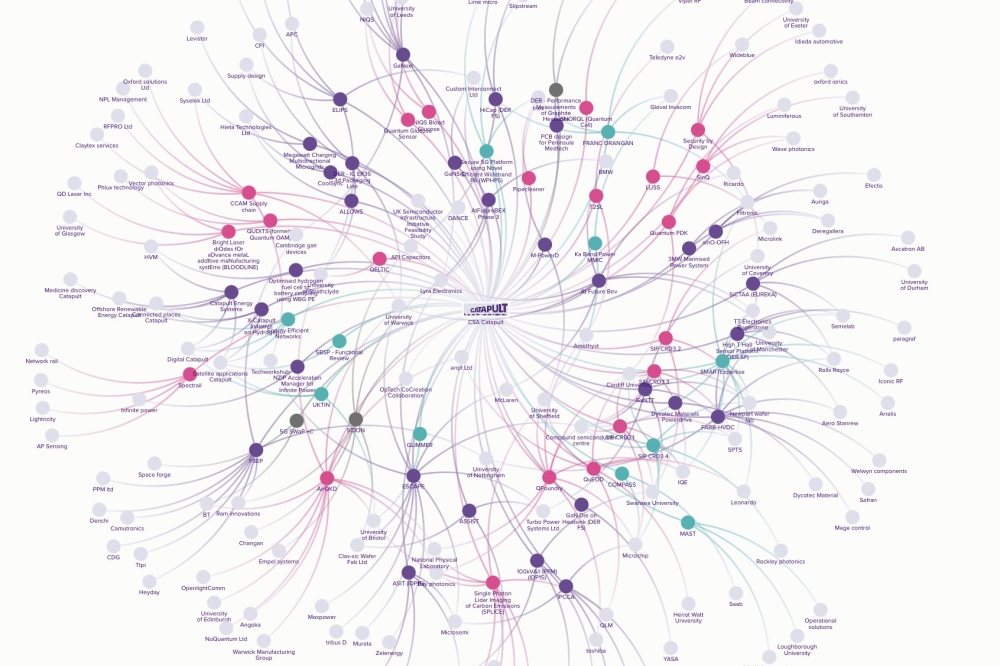

Supplyframe Commodity IQ is a transformed approach to electronics supply chain sourcing and analysis that provides unique, predictive, and prescriptive intelligence for electronic components, systems, and associated commodities based on operational analytics. This always-on software-as-a-service solution from Supplyframe pairs expert analysis and context with global electronics design, demand, pricing, lead time, and inventory indices to help companies connect the dots.

For the first quarter of 2023, Commodity IQ forecasts indicate the global market will experience an 8% decline in the number of rising lead times and commodities with part allocations for active and passive components. According to the Commodity IQ Price Index for Q1, the number of component pricing dimensions will decrease by 14%. And global electronic component demand and sourcing activities quarter-on-quarter in the first quarter of this year are expected to be down by 2%, while engineering design will be off by 20% – further evidence of demand erosion.

