A happy coexistence: silicon IGBTs and SiC MOSFETs

Opportunities in electric vehicles, automation, data centres and

renewables will underpin the growth of the SiC MOSFET, as well as its

lower performance, but cheaper alternative, the silicon IGBT.

BY CALLUM MIDDLETON AND PAUL PICKERING FROM OMDIA

Those of you owning vehicles powered by a battery will know that, in many ways, the driving experience is no different from that provided by a car consuming petrol or diesel. But there are some notable differences.

One of the first of these you’ll encounter is that rather than having a traditional fuel gauge, you’ll get a figure for the estimated range. And unfortunately, it will not take you long to discover that what this figure lacks in accuracy, it makes up for in optimism.

Driving range often tops the list of considerations of those looking to purchase an electric vehicle in an ever more competitive marketplace. Helping to maximise this range is the SiC MOSFET, which draws on its superior efficiency over the silicon IGBT. Having the upper hand on this front is the primary justification for OEMs to opt for the SiC solution.

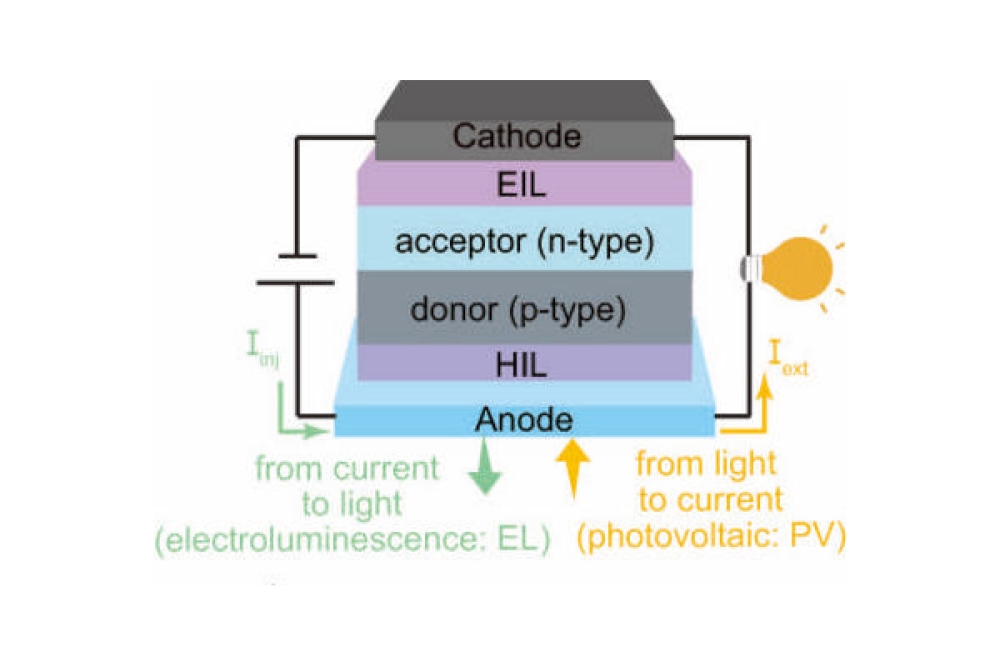

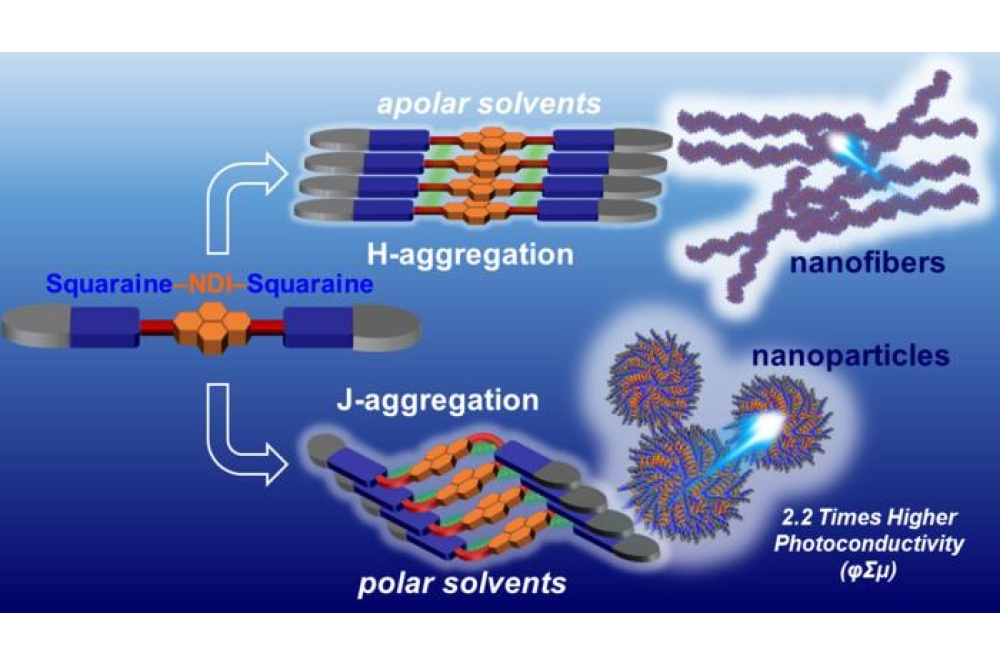

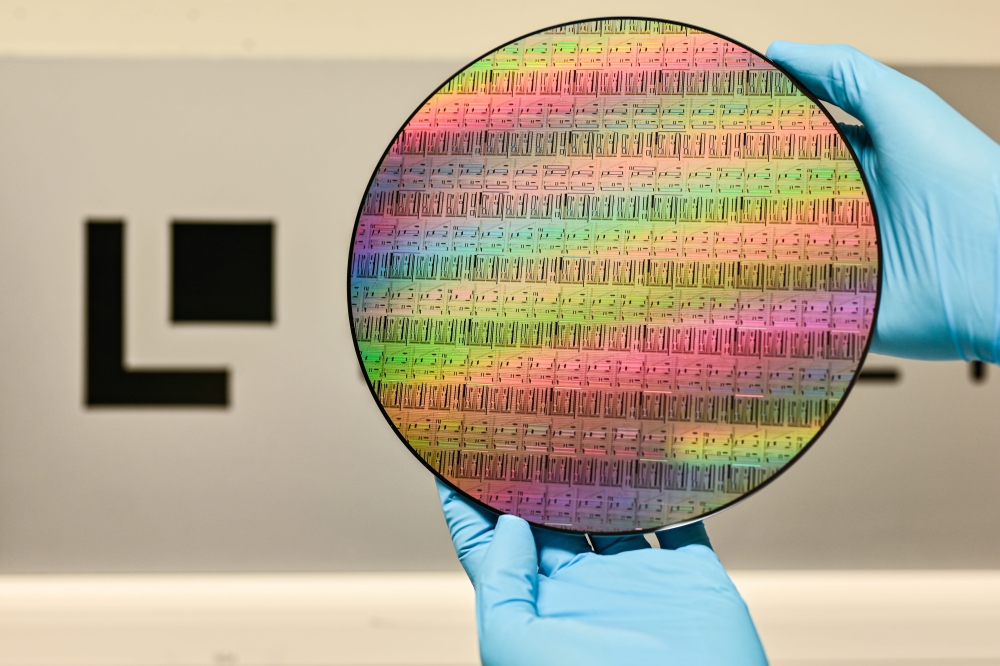

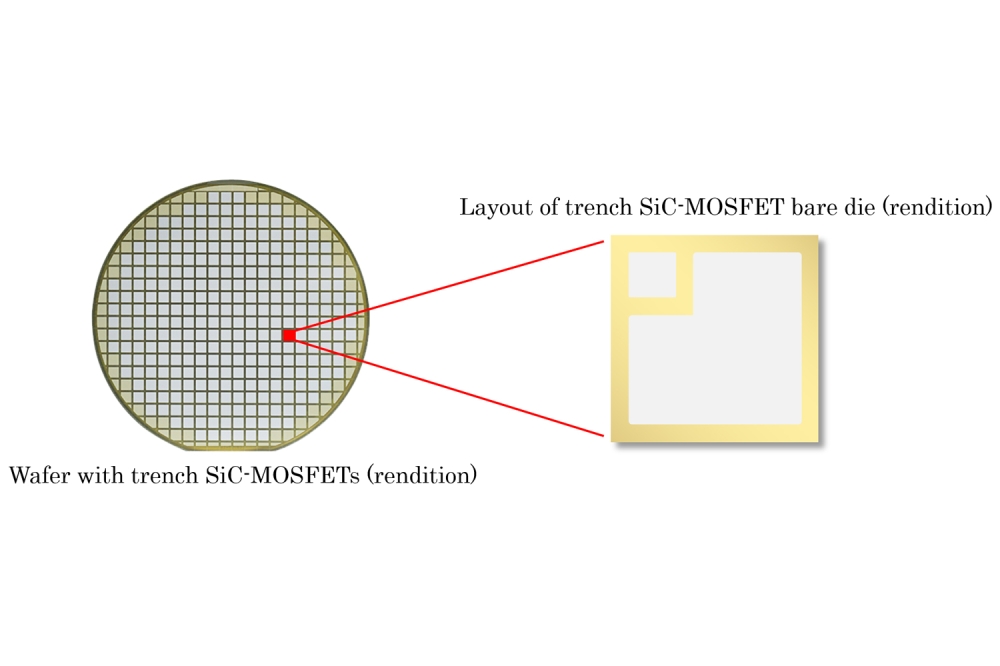

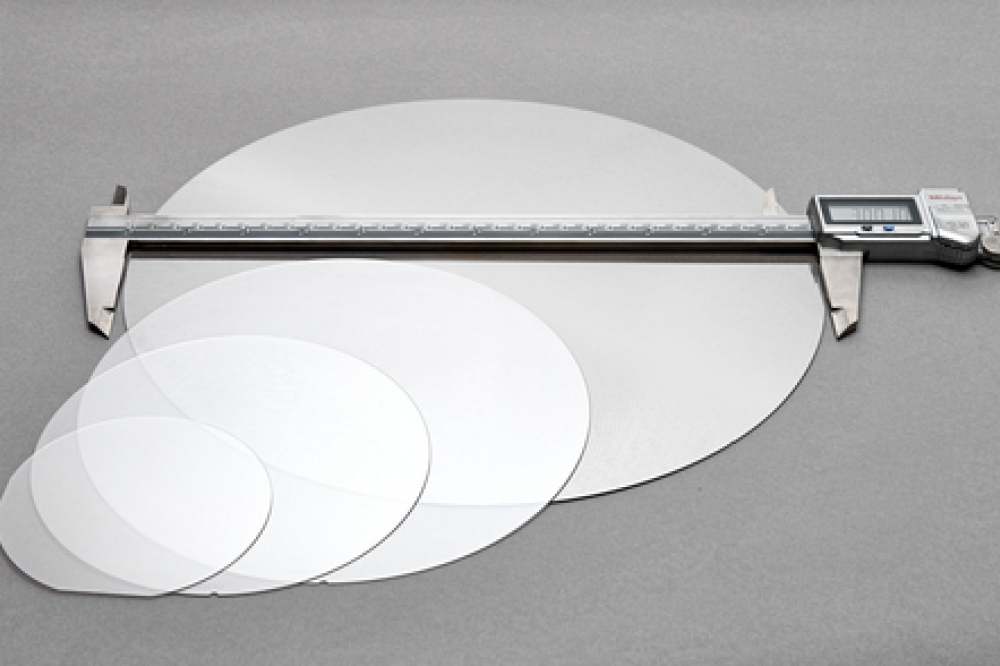

While the efficiency of the SiC MOSFET is a major selling point, that’s not the only benefit it offers over the silicon IGBT. Additional merits are a doubling of thermal conductivity and a far higher switching frequency, which allows the use of smaller passives and cheaper systems. It’s also worth noting that many of the advantages of SiC are greater at higher voltages, allowing the wider bandgap transistor to shine in higher-voltage systems, such as 800 V electric vehicles and 1500 V photovoltaic inverters. The only significant downside of the SiC MOSFET is that it’s pricey, but that concern is diminishing, as wafer sizes expand and material prices fall. So, is there much of a future for the silicon IGBT?

Well, one should not dismiss the importance of its lower price. The best engineering solution is not always the best solution, and there is no reason to expect the SiC MOSFET to ever reach price parity with the silicon IGBT, due to its higher inherent costs that are associated with the manufacturing process. While turning to SiC can drive down system costs, offsetting some of the difference in die cost, this can be a challenging proposition to make, and it is likely that users will always face a choice between performance and cost.

In the traction inverter market, after weighing up the pros and cons, many automotive OEMs and tier ones are deciding to deploy SiC. Tesla introduced SiC to this sector to distinguish its vehicles from its competitors, and in the process became the leading BEV manufacturer in the world. Now many automotive companies are following suit in an attempt to close the gap. This is driving a ramp in SiC device sales, which climbed by 75 percent in 2023. However, today’s BEVs are primarily in the ‘luxury’ and ‘mid-range’ categories, where consumers are willing to pay a little more for improved performance. As the BEV market expands, makers of these vehicles will have to penetrate the economy end of the market, where price matters much more. For customers who tend to use their vehicles for short journeys in urban settings, cars fitted with IGBTs will appeal.

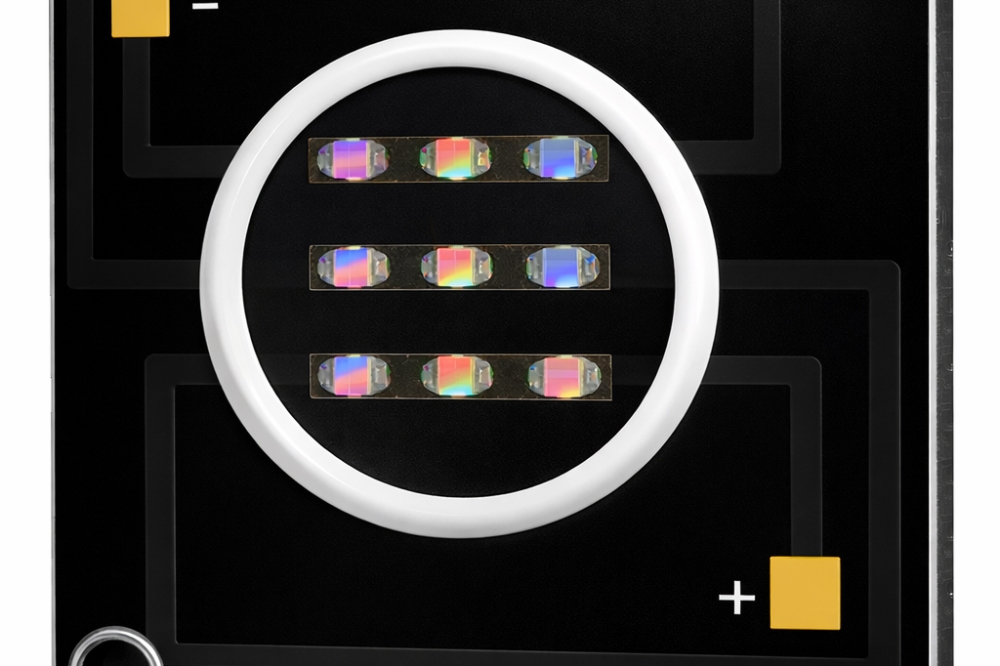

It’s quite feasible that even the more expensive vehicles will not solely use SiC. The Tesla model that pioneered SiC featured 48 MOSFETs. But in March 2023, that trailblazer of the BEV surprised many when it announced it would be trimming usage of these wide bandgap chips by 75 percent. Arguably, this decision should not have raised that many eyebrows, as one should expect that innovations in device design and inverter design would lead to a reduction from 48 MOSFETs, alongside a possible move to a blend of SiC MOSFETs and silicon IGBTs.

As already mentioned, BEVs are renowned for their optimistic range. This is partly due to difficulties in estimating this critical distance, which is influenced by numerous factors, including driving style and ambient temperature. The mission profile of the traction inverter within a BEV can vary greatly depending on where it is located, who the owner is, and even the day of the week. Due to these considerations, what’s needed is a varied internal solution that allows the system to operate in the most efficient manner, irrespective of what is asked of it, without over-engineering. It remains to be seen whether this blended solution comes from vehicle designers deploying multiple inverters within a vehicle, or the use of power modules containing both SiC MOSFETs and silicon IGBTs.