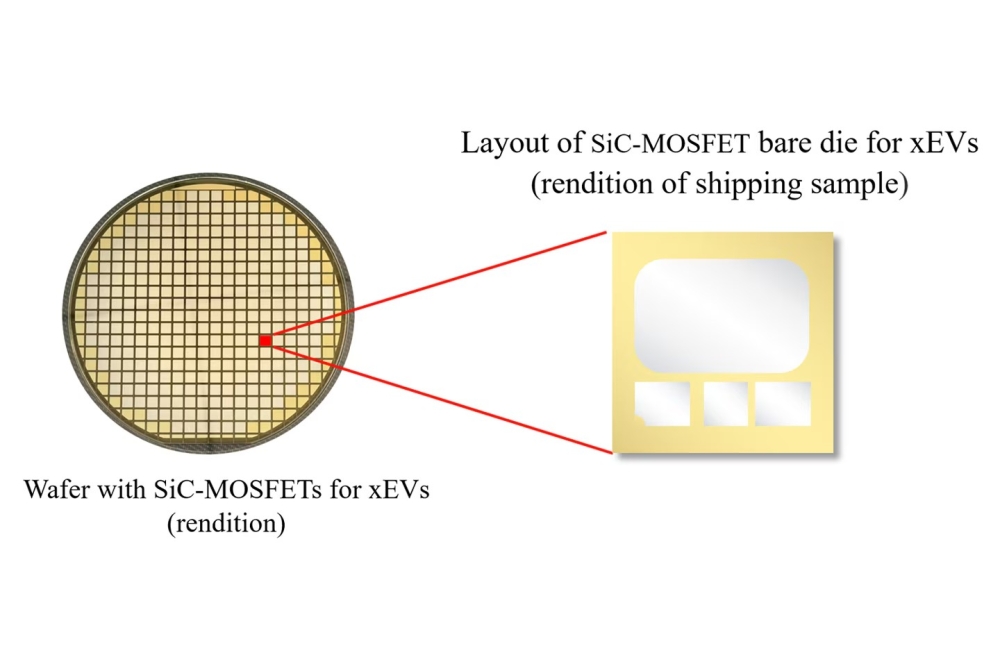

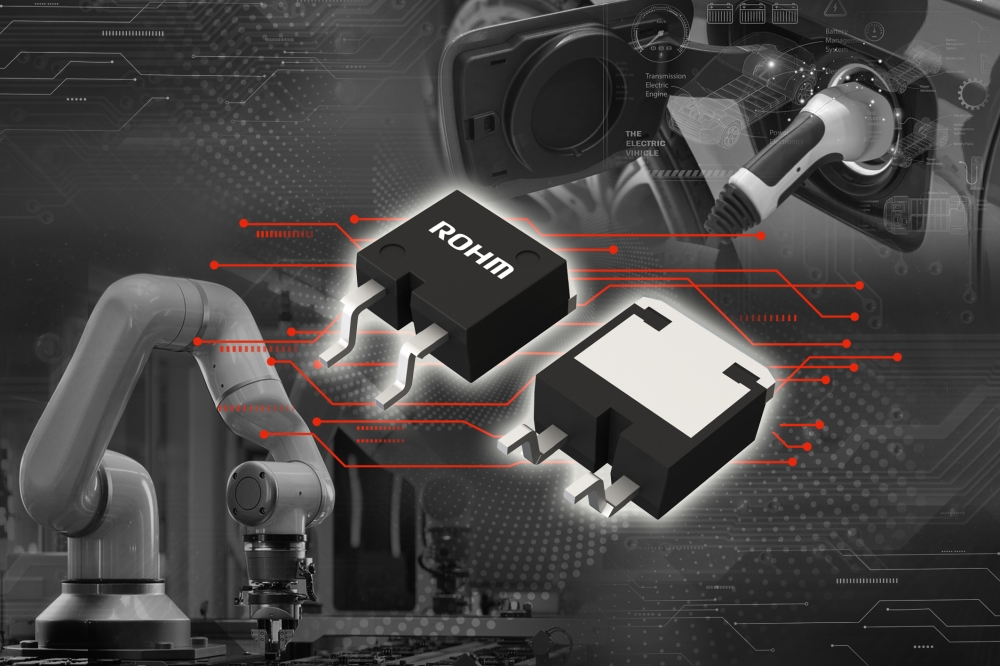

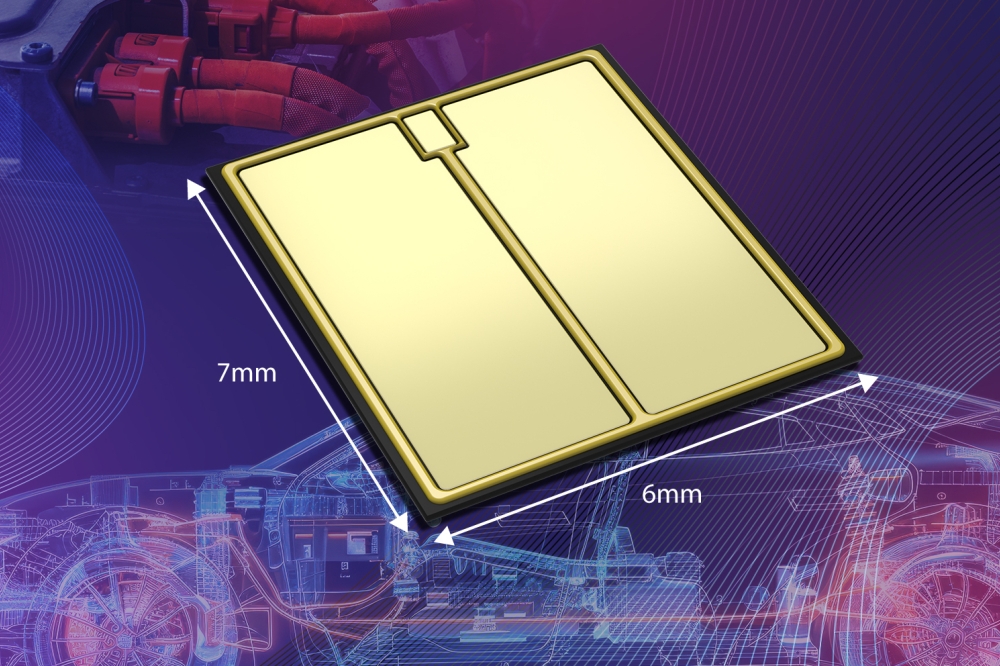

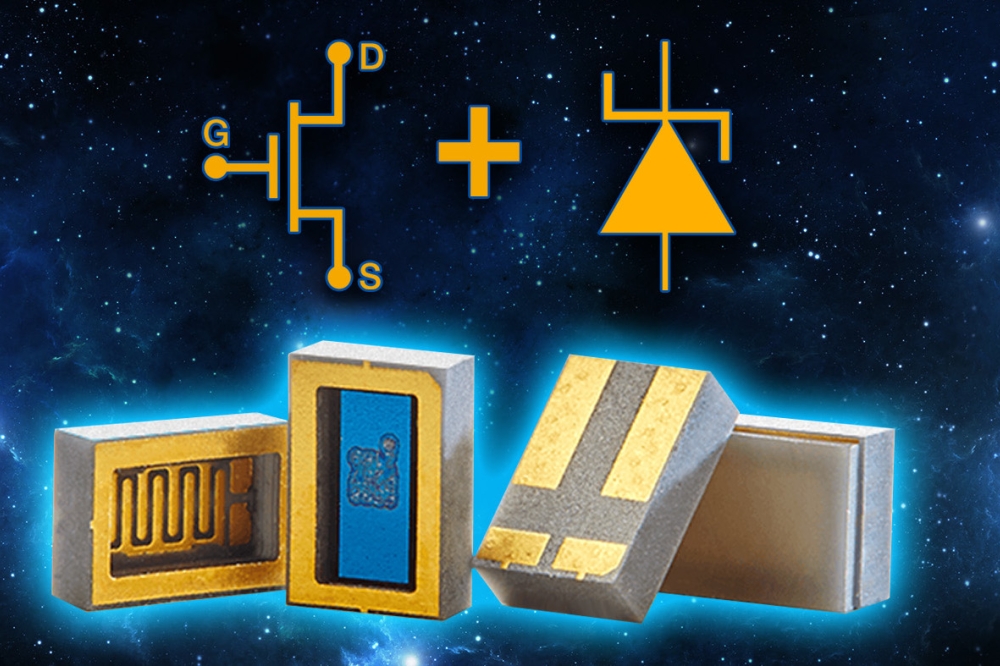

While there are bloated inventories for components like memory and small case-size ceramic capacitors, automotive-grade microcontrollers, and FPGAs remain far below the Commodity IQ Inventory Index baseline. And analog integrated circuits (ICs), microcontrollers, and discrete ICs (especially power MOSFETs) will remain constrained and costly in the first quarter and beyond.

In the third quarter of 2023, global lead times for all electronic components will ebb dramatically as compared to the third quarter of 2022. Commodity IQ projects that nearly 60% of lead time dimensions will decrease in the third quarter versus 1% in the third quarter of 2022, with none expected to increase in the third quarter compared to a massive 73% in the same quarter of 2022. But Commodity IQ expects extended lead times to endure into the second half for semiconductors, including programmable logic devices and passive components like automotive-specific resistors.