The historical and forecast revenue for the silicon IGBT and the SiC MOSFET. Data has been normalised to the 2023 revenue of IGBT technologies.

When considering these factors, it is clear that the rise of the electric vehicle provides a great opportunity for both SiC MOSFETs and silicon IGBTs. At Omdia, we are forecasting a compound annual growth rate of 32.6 percent for SiC device revenue between 2023 and 2028, and over that time frame an equivalent figure of 10.8 percent for power modules based on the silicon IGBT. Our forecast growth in SiC is eye-catching, justifying the level of investment in this technology, while the growth in the silicon IGBT offers a compelling reason to continue investing in device research and development to help companies claim more of this growing pie.

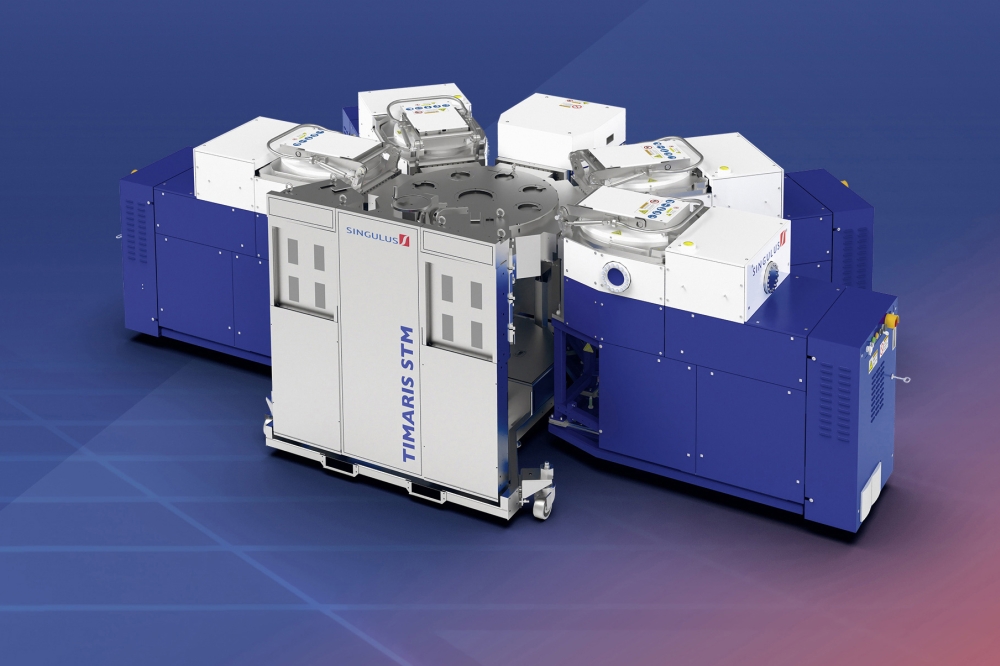

Outside the automotive sector, many of the same trade-offs apply. However, the absence of a key performance metric, such as range, makes it harder to justify a transition to SiC. We are living in a time of high energy costs and increased automation, factors that encourage investment in motor drives and grid infrastructure – and present opportunities for both SiC MOSFETs and silicon IGBTs. As SiC capacity expands, this should trim costs, but capacity is closely tied to the automotive sector. This tie-in may encourage equipment manufacturers in other sectors to stick with silicon until there’s greater maturity in the SiC industry. Whilst improved efficiency is a big benefit at a time of increased energy costs, it still may not be enough to offset the extra chip cost. Therefore, it is most likely that the greatest penetration will come in applications where space savings are highly desirable, such as microinverters for photovoltaic systems, or power supplies for data centres.

There’s no question that SiC growth is a huge opportunity for the power semiconductor industry, but it’s not easy to see MOSFETs getting to the price of silicon IGBTs. Instead, they offer another option for the power electronics engineer, who has the opportunity to use the SiC MOSFET and the silicon IGBT concurrently. Thanks to overarching growth trends of electrification, electric vehicles, and renewable energy, there is the potential for a significant growth in sales of both device types; and industry should continue to develop IGBT technologies to aid the green transition.