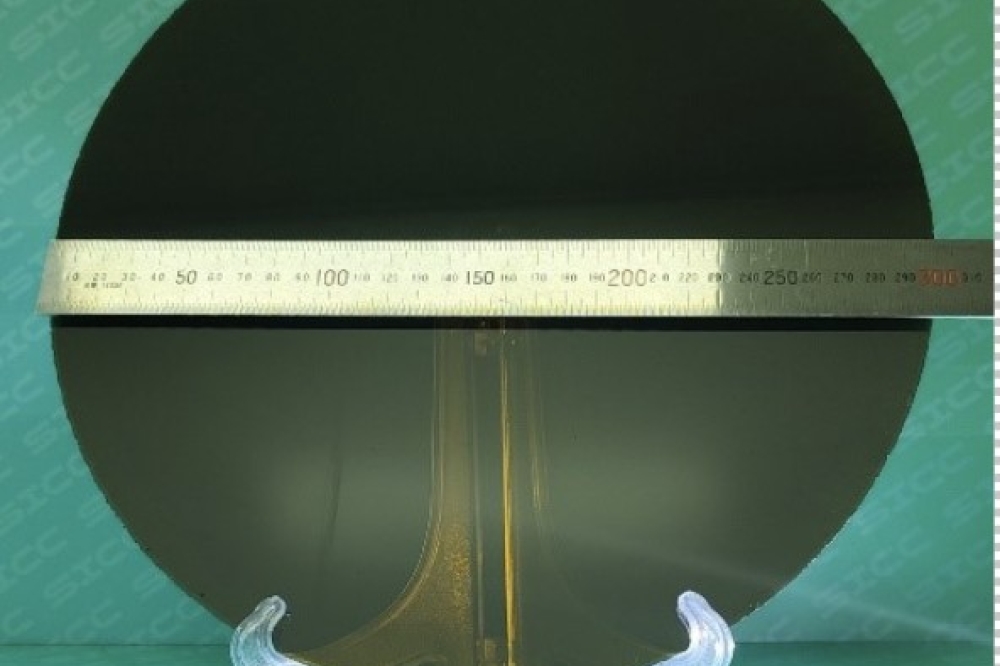

Despite inventory reductions that will likely be complete by the end of the first half, IC orders, wafer starts, and capacity utilization will begin to rise and memory pricing will reach its bottom in the second half of this year. The company forecasts that DRAM prices will commence recovery in the third quarter, and NAND pricing will follow in the fourth quarter or early in 2024.

Eurozone demand rebounded in January

Following seasonal trends, global demand activities increased by 7% month-over-month in January, with all regions rising except Asia, which declined by 14% from December to January on general economic weakness and the Chinese Lunar Holiday.

In the Europe/Middle East/Africa region, growth was driven by significant sourcing action increases in Germany (44%), France (37%), Italy (32%), Israel (15%), and the United Kingdom (55%). Month-over-month through January in these countries, transistors, including constrained IGBTs, rose sharply by 68%, microcontrollers and microprocessors climbed by 34%, capacitors expanded by 30%, and diodes were up by nearly 40%.

The Commodity IQ global electronic component demand forecast is for a weaker first half in 2023, compared to 2022, with Q1 anticipated to grow just 1% versus Q4 2022. Given automotive and industrial component order optimism and a resilient macroeconomic outlook, Supplyframe projects an overall demand rebound commencing in the second half of the year.

“Commodity IQ data clearly indicate that certain aspects of the electronic component arena are headed for greater stability, but the fact remains that disruption is the new normal throughout the world,” said Flagg. “Sanctions between China and the U.S., among others, and the trends toward friendshoring, nearshoring, onshoring, and reshoring are changing the game. Shifts to more mature semiconductor process nodes could benefit Chinese players and industries that lack restrictions on the Chinese content of manufactured items. Supply chain complexity is increasing, with shorter product and demand cycles. And while some financial leaders are indicating the U.S. could avert a recession altogether, that could result in the return of electronic component constraints should we see, for example, a resurgence in electric vehicle demand.”

“Buy-side and sell-side organizations in the electronics component supply chain can use the power of intelligence to better position themselves in this complex, uncertain world,” said Richard Barnett, chief marketing officer and SaaS sales leader at Supplyframe. “They can use such intelligence to build resilience into their products and better understand and act to address current and future demand. As Commodity IQ indicates, there are many opportunities for enhanced supplier negotiations, better-timed sourcing events, and 360-degree supply chain visibility.”